USD/CHF Price Forecast: Extends rebound as Fed hold rates, Trump boosts USD

- USD/CHF trades at 0.8180, up 0.08%, as Fed sticks to rate hold and eyes two 2025 cuts.

- Trump’s openness to Iran talks supports safe-haven Dollar demand despite geopolitical risk.

- Pair consolidates between 0.8038–0.8350; bulls eye 0.8233 and 0.8300 on breakout.

The USD/CHF advances for the fourth straight day after the Federal Reserve’s (Fed) decision to hold rates unchanged, though they are still eyeing two rate cuts in 2025. This, along with US President Trump's remarks that he’s open to Iran talks, boosted the Dollar. At the time of writing, the pair trades at 0.8180, up 0.08%.

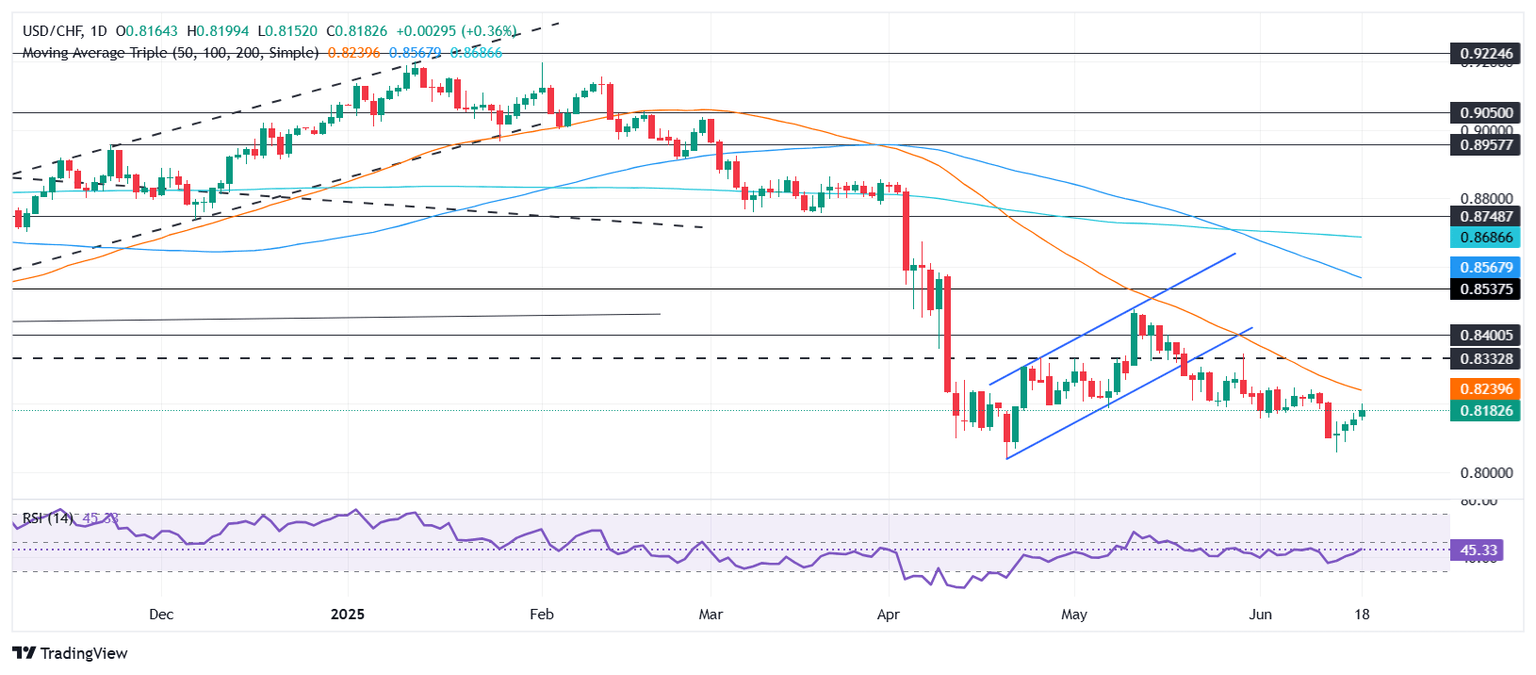

USD/CHF Price Forecast: Technical outlook

Price action suggests that the USD/CHF downtrend remains in place, although since June 13, it appears to be consolidating within the 0.8038-0.8350 range in the near term. This is because the Relative Strength Index (RSI) turned flat at its 50-neutral line.

If USD/CHF climbs past 0.82, buyers could test the 50-day SMA at 0.8233. If broken, expect a rally to 0.8300, which clears the path to test the May 29 daily peak of 0.8347, ahead of 0.84. The other scenario would be if the downtrend resumes, but sellers need to surpass the 0.8100 figure. A breach of the latter will expose the June 17 swing low of 0.8054, before testing the YTD low of 0.8038.

USD/CHF Price Chart – Daily

Swiss Franc PRICE This week

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies this week. Swiss Franc was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.46% | 1.02% | 0.28% | 0.76% | -0.42% | -0.23% | 0.81% | |

| EUR | -0.46% | 0.44% | -0.20% | 0.31% | -0.76% | -0.67% | 0.35% | |

| GBP | -1.02% | -0.44% | -0.60% | -0.13% | -1.19% | -1.11% | -0.09% | |

| JPY | -0.28% | 0.20% | 0.60% | 0.48% | -0.98% | -0.84% | 0.13% | |

| CAD | -0.76% | -0.31% | 0.13% | -0.48% | -1.09% | -0.98% | 0.04% | |

| AUD | 0.42% | 0.76% | 1.19% | 0.98% | 1.09% | 0.08% | 1.11% | |

| NZD | 0.23% | 0.67% | 1.11% | 0.84% | 0.98% | -0.08% | 1.03% | |

| CHF | -0.81% | -0.35% | 0.09% | -0.13% | -0.04% | -1.11% | -1.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.