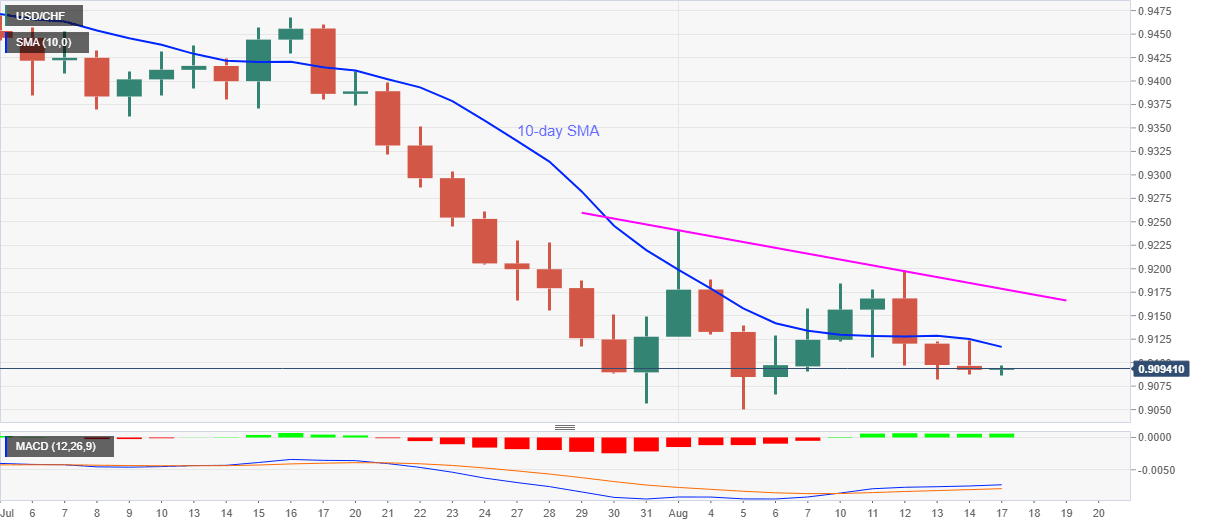

USD/CHF Price Analysis: 10-day SMA probes the halt to three-day losing streak

- USD/CHF keeps recovery from 0.9087 to challenge the sellers.

- Bullish MACD, repeated failures to stay well below 0.9100 favor the buyers.

- A two-week-old falling trend line adds to the upside barriers.

USD/CHF bears catch a breather around 0.9093 during the pre-European trading on Monday. In doing so, the pair stalls the three-day losing streak amid bullish MACD.

Not only the MACD but multiple pullbacks from the sub-0.9100 area also tease the bulls to take entry.

While identifying the odds for it, a daily close past-10-day SMA level of 0.9117 becomes the first hurdle to clear ahead of a short-term falling trend line near 0.9180.

If at all the bulls manage to cross 0.9180, the monthly top close to 0.9245 will be attacked while keeping the early-July low of 0.9362 on the watch-list.

Meanwhile, 0.9080 and 0.9050 can entertain the short-term sellers ahead of diverting them to the 0.9000 threshold. Additionally, the pair’s extended weakness below 0.9000 might not refrain from attacking July 2014 bottom surrounding 0.8860/55.

USD/CHF daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.