USD/CAD Price Analysis: Bulls moving in on the strong bearish move

- USD/CAD is on the move to the downside, bears look to 1.2600.

- A correction to the upside could be on the cards for the start of the year.

USD/CAD fell below a critical support zone during the holiday thin markets which leave a bearish bias on the charts. However, there are prospects of a bullish correction and the following illustrates the prospects for price action in the opening sessions of the week.

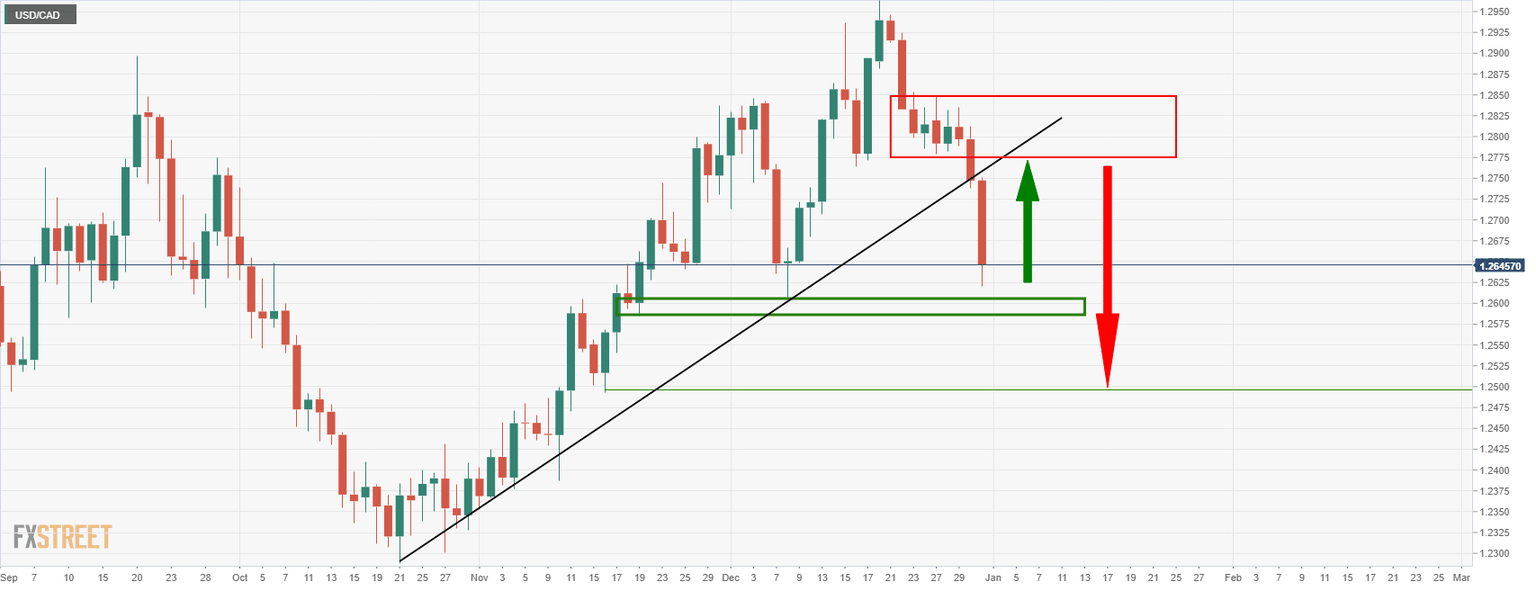

USD/CAD daily chart

USD/CAD has broken the trendline support and is due for a correction. However, that is not to say that the price can not continue lower before a meaningful correction occurs. 1.26 the figure could be tested in the opening sessions of this week.

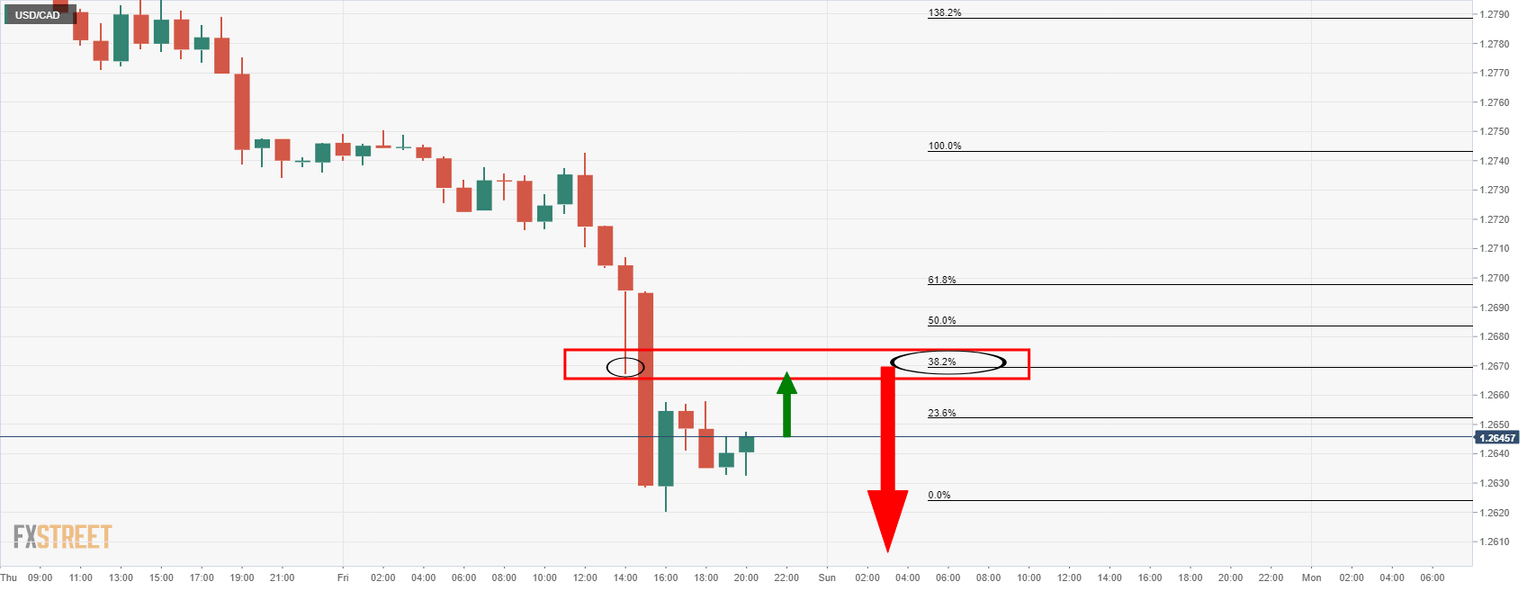

USD/CAD H1 chart

From an hourly perspective, the price has already started to correct, although there is more to go until the correction might be significant enough before sellers may become interested to enter or reenter and target the 1.26 figure or lower. 1.2660 on the flip side is a compelling level that meets the 38.2% Fibo.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.