USD/CHF Price Analysis: Climbs toward 0.9370s as a double-bottom emerged

- USD/CHF bounces around the last week’s lows around 0.9310s.

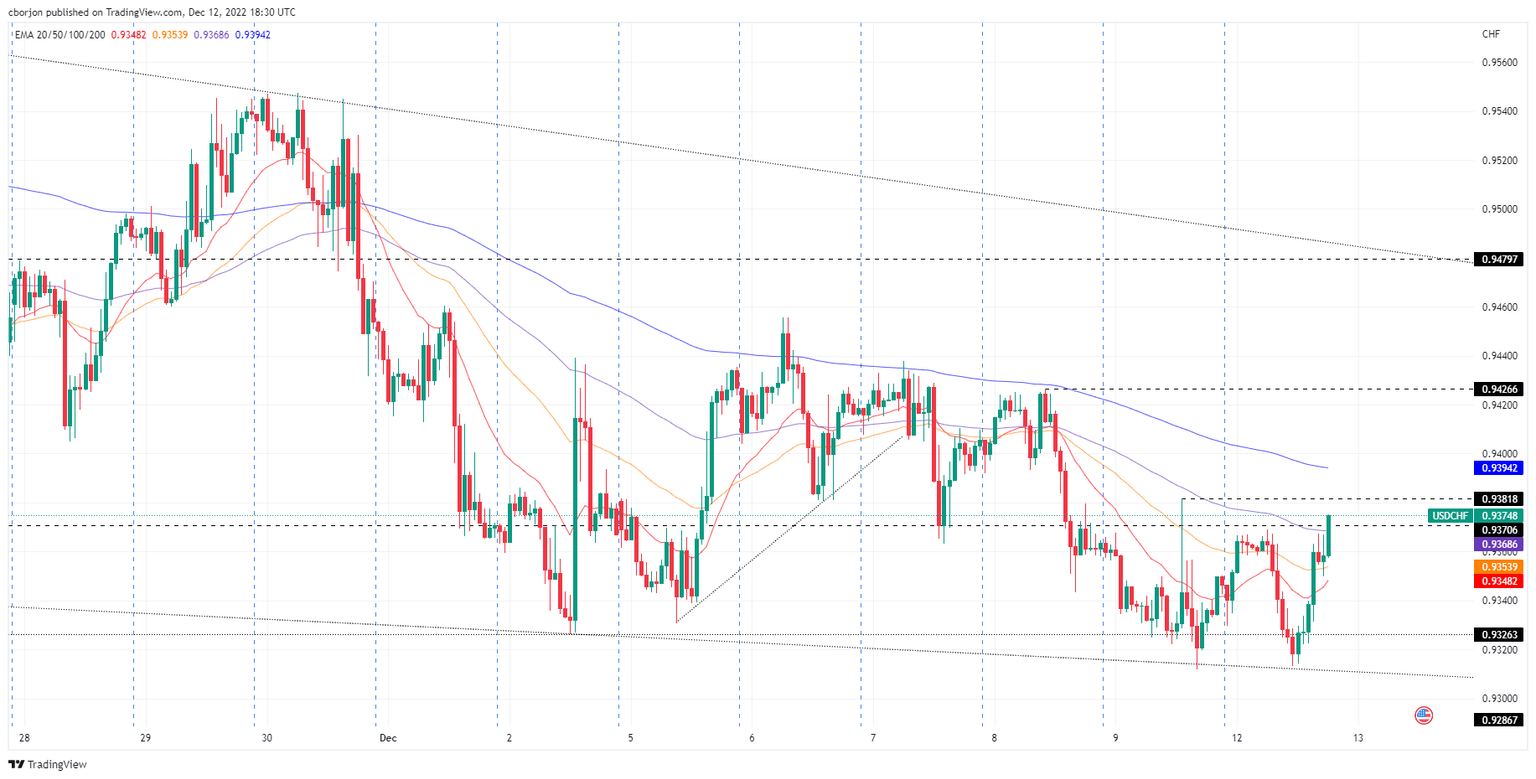

- Near term, the USD/CHF formed a double bottom, which targets a rally towards 0.9430s.

The USD/CHF bounces from last week’s lows around 0.9313 and rises toward 0.9350s, due to a slight jump in US Dollar (USD) demand, amidst an optimistic market sentiment. Elevated US Treasury yields and market-moving economic data from the US due Tuesday bolstered the USD. At the time of writing, the USD/CHF is trading at 0.9378, above its opening price.

USD/CHF Price Analysis: Technical outlook

With the USD/CHF climbing in the North American session after bottoming at the falling-wedge bottom trendline, the USD/CHF remains neutral to downward biased. Nevertheless, a clear break above last Friday’s high of 0.9381 could pave the way to challenge the 0.9400 figure. The Relative Strength Index (RSI0 at bearish territory suggests sellers remain in charge; whatsoever the Rate of Change (RoC) indicates, they are losing momentum.

Short term, the USD/CHF formed a double bottom in the one-hour chart, which would be confirmed by a decisive break above 0.9381. Once achieved, the USD/CHF following resistance would be 0.9400, followed by the December 8 daily high of 0.9426, ahead of 0.9455. On the flip side, the USD/CHF first support would be the 100-Exponential Moving Average (EMA) at 0.9368. A breach of the latter will expose the 50-EMA at 0.9353, followed by the 20-EMA at 0.9347.

USD/CHF Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.