USD/CAD stays firm at 1.3350 after US inflation data, ahead of US Retail Sales

- USD/CAD snapped two days of losses and rose towards 1.3350s on US inflation data.

- The US Consumer Price Index for January was mixed, with MoM aligned with estimates, while YoY figures were above forecasts.

- USD/CAD Price Analysis: Set for higher prices as a bullish engulfing pattern forms.

The USD/CAD braces to its early gains in the day, though it retreated after hitting a daily high of 1.3390 on news that inflation edged down, though it was above expectations. That increased demand for the greenback, which has remained bid, during the New York session. Hence, the USD/CAD is trading at 1.3352 after hitting a low of 1.3273

The US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) for January increased by 6.4% compared to the same period last year, which was higher than the predicted rate of 6.2%. Similarly, the core CPI rose by 5.6% year-on-year, above the estimated figure of 5.5%. Month-over-month data readings were consistent with the predicted values.

Following the release of the US inflation report, a slew of Federal Reserve (Fed) policymakers had crossed newswires. Officials expressed that the US central bank is not done hiking rates while emphasizing that inflation is high and that further tightening is needed. They stressed that higher-for-longer is their playbook and are not expecting to cut rates in 2023.

Given the backdrop, the USD/CAD remained on the front foot and was bolstered by falling US crude oil prices, with WTI dropping 1.53%. Money market futures estimate the Federal Reserve will hike above the 5% threshold, expecting the first rate cut by December 2023.

Aside from this, even though the Bank of Canada (BoC) is foreseen to raise rates further, the interest rate differential between both countries would benefit the US Dollar (USD). Therefore, further upside is expected on the USD/CAD pair.

What to watch?

The Canadian docket will feature housing and manufacturing data. The US economic calendar will unveil Retail Sales, the NY Fed Manufacturing Index, and Industrial Production.

USD/CAD Technical analysis

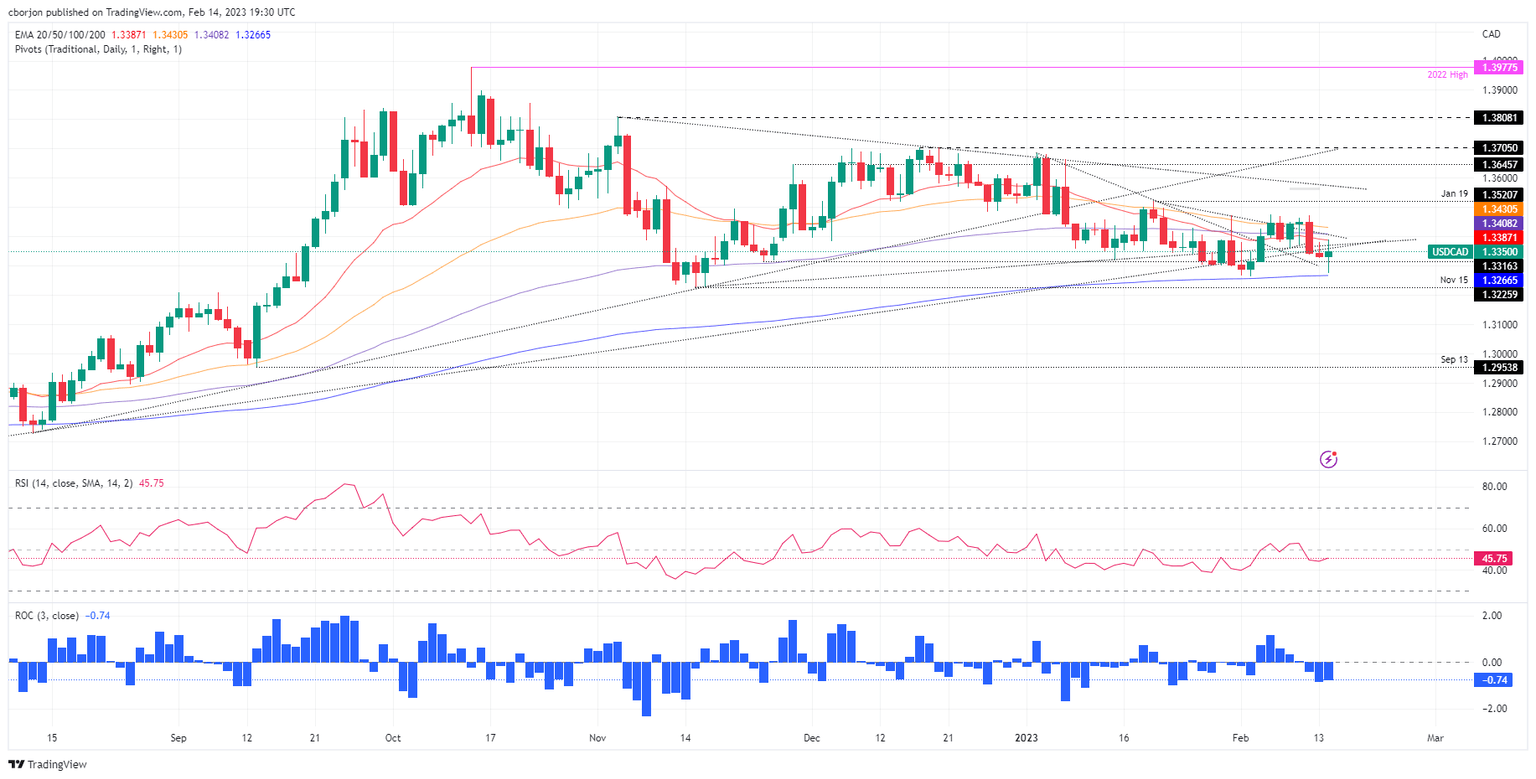

The USD/CAD daily chart suggests an upward reversion is forming, as Tuesday’s price action is engulfing the previous day. Therefore, a bullish engulfing candle pattern might open the door for further upside though solid resistance remains. The 20-day Exponential Moving Average (EMA), at around 1.3386, would be the bears’ first line of defense. A breach of the latter and 1.3400 is up for grabs, closely followed by the 100 and 50-day EMAs, each at 1.3408 and 1.3430.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.