USD/CHF Price Forecast: Clings to 0.8800 as bulls eye 200-day SMA

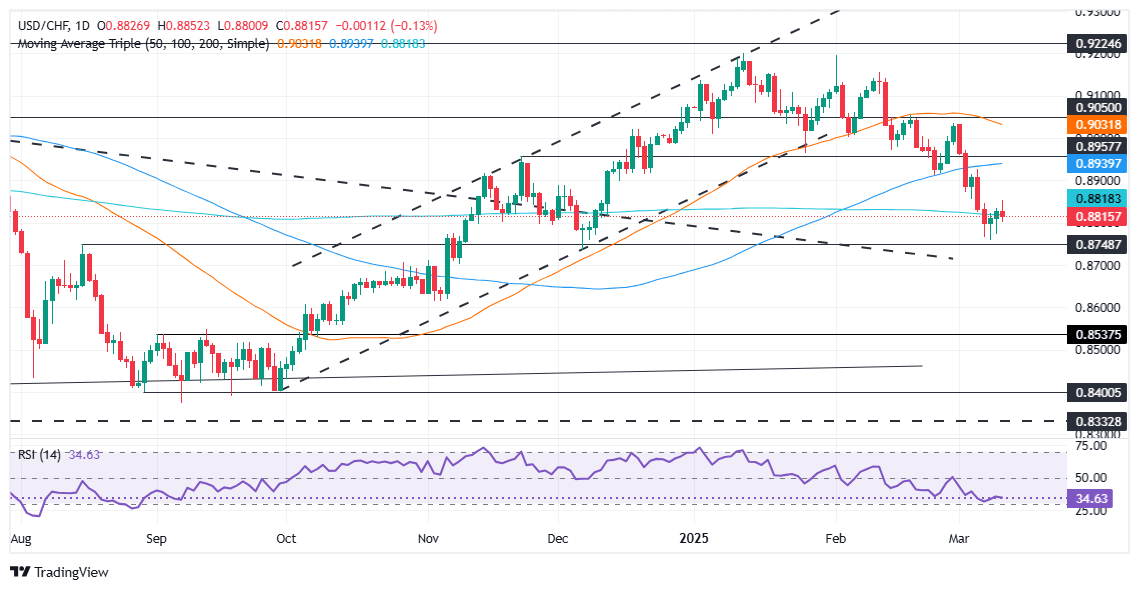

- USD/CHF stabilizes at 0.8810 for second straight day, hugs critical 200-day SMA after rebound from yearly lows.

- Technical downtrend persists; recent lower highs and lower lows suggest bears maintain control but momentum slows.

- Break below 0.8800 could trigger deeper declines toward cycle lows; upside break opens door to 0.8850, then potentially 0.9000.

The USD/CJF holds firm around the 0.8810 mark for the second consecutive day and clings to the 200-day Simple Moving Average (SMA) at 0.8813 after bouncing off yearly lows of 0.8757. At the time of writing, the pair trades at 0.8814, virtually unchanged, as Thursday’s Asian session begins.

USD/CHF Price Forecast: Technical outlook

USD/CHF is in an ongoing downtrend after dropping below key dynamic support levels like the 100 and 200-day SMAs. In addition, the pair carved successive series of lower highs and lower lows, indicating that sellers might be in charge. Nevertheless, the fall halted shy of clearing the latest cycle low of 0.8726, the December 6 low.

The Relative Strength Index (RSI) began to rise on Monday but shifted flat during the session. Therefore, USD/CHF might remain sideways, awaiting a fresh catalyst.

If USD/CHF clears the 200-day SMA, this paves the way to challenge 0.8800, ahead of the latest cycle low. Otherwise, if buyers reclaim the 200-day SMA, look for a test of the 0.8850 area before rallying to the 0.9000 mark.

USD/CHF Price Chart – Daily

Swiss Franc FAQs

The Swiss Franc (CHF) is Switzerland’s official currency. It is among the top ten most traded currencies globally, reaching volumes that well exceed the size of the Swiss economy. Its value is determined by the broad market sentiment, the country’s economic health or action taken by the Swiss National Bank (SNB), among other factors. Between 2011 and 2015, the Swiss Franc was pegged to the Euro (EUR). The peg was abruptly removed, resulting in a more than 20% increase in the Franc’s value, causing a turmoil in markets. Even though the peg isn’t in force anymore, CHF fortunes tend to be highly correlated with the Euro ones due to the high dependency of the Swiss economy on the neighboring Eurozone.

The Swiss Franc (CHF) is considered a safe-haven asset, or a currency that investors tend to buy in times of market stress. This is due to the perceived status of Switzerland in the world: a stable economy, a strong export sector, big central bank reserves or a longstanding political stance towards neutrality in global conflicts make the country’s currency a good choice for investors fleeing from risks. Turbulent times are likely to strengthen CHF value against other currencies that are seen as more risky to invest in.

The Swiss National Bank (SNB) meets four times a year – once every quarter, less than other major central banks – to decide on monetary policy. The bank aims for an annual inflation rate of less than 2%. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Macroeconomic data releases in Switzerland are key to assessing the state of the economy and can impact the Swiss Franc’s (CHF) valuation. The Swiss economy is broadly stable, but any sudden change in economic growth, inflation, current account or the central bank’s currency reserves have the potential to trigger moves in CHF. Generally, high economic growth, low unemployment and high confidence are good for CHF. Conversely, if economic data points to weakening momentum, CHF is likely to depreciate.

As a small and open economy, Switzerland is heavily dependent on the health of the neighboring Eurozone economies. The broader European Union is Switzerland’s main economic partner and a key political ally, so macroeconomic and monetary policy stability in the Eurozone is essential for Switzerland and, thus, for the Swiss Franc (CHF). With such dependency, some models suggest that the correlation between the fortunes of the Euro (EUR) and the CHF is more than 90%, or close to perfect.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.