USD/CAD Price Forecast: Consolidates around 1.3800 ahead of US NFP revision

- USD/CAD wobbles around 1.3800 as investors await the release of the US NFP benchmark revision report.

- The Fed is almost certain to cut interest rates in the policy meeting next week.

- USD/CAD trades below the 200-day EMA, indicating that the overall trend is bearish.

The USD/CAD pair trades in a tight range inside Monday’s range around 1.3800 during the European session on Tuesday. The Loonie pair consolidates as investors await the United States (US) Nonfarm Payrolls (NFP) benchmark revision report, which will be published at 14:00 GMT.

The NFP benchmark revision report will cover the 12-month period through March 2025 before the final benchmark revision is reported within the employment report of February 2026.

Ahead of the US employment revision report, the US Dollar (USD) underperforms its major peers amid firm expectations that the Federal Reserve (Fed) will cut interest rates in the policy meeting next week.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh six-week low near 97.25.

Meanwhile, the Canadian Dollar (CAD) is also underperforming its peers as weakening Canada’s job market conditions have increased the need of more interest rate cuts by the Bank of Canada (BoC) in the near term.

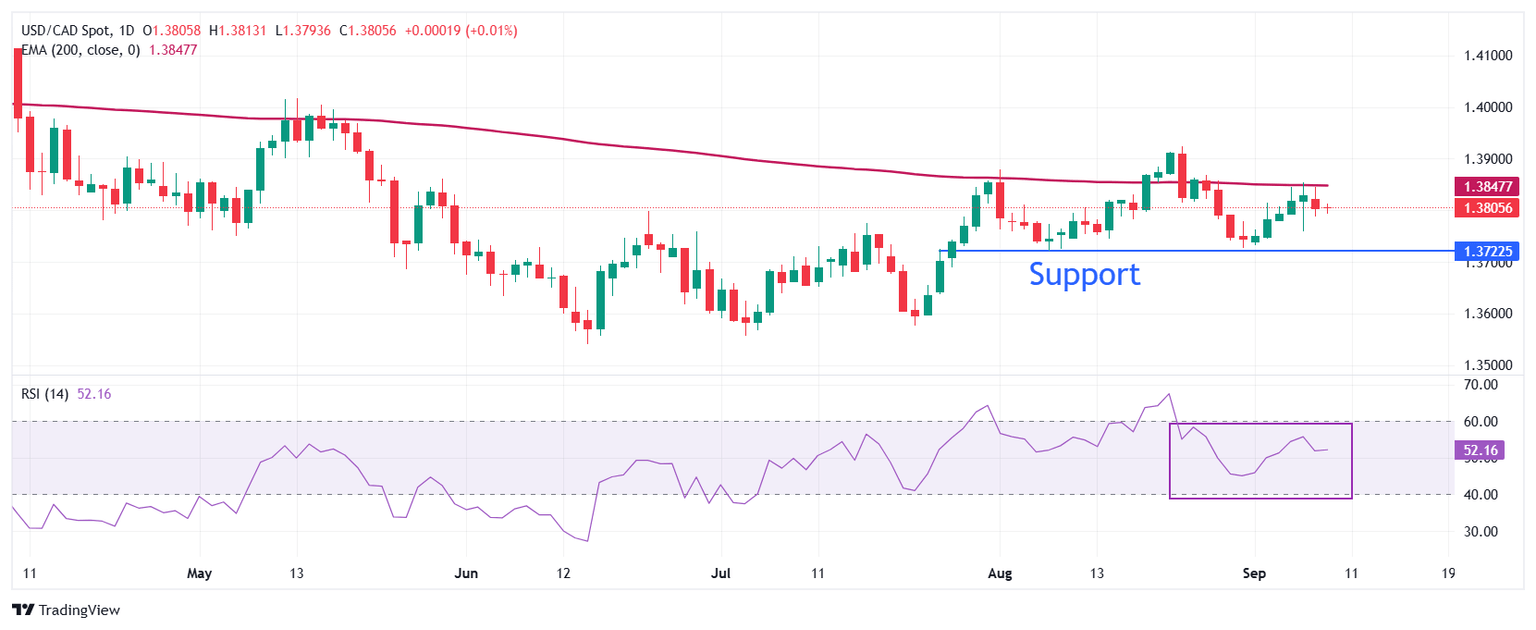

USD/CAD stays below the 200-day Exponential Moving Average (EMA), which trades around 1.3870, suggesting that the overall trend is bearish.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating a sideways trend.

Going forward, the asset could slide towards the round level of 1.3600 and June 16 low of 1.3540 if it breaks below the August 7 low of 1.3722.

On the flip side, a recovery move by the pair above the August 22 high of 1.3925 would open the door towards the May 15 high of 1.4000, followed by the April 9 low of 1.4075.

USD/CAD daily chart

Economic Indicator

Nonfarm Payrolls Benchmark Revision

The US Bureau of Labor Statistics (BLS) announces the preliminary estimate of the annual benchmark revision to the establishment survey employment series, which can lead to a revision as well for the Nonfarm Payrolls data in the twelve months to March. This preliminary revision could have implications for employment figures for the rest of the year.

Read more.Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.