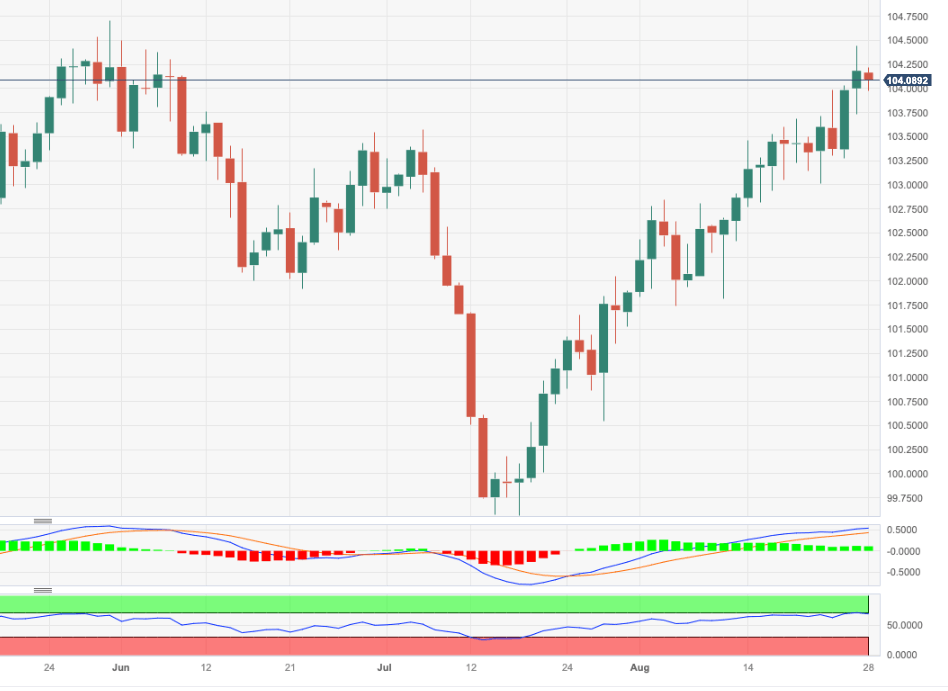

USD Index Price Analysis: Further upside could retest 104.70

- DXY trims part of the recent two-day advance.

- Bulls remain focused on the May high in the 104.70 zone.

DXY comes under pressure and confronts the key support at the 104.00 region at the beginning of the week.

Immediately to the upside turns up the August top at 104.44 (August 25), while the surpass of this level should open the door to a rapid test of the May high of 104.69 (May 31) prior to the 2023 peak of 105.88 (March 8).

While above the key 200-day SMA, today at 103.10, the outlook for the index is expected to shift to a more constructive one.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.