USD/CAD Price Analysis: Bulls brace for a bumpy road to the north as US/Canada data looms

- USD/CAD grinds higher after positing two-day winning streak.

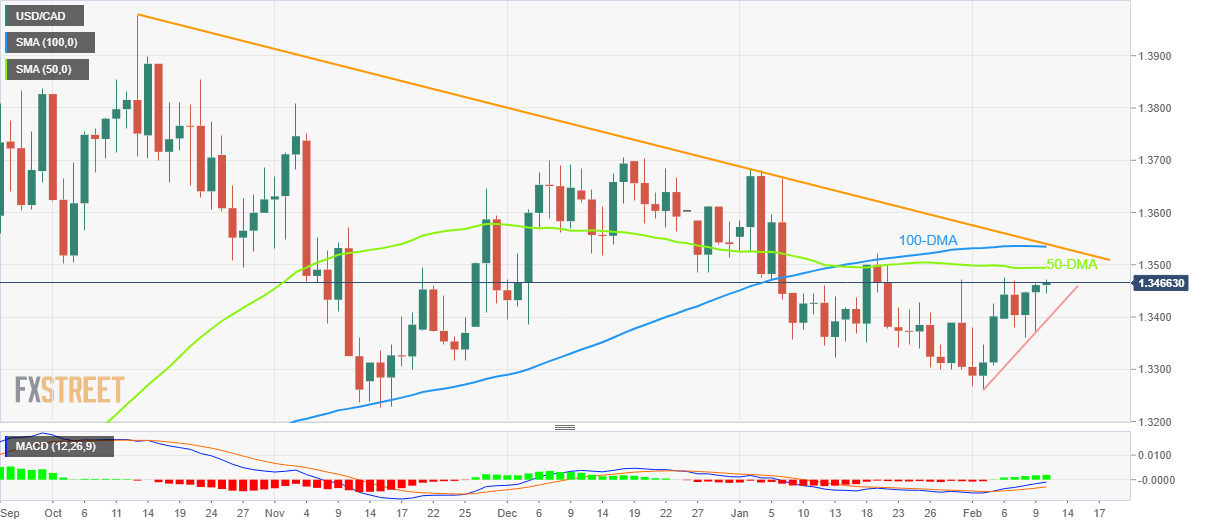

- Bullish MACD signals, sustained trading beyond weekly support line favor buyers.

- Convergence of 100-DMA, four-month-old resistance line appears a tough nut to crack for bulls.

USD/CAD teases buyers around 1.3465-70 heading into Friday’s European session, after a two-day uptrend, as the Loonie pair traders await crucial statistics from Canada and the US. In doing so, the quote remains indecisive despite printing minor gains by the press time.

Even so, the bullish MACD signals join the pair’s successful trading above the weekly support line, around 1.3390 by the press time, to keep the buyers hopeful.

That said, the 50-DMA level surrounding 1.3500 guards the USD/CAD pair’s immediate upside before the convergence of the 100-DMA and descending resistance line from early October, close to 1.3540 at the latest.

In a case where the Loonie pair manages to stay beyond 1.3540, the previous monthly high of 1.3685 and the December 2022 peak surrounding 1.3705 will act as the last defense of the USD/CAD bears.

On the flip side, a clear break of the weekly support line, near 1.3390, will aim for the weekly low of 1.3360 before highlighting the monthly bottom surrounding 1.3260.

Should the USD/CAD prices remain weak past 1.3260, November 2022 low and the last July’s peak, respectively around 1.3235 and 1.3220, will gain the market’s attention.

USD/CAD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.