USD/CHF picks up from 0.9075 support following Fed Golsbee’s comments

- The US Dollar pares previous losses and returns to levels right below 0.9100

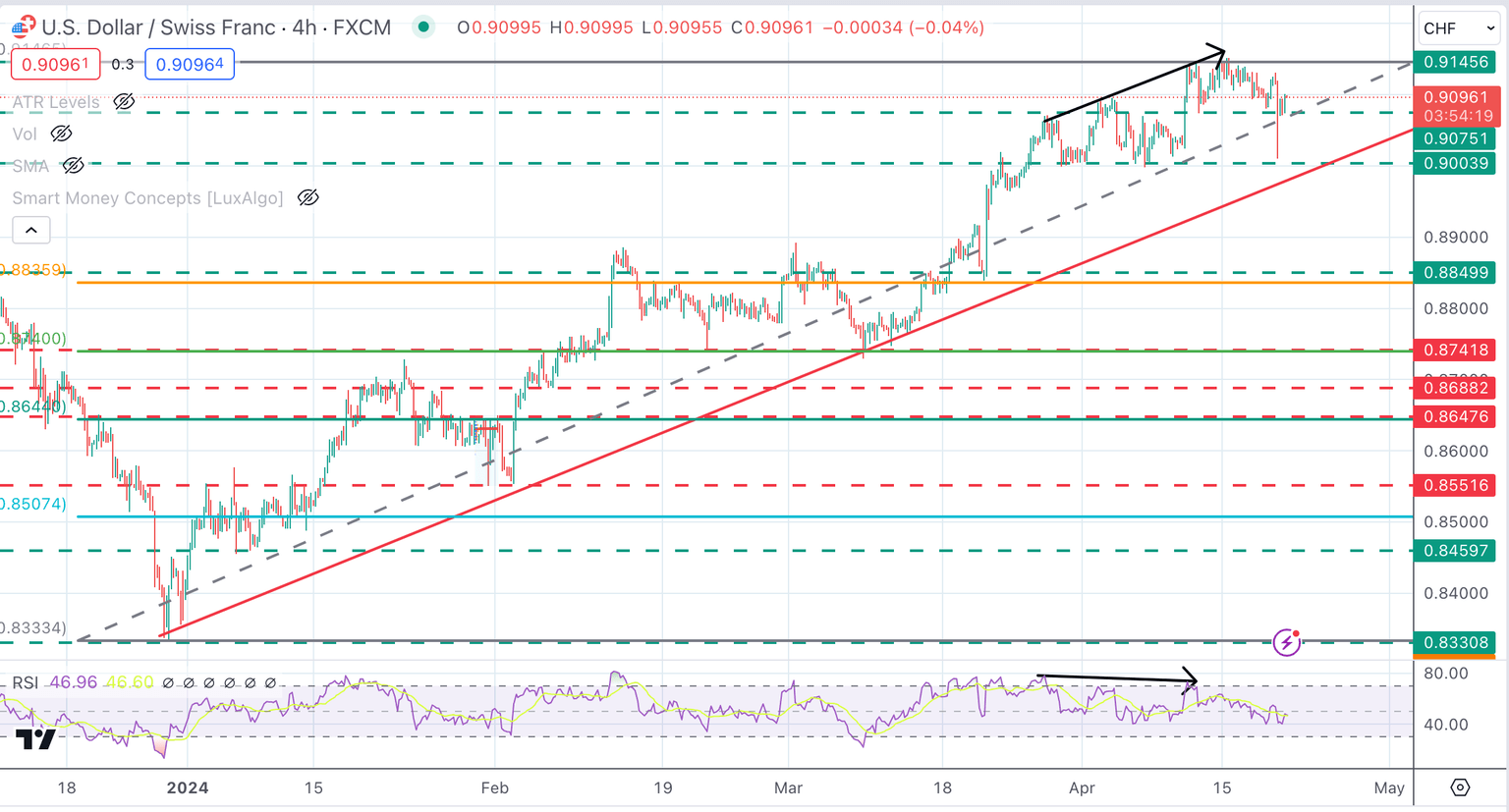

- A doji candle in the weekly chart and the bearish divergence on intra-day charts suggest the possibility of a deeper correction.

- USD/CHF bears need to breach 0.9075 support level.

The US Dollar has retraced previous losses, as news of an Israeli attack on Iran boosted the safe-haven CHF, to consolidate at previous ranges, above the 0.9075 resistance area.

On Friday, Chicago Fed President Austen Goolsbee has reiterated the the lack of progress on inflation and reaffirmed the data-dependant approach on further monetary policy decisions. The Dollar has traded moderately higher following these comments

Fundamentals are Dollar-supportive, as the Federal Reserve is likely to keep rates at high levels for a longer time, while the SNB has cut rates already and is likely to cut them again later this year.

USD/CHF Technical Analysis

The pair, however, has been trading without a clear direction below the 0.9145 resistance area following a strong rally from early January. The weekly chart is set to print a Doji candle, which often indicates that a potential correction might be ahead.

A bearish divergence on the 4-hour chart is also pointing to that direction, although bears need to confirm below 0.9075 to confirm a trend shift. Below there, the next targets would be the 0.9000 area and the trendline support at 0.8980. On the upside, a bullish reaction beyond 0.9245 would expose October’s high, at 0.9240.

USD/CHF 4-Hour Chart

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.