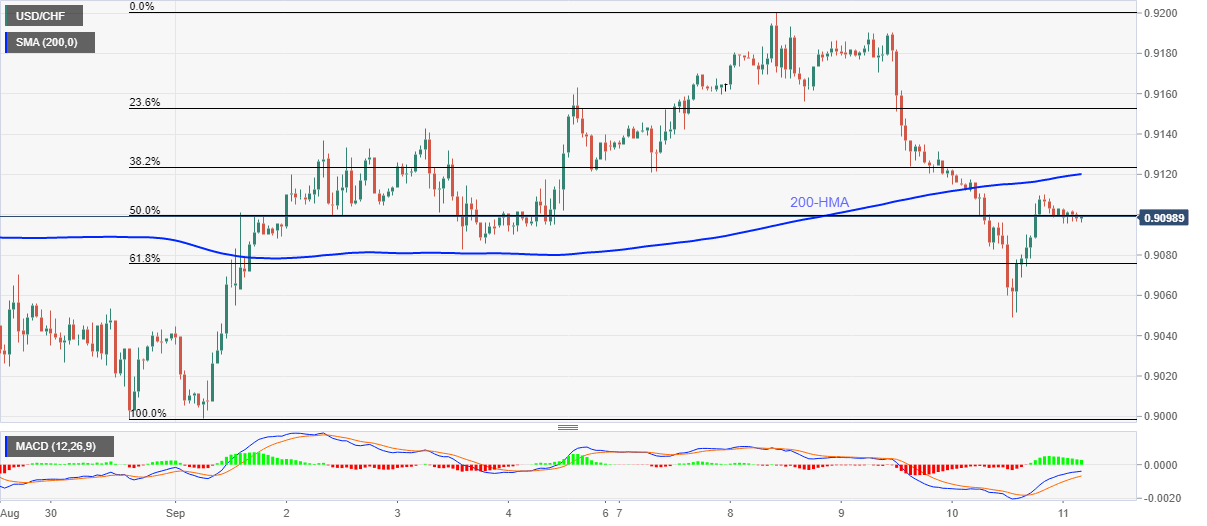

USD/CHF Price Analysis: Bears attack 0.9100 on sustained weakness below 200-HMA

- USD/CHF stays mildly offered after stepping back from 0.9109.

- Bullish MACD restricts the pair’s further downside, bulls fear taking entries below 200-HMA.

- 61.8% of Fibonacci retracement acts as immediate support.

USD/CHF drops to 0.9096, down 0.10% on a day, during the pre-European session on Friday. In doing so, the pair takes rounds to 50% Fibonacci retracement of its August 31 to September 08 upside while staying below 200-HMA.

Considering the pair’s extended weakness below the key HMA, sellers are likely to keep the reins and target a 61.8% Fibonacci retracement level of 0.9075 during the immediate declines.

Though, the weekly low of 0.9048 will probe the bears targeting to refresh the monthly bottom near 0.9000.

Alternatively, an upside break of the recent high of 0.9109 may trigger the pair’s another attempt in crossing the key HMA level around 0.9120.

If at all the bulls manage to clear 0.9120 level, 0.9140 and 0.9160/65 can challenge their run-up to the monthly high of 0.9200.

It should be noted that the pair’s consolidation near the multi-month low increases the odds of its upside break than the otherwise case on a broader view.

USD/CHF hourly chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.