USD/CHF Price Analysis: Falls to two-month lows, below 0.8900

- USD/CHF plunges to a two-month low of 0.8889, down 0.72%, due to weaker-than-expected US labor data and a weakened US Dollar.

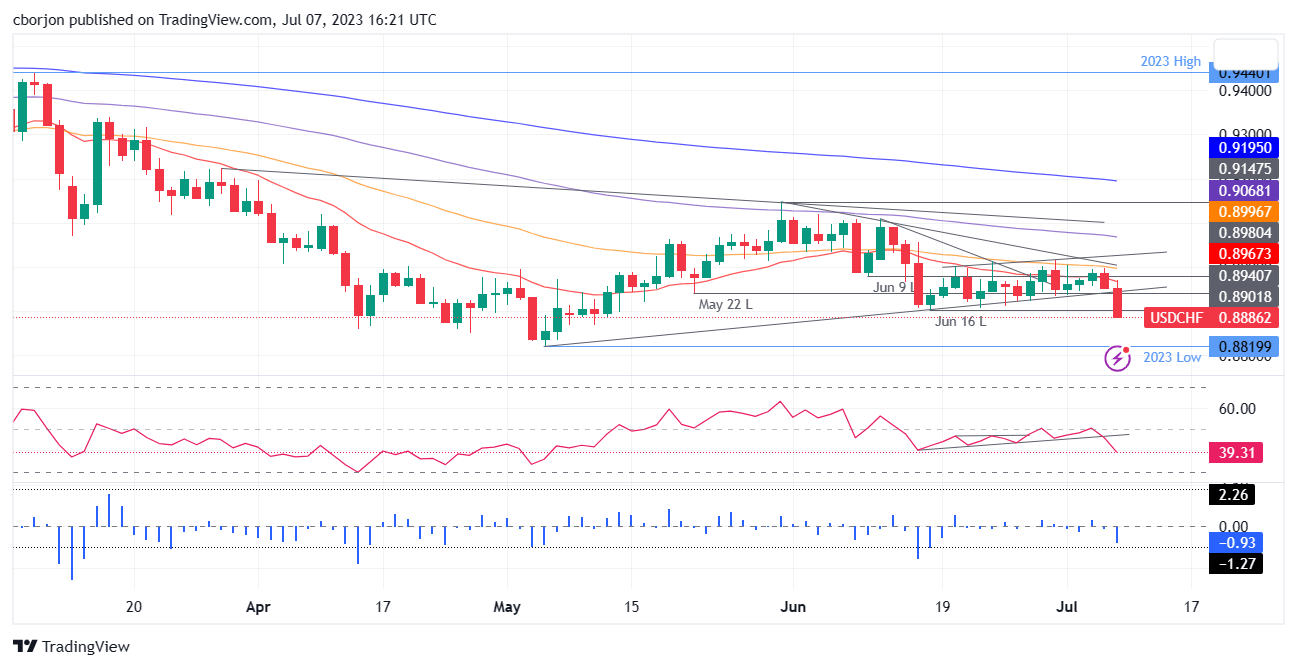

- The pair breaches a two-month support trendline, extending losses below 0.8900.

- The next target is the year-to-date low of 0.8819, pending a breakthrough of the 0.8850 psychological level.

- If buyers reclaim 0.8900, initial resistance lies at 0.8950, followed by the 20-day EMA at 0.8967 and the 50-day EMA at 0.8997.

USD/CHF dives into a new two-month-old on Friday after labor data from the United States (US) was softer than expected, weakening the US Dollar (USD). Earlier, the USD/CHF hit a daily high of 0.8970, which dropped below the 0.8900 figure on the data release. The USD/CHF is trading at 0.8889, down 0.72%.

USD/CHF Price Analysis: Technical outlook

From a daily chart perspective, the USD/CHF extended its losses past the 0.8900 mark after breaking a two-month-old support trendline. That exacerbated the USD/CHF fall below the June 16 swing low of 0.8901, intermediate support opening the door for a test of the year-to-date (YTD) low of 0.8819. Nevertheless, the USD/CHF must surpass the 0.8850 psychological level on its way down.

Notably, the Relative Strength Index (RSI) indicator and the three-day Rate of Change (RoC) suggested that sellers remain in charge, as both turned bearish.

Conversely, if USD/CHF buyers reclaim 0.8900, the first resistance would emerge at 0.8950. A breach of the latter, the USD/CHF could rally to the 20-day EMA at 0.8967, followed by the 50-day EMA at 0.8997. A breach of the latter will put into play the 0.9000 figure.

USD/CHF Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.