USD Index loses the grip and drops to 111.30 ahead of data, Fedspeak

- The index remains under pressure near the 111.30 zone.

- Improved sentiment in the risk complex weighs on the dollar.

- Factory Orders, Fedspeak next of note in the NA session.

The USD Index (DXY), which gauges the greenback vs. a basket of its main competitors, accelerates the downside and revisits the 111.35/30 band on turnaround Tuesday.

USD Index looks to data, Fed speakers

The index keeps the pessimism unchanged in the first half of the week and now flirts with multi-session lows in the 111.30 region on the back of the persistent improvement in the riskier assets.

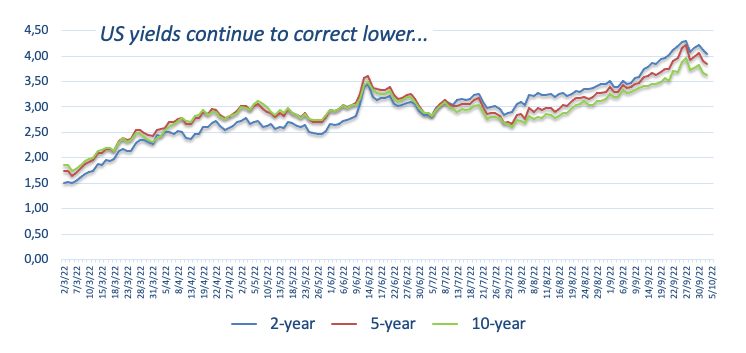

Further weakness in the dollar is also accompanied by another daily pullback in US yields across the curve, which remain within a corrective move after hitting multi-year peaks during last week.

In the US data space, Factory Orders for the month of August will be the sole release of note seconded by speeches by Dallas Fed L.Logan (2023 voter, centrist), NY Fed J.Williams (permanent voter, centrist), Cleveland Fed L.Mester (voter, hawk), FOMC Governor P.Jefferson (permanent voter, centrist) and San Francisco Fed M.Daly (2024 voter, hawk).

What to look for around USD

The index keeps suffering the better tone in the risk complex and already tests the 111.50 region.

Propping up the dollar’s underlying positive stance appears the firmer conviction of the Federal Reserve to keep hiking rates until inflation looks well under control regardless of a likely slowdown in the economic activity and some loss of momentum in the labour market.

Looking at the more macro scenario, the greenback also appears bolstered by the Fed’s divergence vs. most of its G10 peers in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: Factory Orders (Tuesday) – MBA Mortgage Applications, ADP Employment Change, Balance of Trade, Final Services PMI, ISM Non-Manufacturing (Wednesday) – Initial Jobless Claims (Thursday) – Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change, Wholesale Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is down 0.23% at 111.40 and a breach of 109.35 (weekly low September 20) would open the door to 107.68 (monthly low September 13) and finally 107.58 (weekly low August 26). On the other hand, the next up barrier comes at 114.76 (2022 high September 28) seconded by 115.00 (round level) and then 115.32 (May 2002 high).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.