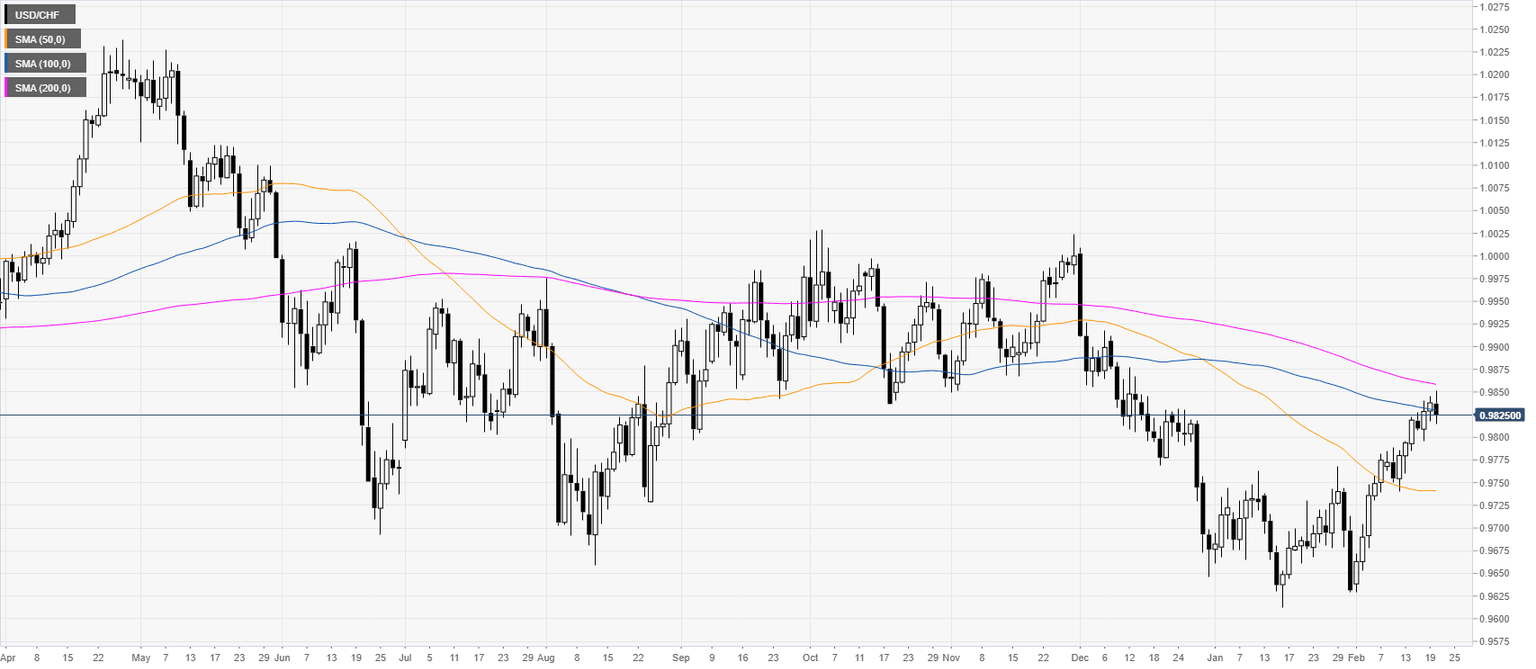

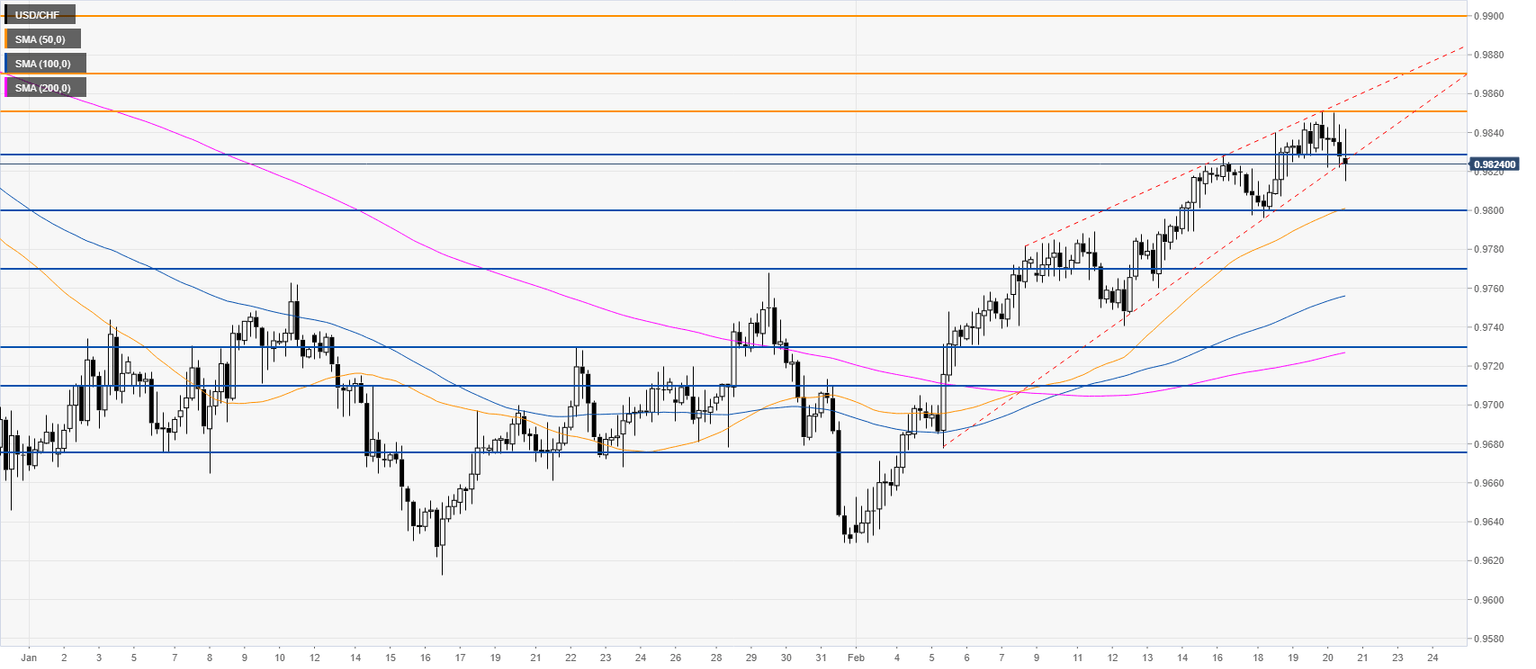

USD/CHF New York Price Analysis: Dollar eases from session highs, trades below 0.9830 vs. Swiss franc

- USD/CHF prints another 2020 high and retraces down in the New York session.

- Bears are challenging the 0.9830 level.

USD/CHF daily chart

USD/CHF four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst