USD/CAD Price Analysis: Trims intraday gains, moves below 1.3700

- USD/CAD loses ground ahead of Retail Sales data from Canada.

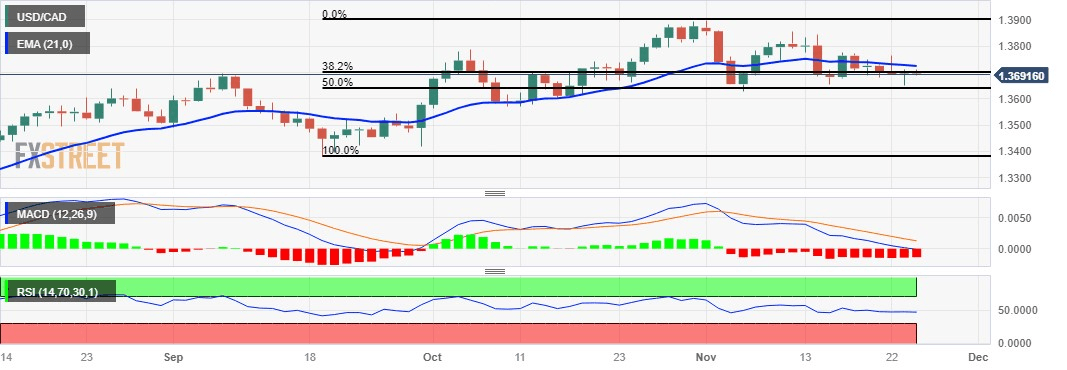

- Technical indicators suggest testing the major support level at 1.3650.

- A break above the 1.3700 could meet the resistance at the 21-day EMA.

USD/CAD cuts intraday gains, trading near 1.3690 during the European session ahead of Canada’s Retail Sales release on Friday. Investors are betting on the likelihood of no further interest rate hikes by the Federal Reserve (Fed), potentially weakening the USD/CAD pair.

The technical indicators for the USD/CAD pair support the current downward trend. The Moving Average Convergence Divergence (MACD) line is below the centerline and the signal line, indicating a bearish momentum in the pair.

Furthermore, the 14-day Relative Strength Index (RSI) below 50 indicates bearish sentiment, indicating that the pair could meet the major support level at 1.3650 aligned with the 50.0% retracement level at 1.3639.

A firm break below the latter could influence the bears of the USD/CAD pair to navigate the support region around 1.3600.

On the upside, if the USD/CAD pair surpasses the psychological barrier of 1.3700, it could test the 21-day Exponential Moving Average (EMA) at the 1.3724 level followed by the 1.3750 major level. A breakthrough above the level could open the doors for the pair to explore the region around the 1.3800 level.

USD/CAD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.