USD/CAD Price Analysis: Ready to refresh two-month low under 1.2600

- USD/CAD remains pressured around two-month low, holds onto the key technical level break.

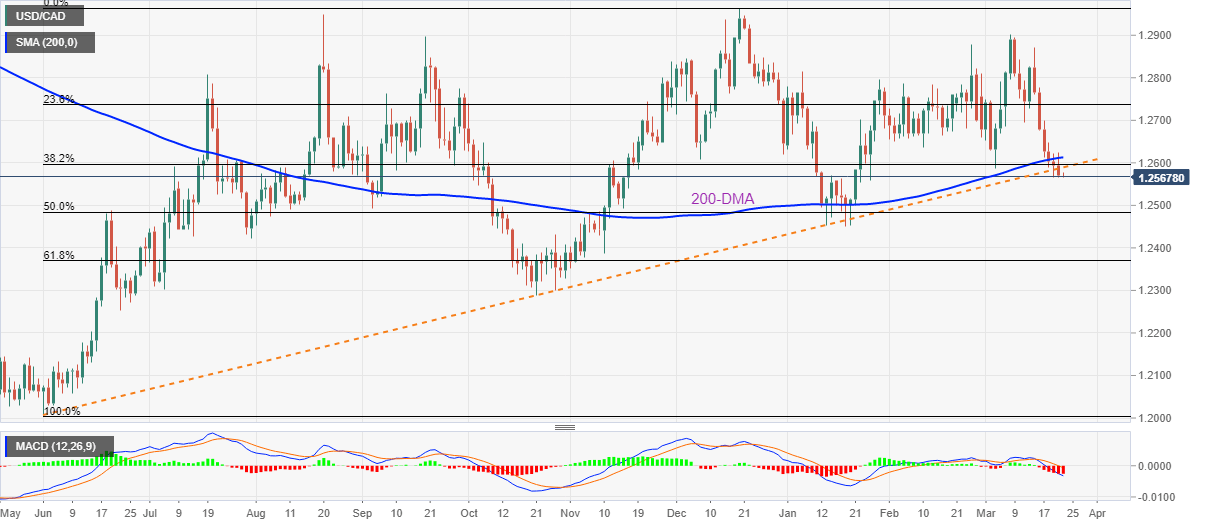

- Bearish MACD joins downside break of 200-DMA, nine-month-old rising trend line to favor sellers.

- Bulls need validation from February’s low for fresh entry.

- 50% Fibonacci retracement of June-December 2021 upside lures sellers.

USD/CAD bears keep reins around the lowest levels since late January, pressured near 1.2565 during Wednesday’s initial Asian session.

In doing so, the sellers cheer the previous day’s clear downside break of an ascending trend line from June 2021 and the 200-DMA.

Given the bearish MACD signals supporting the latest break of the key technical supports, now resistance, USD/CAD bears have a pleasant journey ahead.

That said, the 50% Fibonacci retracement (Fibo.) of the pair’s rally during June to December 2021, around 1.2485, becomes nearby support to watch during the quote’s further weakness.

However, the yearly low surrounding 1.2450 will challenge the USD/CAD sellers afterward.

On the contrary, the support-turned-resistance line and the 200-DMA will challenge the corrective pullback respectively around 1.2585 and 1.2615.

Following that, the previous month’s low near 1.2635 will challenge the USD/CAD buyers before activating further run-up.

USD/CAD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.