USD/CHF Price Analysis: Reclaims the 50-DMA and is back above 0.9300

- USD/CHF is almost flat as Thursday’s Asian session kicks in.

- USD/CHF Price Analysis: Downward biased, though it appears to have bottomed around 0.9000.

The USD/CHF clings to 0.9300 as the Asian Pacific session begins, but it’s trading beneath its opening price after printing a new weekly high of 0.9318 and gaining 0.39% on Wednesday. At the time of typing, the USD/CHF exchanges hands at 0.9302.

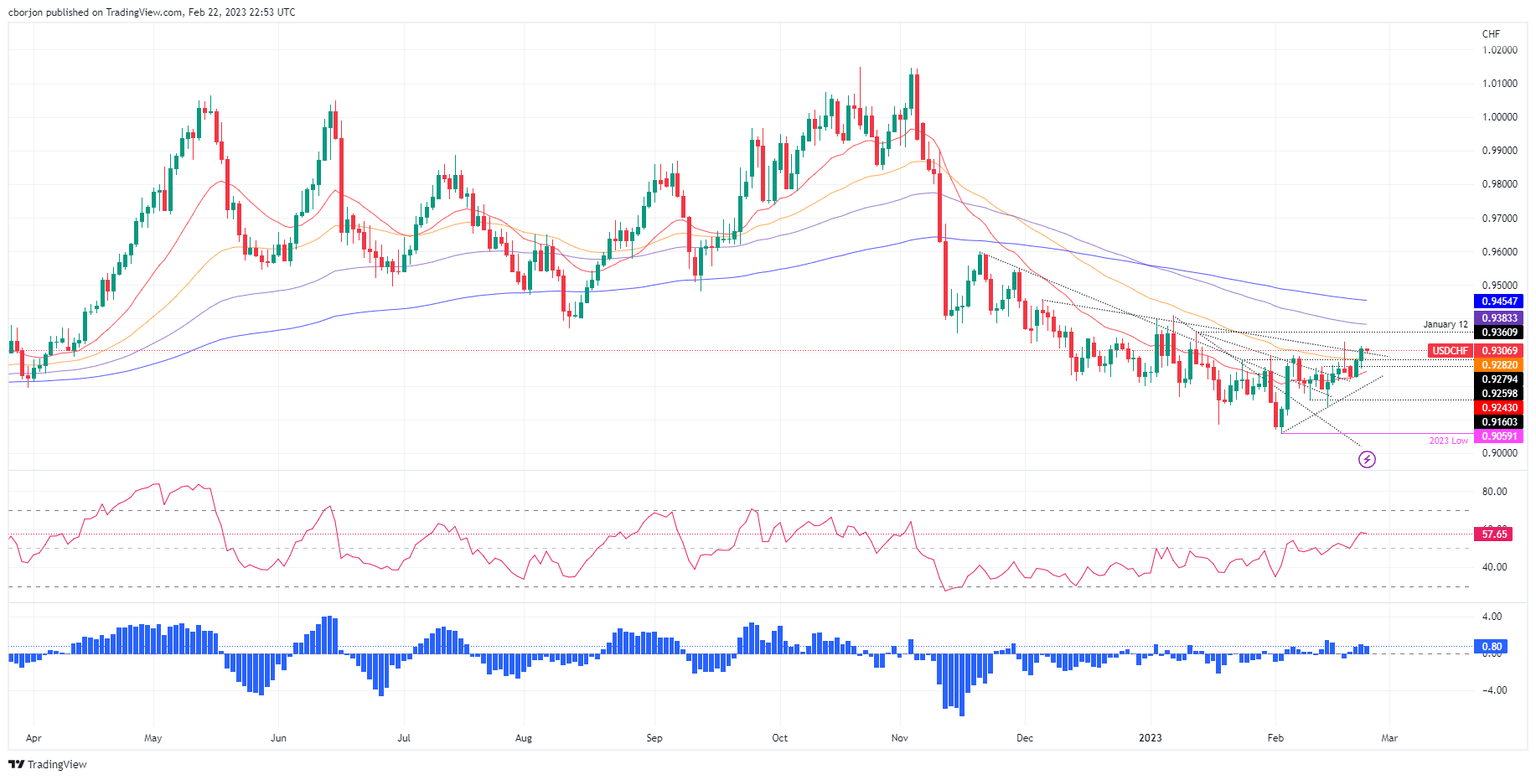

The USD/CHF pair is neutral to downward biased, with the long-term Exponential Moving Averages (EMAs), the 100 and 200-day EMAs, sitting above the exchange rate each at 0.9383 and 0.9454, respectively. In addition, the USD/CHF spot price remains below the January 6 daily high of 0.9409, which, once broken, could send the pair rallying to test the 200-day EMA.

Even though the USD/CHF bias is tilted to the downside, the pair appears to have bottomed around 0.9059. Also, the Relative Strength Index (RSI) and the Rate of Change (RoC) are bullish, suggesting buyers are piling in.

Therefore, the USD/CHF path of least resistance is upward in the near term. The first resistance would be the last week’s high at 0.9331. A decisive break and the following resistance tested would be the 100-day EMA at 0.9383, ahead of the 0.9400 figure. Once those two supply zones are conquered, buyers will aim toward the 200-day EMA at 0.9454 before posing a threat of the 0.9500 figure.

Contrarily, if the USD/CHF drops below the 50-day EMA at 0.9281, that would exacerbate a fall toward the February 14 daily low at 0.9135.

USD/CHF Daily chart

USD/CHF Key technical levels

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.