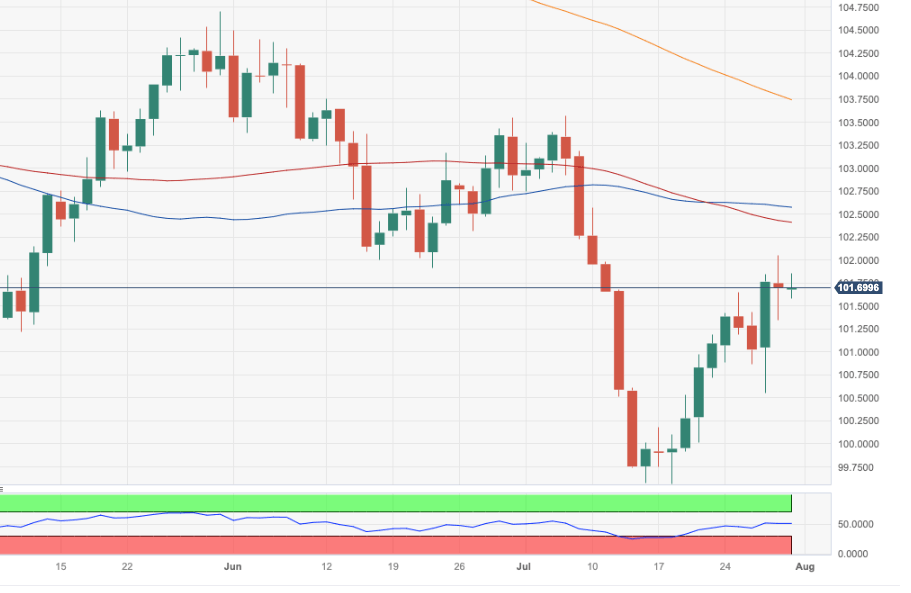

USD Index Price Analysis: Immediate barrier emerges just above 102.00

- DXY gathers further upside traction and retests 101.80/85.

- Further upside targets the weekly high past 102.00.

DXY maintains the optimism well in place and advances for the third session in a row at the beginning of the week.

The index appears poised to extend the ongoing multi-session recovery for the time being. Against that, the surpass of the weekly top of 102.04 (July 28) should prompt the index to embark on a probable visit to the transitory 100-day and 55-day SMAs at 102.40 and 102.56, respectively.

Once this region is cleared, it should alleviate the downside bias in the dollar and allow for extra gains.

Looking at the broader picture, while below the 200-day SMA at 103.73 the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.