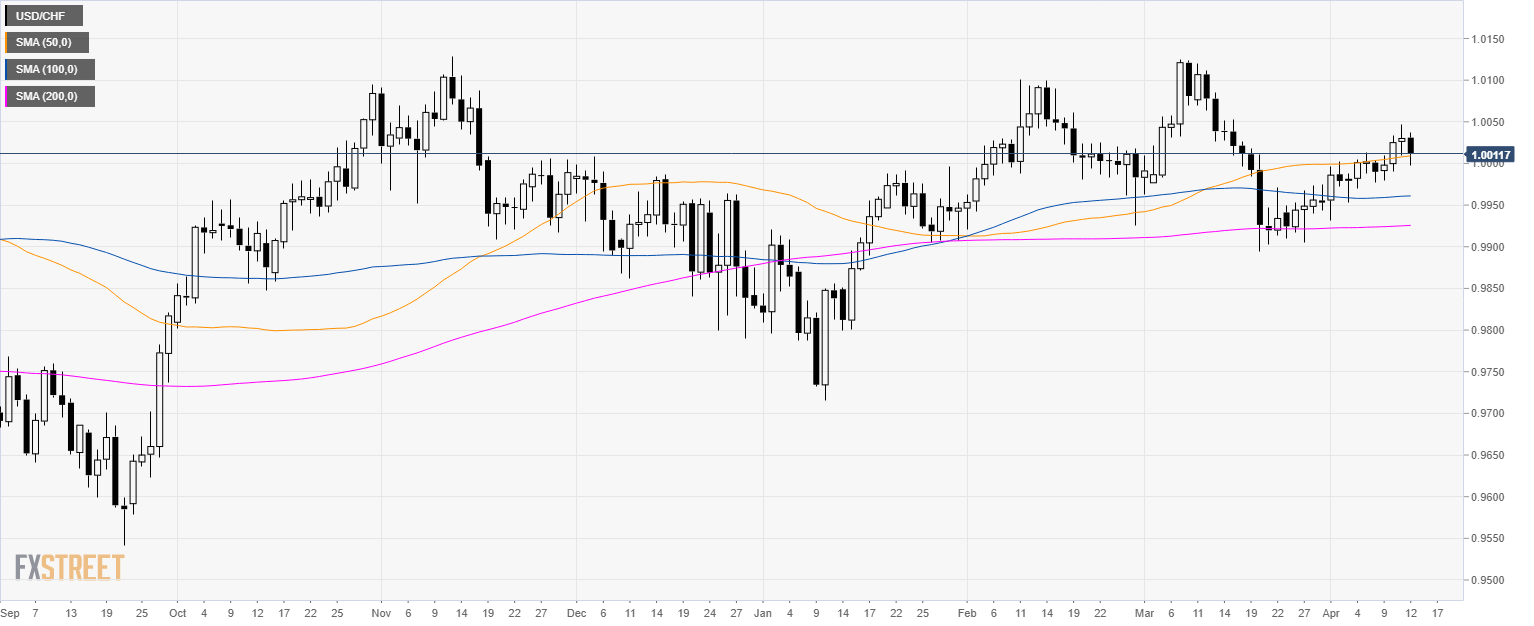

USD/CHF Technical Analysis: Greenback finding support near the parity level

USD/CHF daily chart

- USD/CHF is trading just above the 50-day simple moving average (SMA) and the parity level.

- USD/CHF found some support at the parity level and the 50 and 200 SMA.

USD/CHF 30-minute chart

- USD/CHF is trading near its 200 SMA suggesting that the bulls can revisit the 1.0020 and 1.0035 resistances.

- Support is at 1.0000 and 0.9975 level.

Additional key levels

Author

Flavio Tosti

Independent Analyst