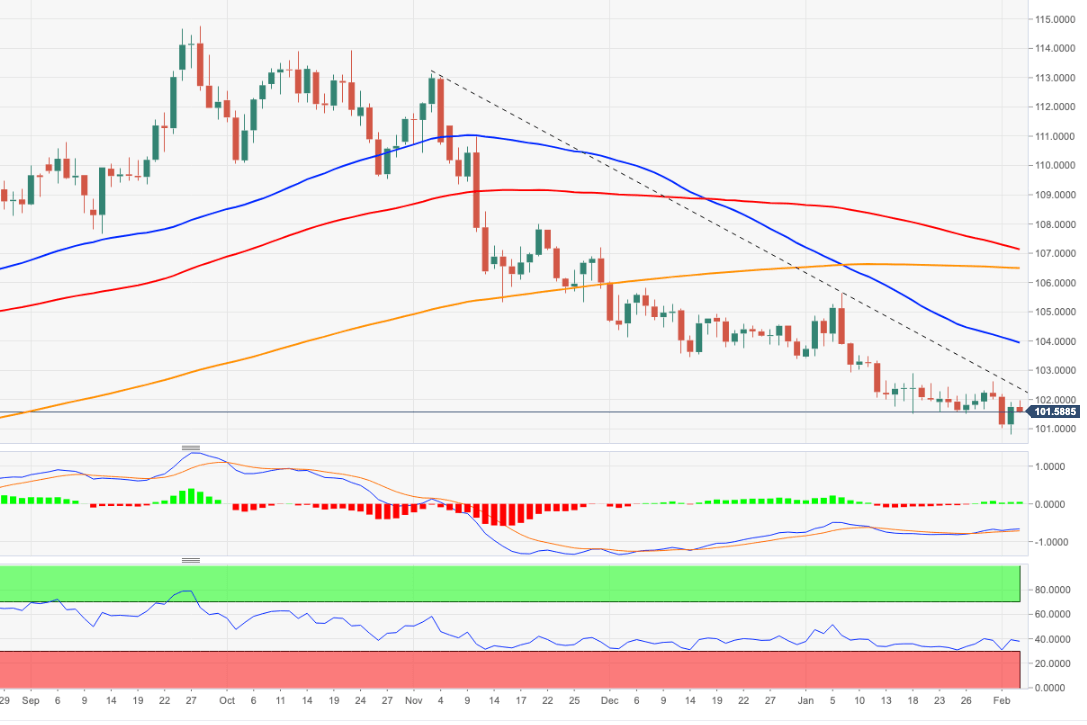

USD Index Price Analysis: Selling pressure unchanged below 102.30

- The index fades the initial uptick to the 102.00 zone on Friday.

- The negative view persists while below the resistance line near 102.30.

The upside momentum in DXY falters just ahead of the key 102.00 barrier in pre-NFP trading at the end of the week.

In the near term, further losses appear in the pipeline while below the 3-month resistance line near 102.30. If the index manages to clear this region it could accelerate gains to the provisional 55-day SMA, today at 103.93.

Below this line, the dollar is expected to keep the short-term bearish bias unchanged and with the immediate target at the 2023 low at 100.80 (February 2).

In the longer run, while below the 200-day SMA at 106.44, the outlook for the index remains negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.