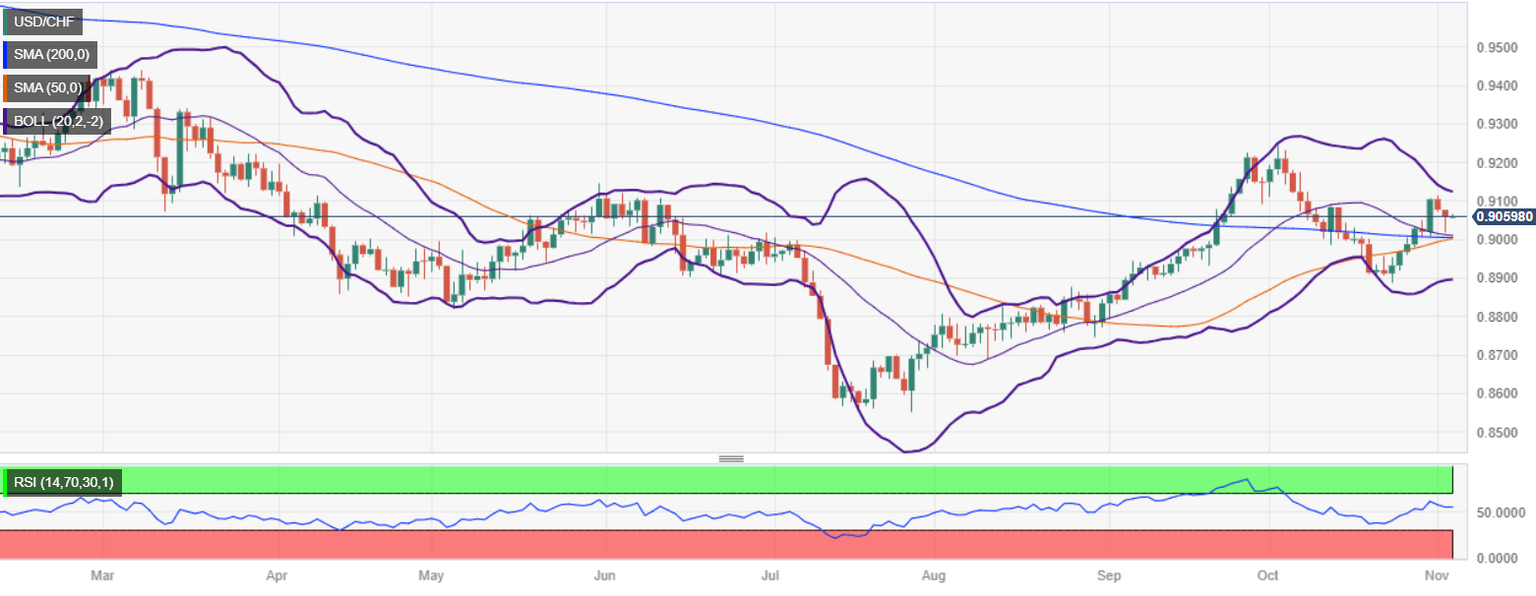

USD/CHF Price Analysis: Golden cross loom, bulls hopeful target 0.9100

- USD/CHF finds support at 0.9010, with buyers lifting pair to 0.9057 in late North American session.

- 'Golden cross' formation of 50-day moving average crossing above 200-day moving average opens door for bullish resumption.

- Sellers must push prices below 0.9000 mark and reclaim latest cycle low at 0.8887 to maintain control.

The USD/CHF finds some support at around the 0.9010 area, though it failed to print a green day on Thursday after market participants speculated the Federal Reserve isn’t raising rates again. However, buyers entered the market late in the North American session and lifted the pair to current exchange rates at 0.9057, almost flat as the Asian session began.

From a technical standpoint, the pair is set to extend its gains as the 50-day moving average (DMA) is about to cross above the 200-DMA, forming a ‘golden cross’ and opening the door for a bullish resumption. However, USD/CHF buyers must reclaim the latest swing high at 0.9112 before setting their sights at the latest cycle high at 0.9245, the October 3 high. Once those two levels are cleared, the year-to-date (YTD) would be exposed at 0.9440.

On the other hand, for sellers to keep in control, they must push prices below the 0.9000 mark, the confluence of the 50 and 200-DMA. Once cleared, they must reclaim the latest cycle low at 0.8887, the October 24 low.

USD/CHF Price Chart– Daily

USD/CHF Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.