USD/CHF Price Analysis: Trading near fresh two-year highs around 0.9830s as the Fed decision looms

- The Swiss franc accumulates losses for the nine-consecutive trading session.

- US equities fluctuate between gainers and losers as risk appetite wobbles.

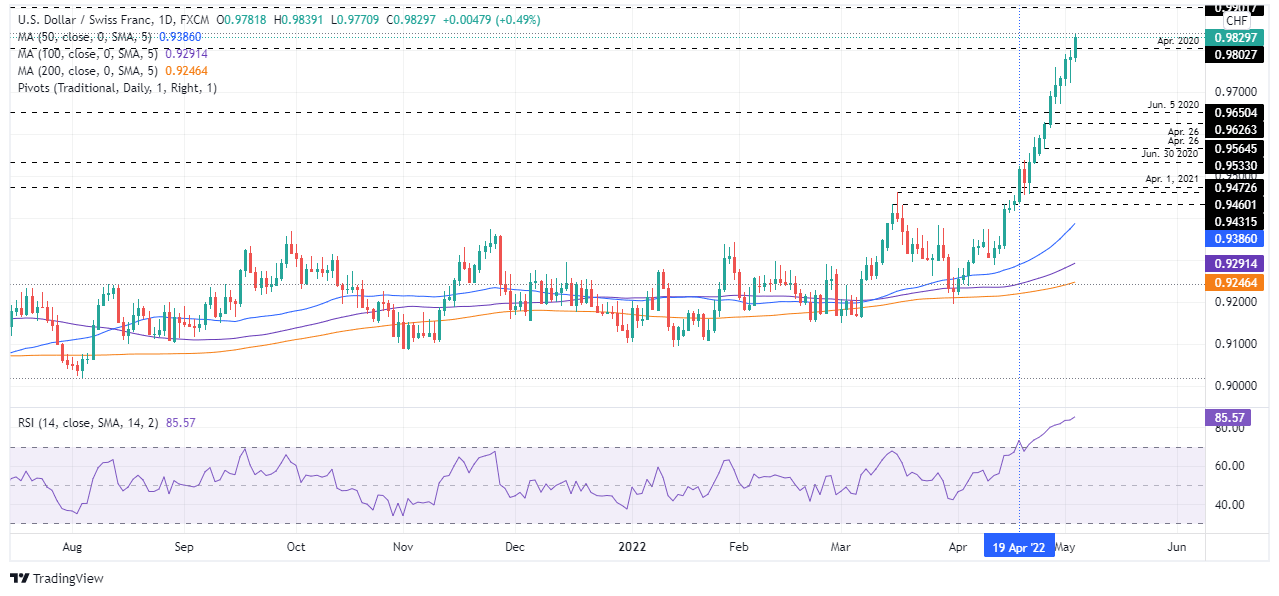

- USD/CHF Price Forecast: Upward biased, despite RSI being in overbought territory but still aiming higher.

The USD/CHF rallied and reached a two-year high at around 0.9839 as traders prepared for the monetary policy decision of the Federal Reserve. At 0.9829, the USD/CHF retraced from daily tops but is recording gains of 0.49% at the time of writing.

Sentiment has improved as the Fed’s monetary policy decision gets closer, the greenback weakens

The market mood is mixed, as US equities fluctuate between gainers and losers. Meanwhile, the Covid-19 crisis hitting China, the second-largest economy, threatens to slow down the post-pandemic economic recovery. However, it has already taken its toll as China’s Caixin PMIs last Saturday showed that the manufacturing and services indices are contracting.

In the meantime, the Ukraine-Russia fighting continues but has moved to the Donbas region, as Russia is trying to seize that territory.

The US Dollar Index, a gauge of the greenback’s value against a basket of its peers, slides some 0.11% and sits at 103.343, ahead of the Fed’s decision. Contrarily, the US 10-year benchmark note sits at 2.989%, up to one and a half basis points during the day.

USD/CHF Price Forecast: Technical outlook

The USD/CHF has sustained the steepest rally since reaching the 0.9200 region on March 31. However, despite the Relative Strength Index (RSI) being in overbought territory at 85.67, it shows no signs of a reversal coming up next, as RSI’s slope remains upward.

With that said, the USD/CHF first resistance level would be the R2 daily pivot at 0.9850. A breach of the latter would send the pair towards the R3 pivot point at 0.9890, followed by the 0.9900 figure, shy of the parity.

On the flip side, the USD/CHF first support would be the R1 pivot point at 0.9810, followed by the 0.9800 mark. Once cleared, the next support would be the 50-hour simple moving average (SMA) at 0.9787, followed by the daily pivot at 0.9770.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.