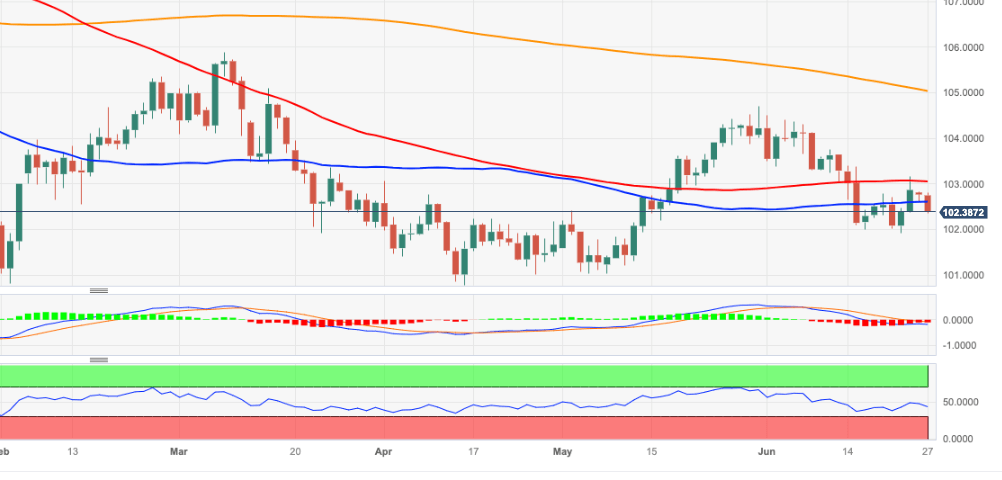

USD Index Price Analysis: Further weakness in store near term

- DXY adds to the weekly leg lower and approaches 102.40.

- Next on the downside emerges the 102.00 zone.

DXY keeps the weekly bearish note unchanged and retreats to the 102.40/35 band on Tuesday.

The index came under renewed downside pressure following last week’s tops past the 103.00 hurdle. Against that, there is still room for the index to revisit June lows in the 102.00 region, while a sustainable breach of this level could expose a deeper decline to April/May lows near 101.00. Dow from here emerges the 2023 low around 100.80 recorded on April 14.

Looking at the broader picture, while below the 200-day SMA at 105.03 the outlook for the index is expected to remain negative.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.