USD Index digests losses near 103.50 ahead of Payrolls

- The index trades in the lower end of the range near 103.50.

- The US Congress passed the debt ceiling bill on Thursday.

- All the attention will be on the Nonfarm Payrolls later in the session.

The greenback, when gauged by the USD Index (DXY), trades slightly on the defensive around the 103.50 region at the end of the week.

USD Index focused on NFP

The index so far adds to Thursday’s strong pullback and navigates in the area of multi-session lows in the mid-103.00s against the backdrop of persistent appetite for the risk complex ahead of the release of the crucial US jobs report later on Friday.

Contributing to the improved optimism among market participants, the US Senate voted 63-36 in favour of legislation to suspend the US debt ceiling and set spending caps through the 2024 election, bringing an end to a drama that threatened a worldwide financial disaster. The bill now moves to President Biden, who promises to sign it only days before the United States defaults (June 5).

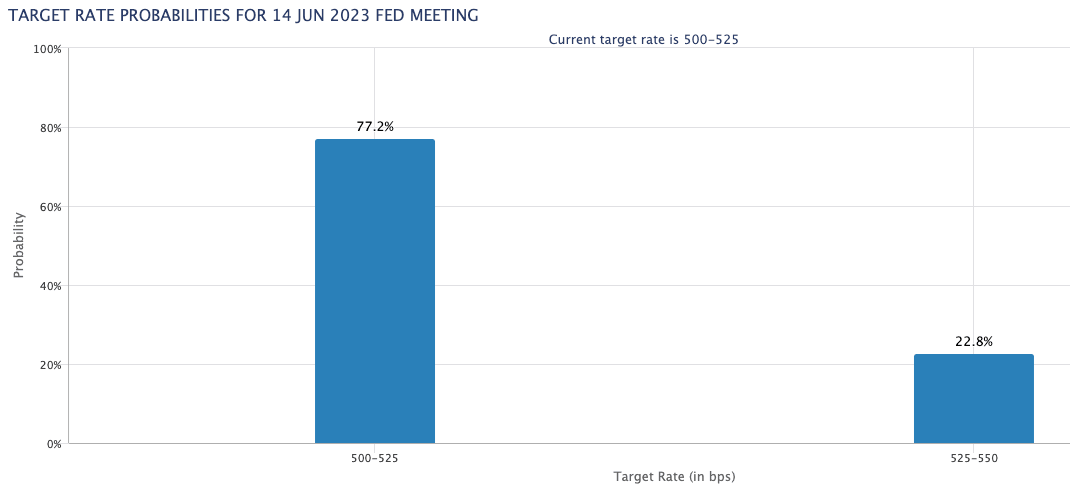

Back at the central banks’ front, the probability of a pause by the Fed at its June 14 gathering now climbs to the boundaries of 80%, according to the FedWatch Tool tracked by CME Group.

In the docket, investors will closely follow the release of the US jobs report for the month of May, when the economy is seen adding 190K jobs and the unemployment rate ticking higher to 3.5%.

What to look for around USD

The index corrects sharply lower and hovers around the 103.50 zone following Thursday’s intense retracement, always on the back of the recent U-turn in expectations of a Fed rate hike later in the month.

In the meantime, bets of another 25 bps at the Fed’s next gathering in June suddenly reversed course in spite of the steady resilience of key US fundamentals (employment and prices, mainly), denting the recent rally in the dollar and favouring a further decline in US yields.

Bolstering a pause by the Fed instead appears to be the extra tightening of credit conditions in response to uncertainty surrounding the US banking sector.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is losing 0.08% at 103.48 and faces the next support at the 100-day SMA at 102.91 followed by the 55-day SMA at 102.41 and finally 101.01 (weekly low April 26). On the upside, the breakout of 104.69 (monthly high May 31) would open the door to 105.58 (200-day SMA) and then 105.88 (2023 high March 8).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.