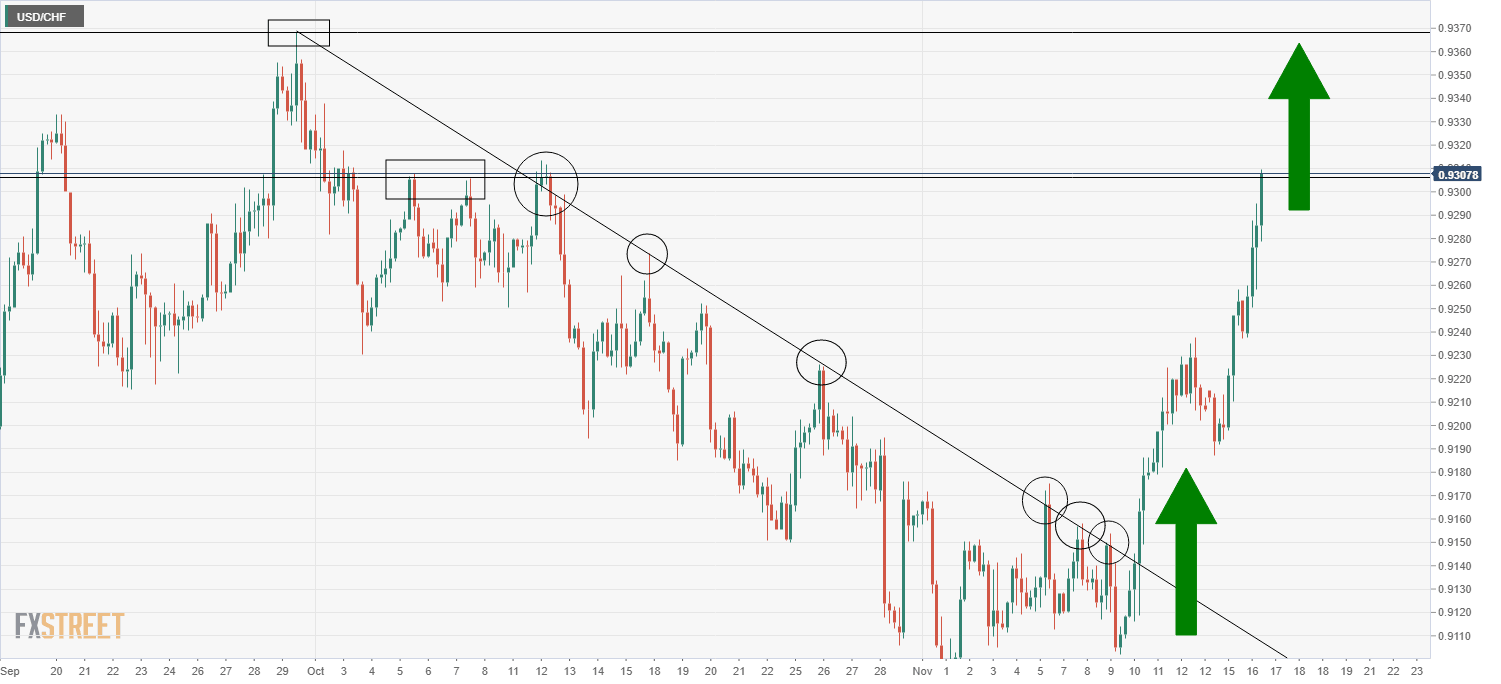

USD/CHF probing resistance at 0.9300, lifted by further positive US data surprises

- USD/CHF has risen for a fifth straight day and is now testing resistance at the 93.00 level.

- Strong US inflation and economic data and the associated divergence in central bank tightening expectations has been the main driver.

USD/CHF has seen substantial upside throughout Tuesday’s session and is now up around 0.6% on the day at 0.9300. The main catalyst for Tuesday’s upside was a further positive US data surprises, which triggered a broad strengthening of the US dollar (the DXY is now at year-to-date highs in the 95.80s). The US October Retail Sales report was much better than expected and there was a stronger than expected rebound in October Industrial Production from September’s Hurricane Ida disruption-related slump.

There is significant resistance at the 0.9300 level in the form of a triple top from early/mid-October. Should that resistance be broken, then it seems likely that the next stop for USD/CHF would be the annual high at 0.9360.

Bullish run continues

USD/CHF is now set to have risen for five straight sessions, during which time it will have rallied over 2.0% from the low 0.9100s to current levels at 93.00. The initial catalyst for the rally was last week’s much hotter than expected US Consumer Price Inflation report, which sent the pair shooting above a negative trendline that had been capping the price action for more than six weeks. Technical momentum has thus played a role, as has the broader theme of central bank divergence.

That is to say, in wake of recent inflation and economic data surprises, markets have been moving to price in a more hawkish Fed. This divergence can be examined by looking at Short-Term Interest Rate (STIR) future markets. December 2022 Swiss France LIBOR futures are broadly unchanged versus last Wednesday’s pre-US CPI data levels at 100.52, implying an SNB rate of roughly -0.5% at the end of 2022, or 25bps of tightening from the bank’s current -0.75% rate. Contrast that with the more than 15 point move lower in the December 2022 Eurodollar future to around 99.05 from previously above 99.20. In other words, USD money markets have pretty much moved to price in three rate hikes from the Fed in 2022, versus two prior to the CPI release.

Watch the EUR/CHF 1.05 floor

USD/CHF traders should key an eye on a key level in the EUR/CHF cross. The Swiss National Bank has been keen to not let EUR/CHF slip below 1.05, indeed, this was the level it defended in the early stages of the pandemic. The pair tested the level on Monday, but has since rebounded somewhat. Some analysts are of the view that this time, the SNB might be willing to let the pair fall below 1.05.

According to Capital Economics, the “persistent weakness of Swiss inflation, and the resulting trend appreciation in the nominal exchange rate, presents the SNB with a moving target when assessing when it will intervene during bouts of upward pressure on the franc... Having defended the CHF 1.05 per euro mark in earnest last year, we suspect that the SNB’s “line in the sand” may now be closer to CHF 1.025, and that it could live with the franc rising to parity with the euro over the coming years.”

A rise in Covid-19 infection rates and Eurozone countries rushing to re-impose restrictions is one reason for FX markets to favour the Swiss Franc over the euro. With regards to the pandemic situation in Europe, things are likely to get far worse before they get any better. Any sustained move below 1.05 in EUR/CHF would make it difficult for USD/CHF to continue its recent rally. In the long-run, though, this is likely to scupper the broader trend of USD/CHF appreciation driven by economic/central bank divergence.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset