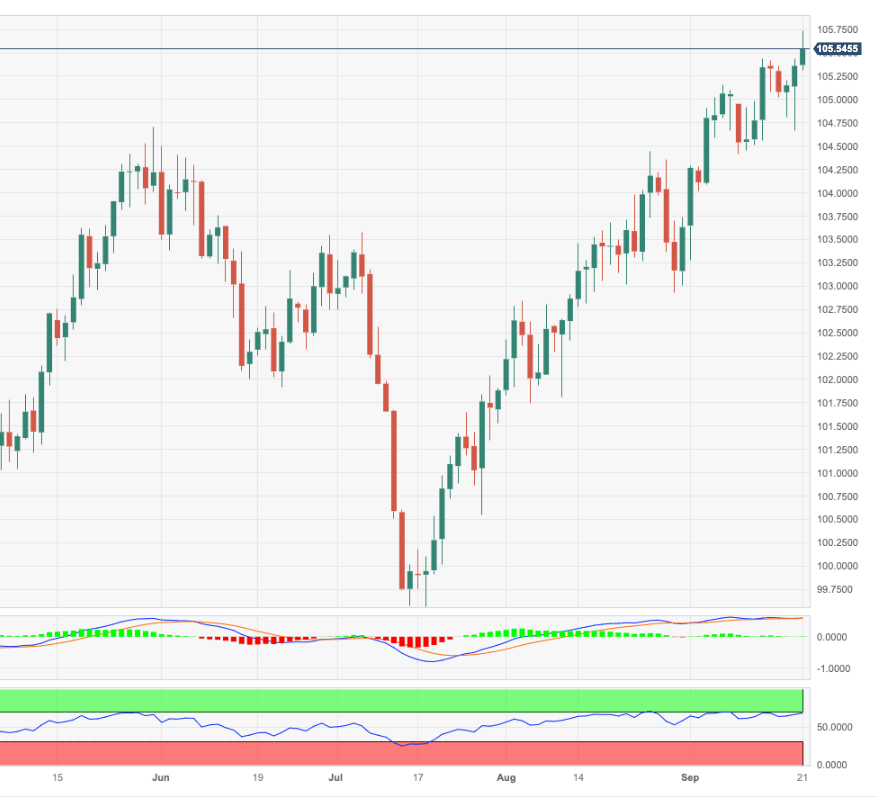

USD Index Price Analysis: The 2023 peak is just around the corner

- DXY extends the uptrend to the 105.70 region.

- Further gains could see the 2023 near 105.90 revisited.

DXY manages to reach new multi-month tops in the 105.70/75 band on Thursday.

The continuation of the upside momentum in the index is expected to challenge the 2023 top at 105.88 (March 8) sooner rather than later. The surpass of this level could put a move to the round level at 106.00 rapidly back on the radar.

While above the key 200-day SMA, today at 103.04, the outlook for the index is expected to remain constructive.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.