USD/CAD Price Analysis: Bounces off lows, down little below mid-1.2700s

- USD/CAD edged lower on Thursday, albeit lacked any strong follow-through selling.

- Weaker oil prices undermined the loonie and extended support amid bullish USD.

- A sustained move beyond the 1.2770-75 area will set the stage for further gains.

The USD/CAD pair witnessed some selling on Thursday and eroded a part of the previous day's gains to weekly tops. The pair remained on the defensive through the mid-European session, albeit has managed to recover a major part of the early lost ground and was last seen trading around the 1.2740-35 region.

The US dollar was seen consolidating its recent rally to the highest level since September 2020 and was seen as a key factor that acted as a tailwind for the USD/CAD pair. That said, prospects for an early policy tightening by the Fed helped limit any deeper losses for the greenback. Apart from this, a softer tone around crude oil prices undermined the commodity-linked loonie and extended some support to the major.

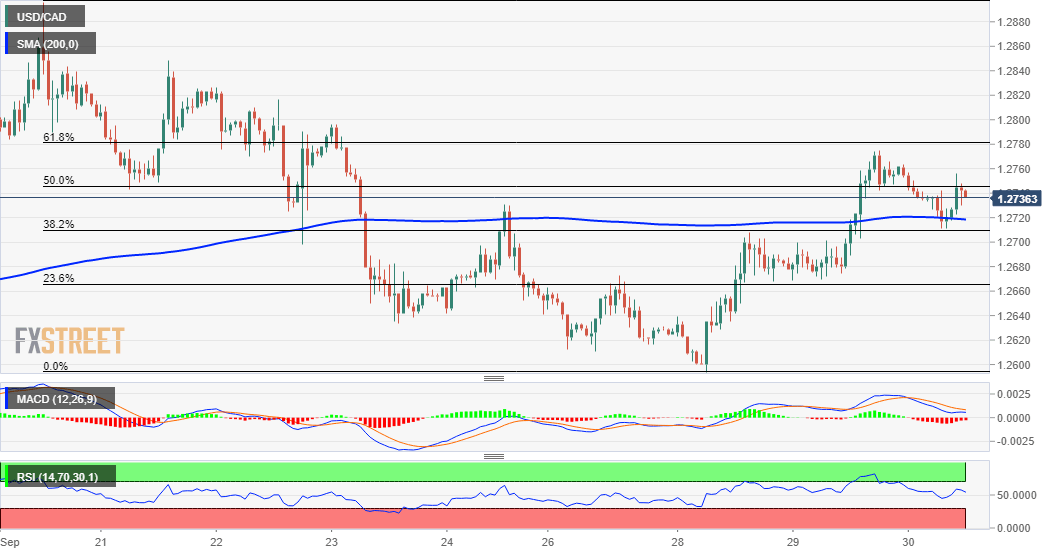

From a technical perspective, the USD/CAD pair stalled this week's bounce from sub-1.2600 levels near the 1.2770-75 region, just ahead of the 61.8% Fibonacci level of the 1.2896-1.1.2594 pullback. The intraday pullback, however, showed some resilience below the 200-hour SMA and found a decent support near the 38.2% Fibo. level. The mentioned resistance and support levels should now act as a pivotal point for intraday traders.

Meanwhile, technical indicators on daily/4-hour charts maintained their bullish bias and are still far from being in the overbought territory. Moreover, oscillators on the 1-hour chart have again started gaining positive traction and support prospects for a further near-term appreciating move. However, bulls are likely to wait for some follow-through buying beyond the 61.8% Fibo. level before placing aggressive bets.

The USD/CAD pair might then aim to surpass the 1.2800 mark and accelerate the momentum towards the next relevant hurdle near the 1.2830 horizontal support. Some follow-through buying has the potential to lift the pair further to the 1.2900 mark and allow bulls to challenge YTD tops, around mid-1.2900s touched on August 20.

On the flip side, the 1.2705-1.2700 area (38.2% Fibo. level) now seems to protect the immediate downside ahead of the 23.6% Fibo. level, around the 1.2670-65 region. Failure to defend the mentioned support levels will negate the bullish bias and turn the USD/CAD pair vulnerable to slide back towards the 1.2600 mark.

USD/CAD 1-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.