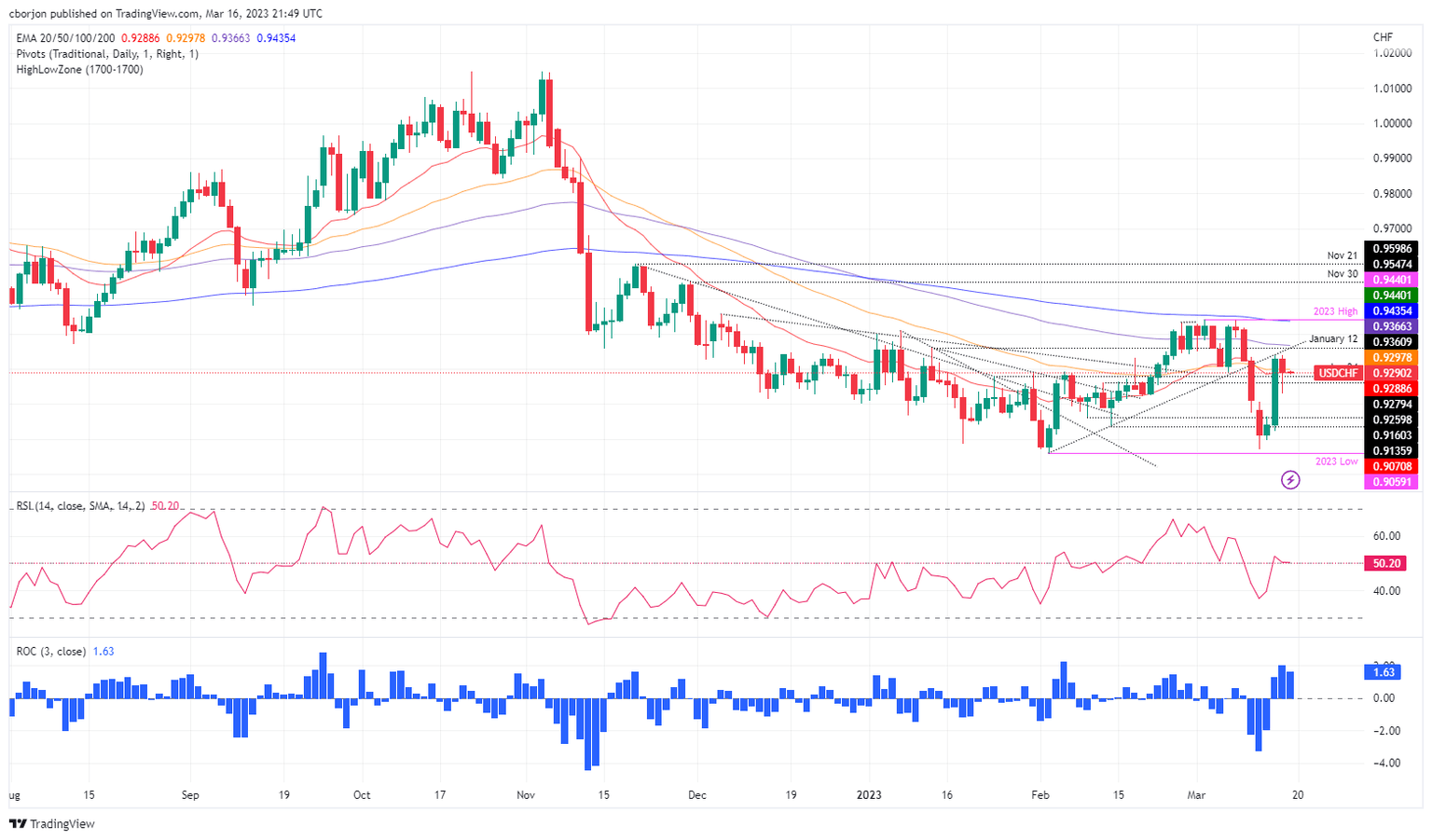

USD/CHF Price Analysis: Bulls and bears clashed around 0.9280/90 on sideways trading

- USD/CHF hovers slightly below the 0.9300 figure and remains around the 20-day EMA.

- USD/CHF Price Analysis: Upward biased in the near term, but downside risks remain on a break below the 20-day EMA.

USD/CHF retreats from weekly highs of 0.9340 and meanders between two daily Exponential Moving Averages (EMAs), at around 0.9290s. An improvement in market sentiment, and a soft US Dollar (USD), triggered flows toward the Swiss Franc (CHF), which recovered some ground.

USD/CHF Price action

Following Wednesday’s price action that saw the USD/CHF pair gaining 2%, Thursday’s session turned red. Nevertheless, the USD/CHF stayed nearby the 20/50-day EMAs, each at 0.9288 and 0.9297, respectively. If the USD/CHF cracks the top of the range, that will poise the pair towards 0.9300 and beyond. Once the figure is conquered, the USD/CHF will test the 100-day EMA at 0.9366, followed by the 0.9400 mark. A rally above will lift the USD/CHF toward the 200-day EMA at 0.9435.

In an alternate scenario, the USD/CHF first support will be the 20-day EMA At 0.9288. a breach of the latter and the USD/CHF will dive towards March 16 low at 0.9229 before stumbling to 0.9200.

USD/CHF Daily chart

USD/CHF Technical levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.