USD/CHF surges towards 0.9900 on risk-aversion as buyers eye a parity test

- As investors expect an aggressive US Fed, USD/CHF rallies 0.80% post US hot inflation.

- Elevated US Treasury yields lifted the greenback and weighed on stocks.

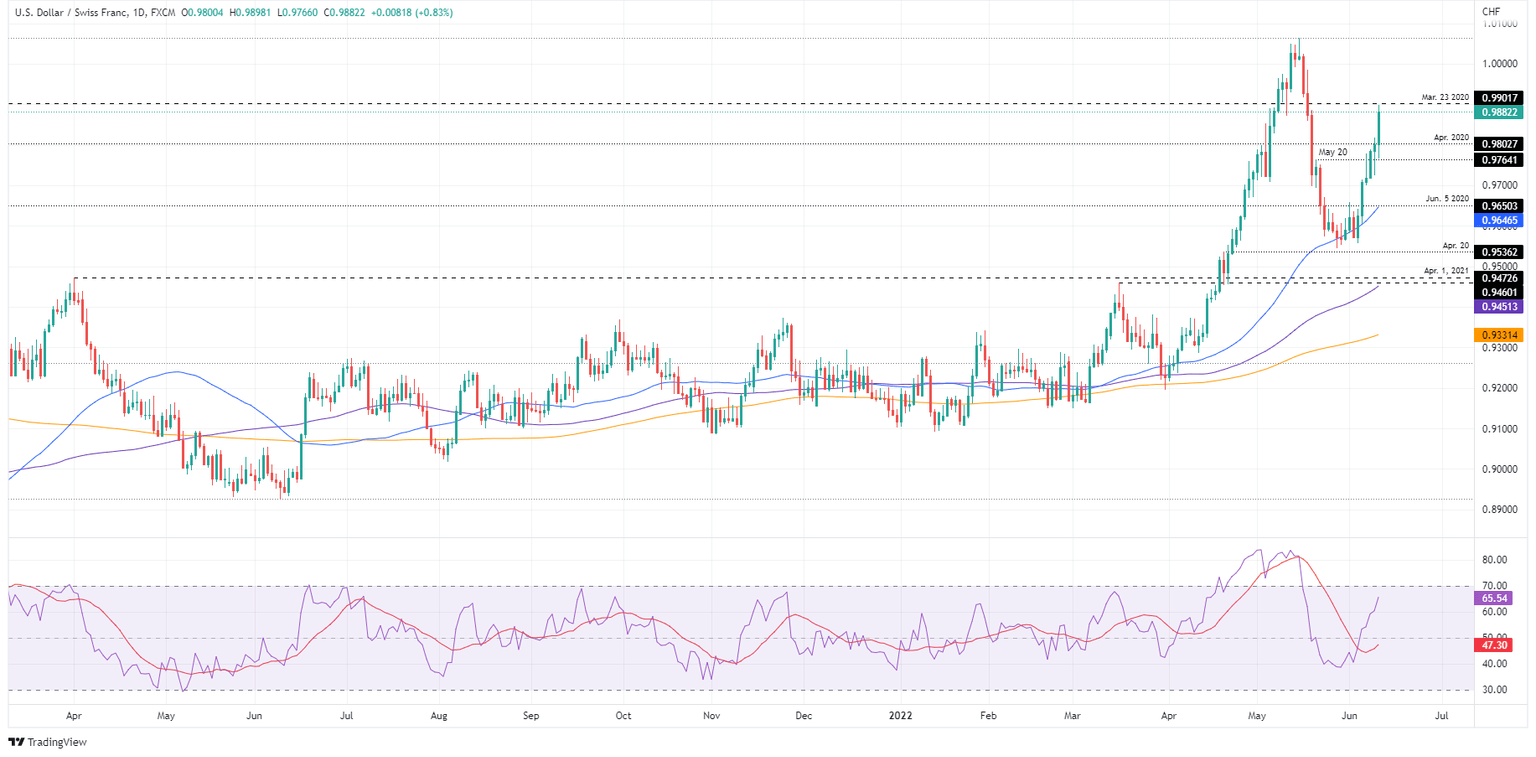

- USD/CHF Price Forecast: The pair is upward biased and would aim towards parity if buyers achieve a daily close above 0.9885.

The USD/CHF rallies sharply following a US inflation report that showed CPI is approaching the 9% threshold, increasing the bets of a US Federal Reserve 50 bps hike added to the June and July’s penciled by the US central bank. At 0.9882, the USD/CHF approaches 0.9900 and opens the door for a parity challenge for the second time in the year.

US CPI increased, lifting US Treasury yields on US Fed hike expectations, and stocks fall

Reflection on US data is better illustrated by the equity markets. European bourses plunged and finished with losses, while US equities nosedive, slashing between 2.12% and 3% of their value. The US dollar rose while US Treasury yields skyrocketed, while the Treasury curve inverts.

The US Dollar Index, a measure of the buck’s value, is advancing 0.84%, sitting at 104.177, while the US 10-year benchmark note rises 21 basis points and is up at 3.154%.

On Friday, the USD/CHF opened around 0.9800 and dipped below the figure on the news from Japan, particularly BoJ’s and finance officials, unveiling a document threatening to intervene in the FX markets. The USD/CHF dipped towards daily’s low at 0.9766 but rallied on US data towards highs of 0.9890s

USD/CHF Price Forecast: Technical outlook

The USD/CHF remains upward biased, though at the time of writing, retraced from daily highs near 0.9898. However, buyers are in control and would keep it if they achieve a daily close above the May 19 daily high at 0.9885. If that scenario plays out, the USD/CHF first resistance would be 0.9900. Break above would expose the May 18 high at 0.9984, followed by a challenge of the YTD high at 1.0007.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.