USD/CHF climbs back over 0.8700 after Swiss CPI inflation misses the mark

- The USD/CHF caught some relief, rebounding back over 0.8700 on Monday.

- Swiss CPI inflation declined faster than markets expected, pressuring the Swiss Franc.

- Broader markets have turned into the US Dollar as risk aversion returns to the fold.

The USD/CHF has rebounded on Monday, climbing 0.6% and touching 0.8750 as the US Dollar (USD) climbs across the board, fueled by broad-market risk-off flows, and the Swiss Franc (CHF) takes a hit after the Swiss Consumer Price Index (CPI) inflation reading misses the mark.

A worse-than-expected decline in US Factory Orders in October is fueling the broader market's souring risk appetite, with overall orders for manufactured goods in the US declining 3.6% versus the market's median expectation of -2.6%. September's Factory Orders also saw a downside revision from 2.8% to 2.3%.

Risk appetite takes a hit on Monday

Investors are seeing renewed jitters about the global economy as economic indicators begin to decline across the board, and growth appears to be wobbling across all major markets.

Switzerland's November CPI missed expectations, with the annualized CPI into November printing at 1.4% compared to the forecast 1.6%, declining even further from October's YoY print of 1.7%. The decline in Swiss CPI appears to be accelerating at the front end of the tail, with November's MoM CPI slipping -0.2% compared to October's 0.1% print.

It's a thin week on the economic calendar for the CHF, and the market's focus will be turning to Tuesday's US ISM Services Purchasing Manager's Index (PMI). Markets are hoping for an upside print in the monthly US Services PMI, which is forecast to tick upwards from 51.8 to 52.0.

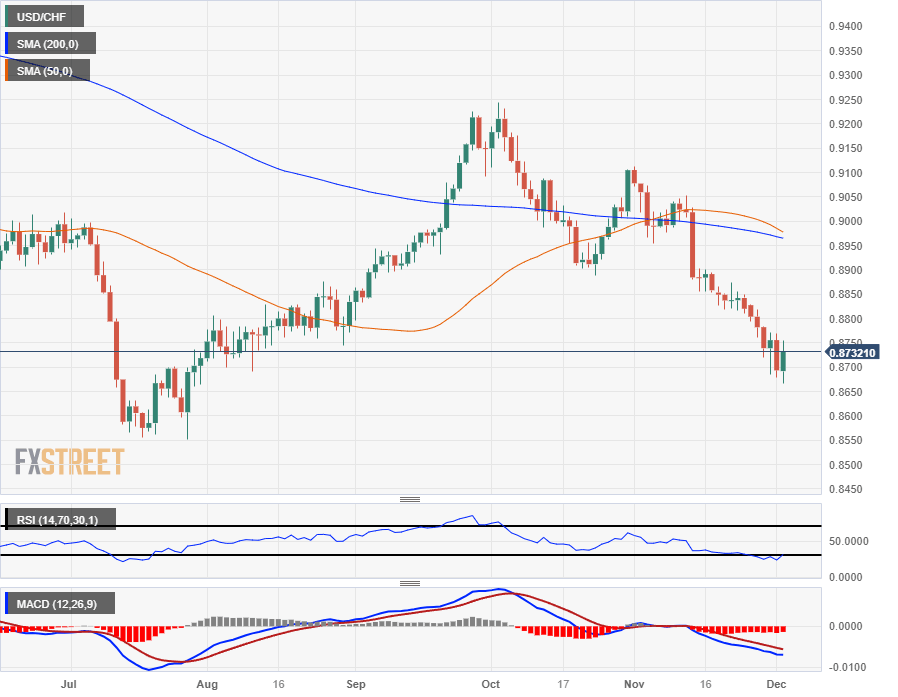

USD/CHF Technical Outlook

Despite Monday's rebound, the USD/CHF remains notable bearish, with the Dollar-Franc pairing coming off the back of three consecutive weeks of declines. The pair is down five and a half percent from October's early bids near 0.9245, and US Dollar bulls have their work cut out for them.

The immediate floor for bids sits at Monday's early low of 0.8666, and the 0.8700 handle is proving a sticky level for the USD/CHF.

Technical indicators are leaning firmly into overbought territory, and an elastic snap higher will see bidders taking a fresh run at the 200-day Simple Moving Average (SMA) which is descending into 0.8950.

A near-term bull run will have to contend with a 50-day SMA set for a bearish crossover of the 200-day SMA, and the immediate ceiling for bidders will be sdupport-turned-resistance at mid-October's swing low into the 0.8900 handle.

USD/CHF Daily Chart

USD/CHF Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.