USD/CAD Price Analysis: Finds an intermediate cushion below 1.3550, US/Canada PMI in focus

- USD/CAD has found short-term support below 1.3550 after a vertical sell-off.

- A power-pack action is anticipated amid the release of US/Canada Manufacturing PMI figures.

- USD/CAD has slipped significantly after facing immense selling pressure from 61.8% Fibo retracement.

The USD/CAD pair has gauged an intermediate cushion below 1.3550 after a vertical sell-off from the weekly high of 1.3668. The Loonie asset is building a base ahead of the Manufacturing PMI data from Canada and the United States ahead.

S&P500 settled Friday’s session on a bullish note as consistent consumer spending and upbeat quarterly figures from technology stocks infused confidence in investors. Investors could show some traits of pre-Federal Reserve (Fed) policy anxiety ahead.

The US Dollar Index (DXY) has rebounded after dropping to near 101.50 and is looking to extend its recovery above 101.70 as the Fed is expected to raise interest rates one more time by 25 basis points (bps).

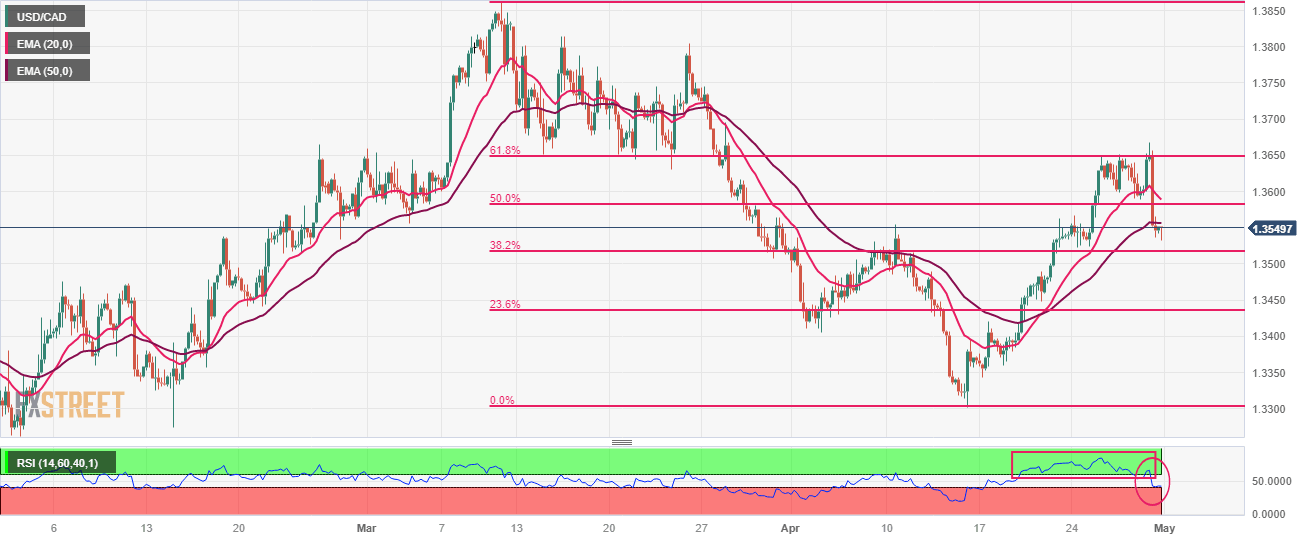

USD/CAD has slipped significantly after facing immense selling pressure from 61.8% Fibonacci retracement (placed from March 10 high at 1.3862 to April 14 low at 1.3301) at 1.3650 on a four-hour scale. It seems that the strength in the selling pressure was extremely high as it dragged the Loonie asset sharply below the 20-and 50-period Exponential Moving Averages (EMAs) at 1.3590 and 1.3566 respectively.

Meanwhile, the Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bullish range of 60.00-80.00. The RSI (14) is struggling to maintain the 40.00 support as a break below the same will strengthen the Canadian Dollar.

Going forward, a decisive break below the intraday low at 1.3533 will expose the asset to psychological support at 1.3500 followed by a 23.6% Fibo retracement at 1.3438.

On the flip side, a recovery move above the 61.8% Fibo retracement at 1.3650 will trigger a reversal and will drive the major toward the round-level resistance at 1.3700. A break above the same will expose the asset to March 22 high at 1.3745.

USD/CAD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.