USD/CHF Price Analysis: Upside attempts capped below 0.9285 resistance

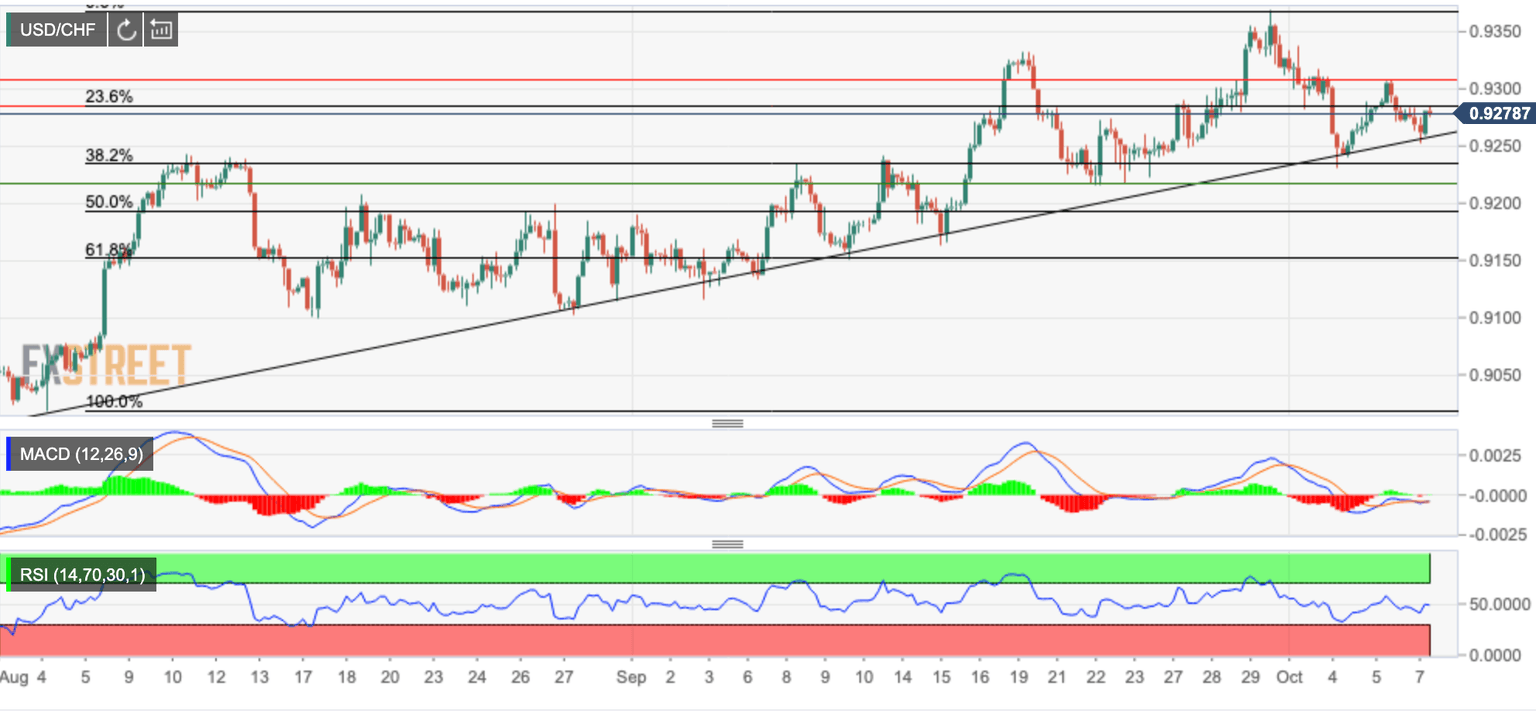

- USD/CHF is hesitating below 0.9285 resistance level.

- The overall bias remains positive while above trendline support at 0.9250.

The US dollar is hesitating against the Swiss franc for the second consecutive day on Thursday. The pair has bounced up from trendline support, at 0.9250 area, yet it seems unable to extend its recovery past 0.9285 resistance so far.

Technical indicators are suggesting a neutral to slightly positive bias, that would confirm once the pair breaches the mentioned 0.9285 (23.6% Fibonacci retracement of the August - September rally). A clear confirmation above here would improve upside momentum, and open the path towards 0.9310 (October 6 high) and attempt a retest of multi-month highs at 0.9365.

On the downside, a clear drop below the trendline support from early August low, now around 0.9260 would cancel the positive trend and expose 0.9215 (September 22, 23, and 24 lows) and 50% Fibonacci retracement at 0.9295.

USD/CHF 4-hour chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.