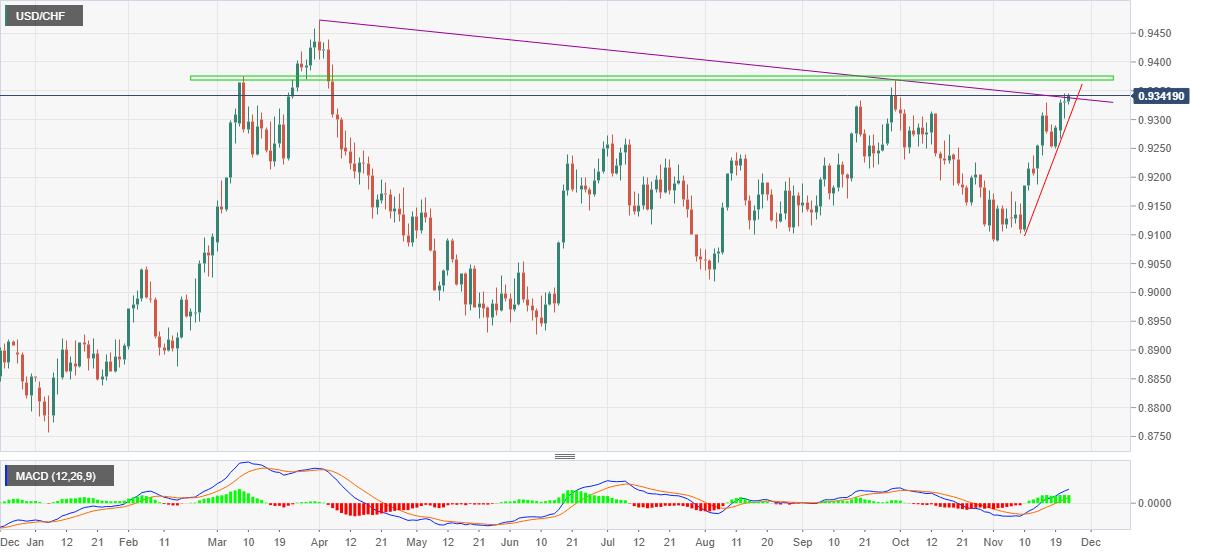

USD/CHF Price Analysis: On the way to 0.9368-75 resistance region

- USD/CHF grinds higher around two-month top, pokes resistance line from April.

- Bullish MACD signals, higher-high formation favor buyers.

- Two-week-old support line restricts immediate downside, multiple hurdles from March challenge further upside.

USD/CHF seesaws around 0.9340, after an uptick to refresh multi-day top during early Wednesday. In doing so, the Swiss currency (CHF) pair buyers flirt with a descending trend line from April amid bullish MACD signals.

Given the recent higher highs favoring the upside momentum, USD/CHF is up for further advances targeting a nearly nine-month-old horizontal area surrounding 0.9368-75. However, a daily closing past 0.9340 is necessary for the same.

Although the pair buyers are likely to take a rest around 0.9375, failing to do so will direct the quote towards the 0.9400 threshold and the yearly peak of 0.9472.

Alternatively, an ascending support line from November 10, near the 0.9300 round figure, restricts short-term pullback of the USD/CHF.

Even if the pair drops below 0.9300, July’s high close to 0.9275 and last week’s swing low around 0.9250 will challenge the bears.

USD/CHF: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.