USD/CAD Price Analysis: Bears have the upper hand while taking on key support areas

- USD/CAD is in the hands of the bears that are taking out key support structures.

- Price imbalance mitigation between 1.2700 and 1.2900 would be expected to play out over the coming days.

USD/CAD is moving below critical support on the charts and the pair could be in for a deeper run towards structure lower down. The following illustrates the potential price path on various time frames for the foreseeable future.

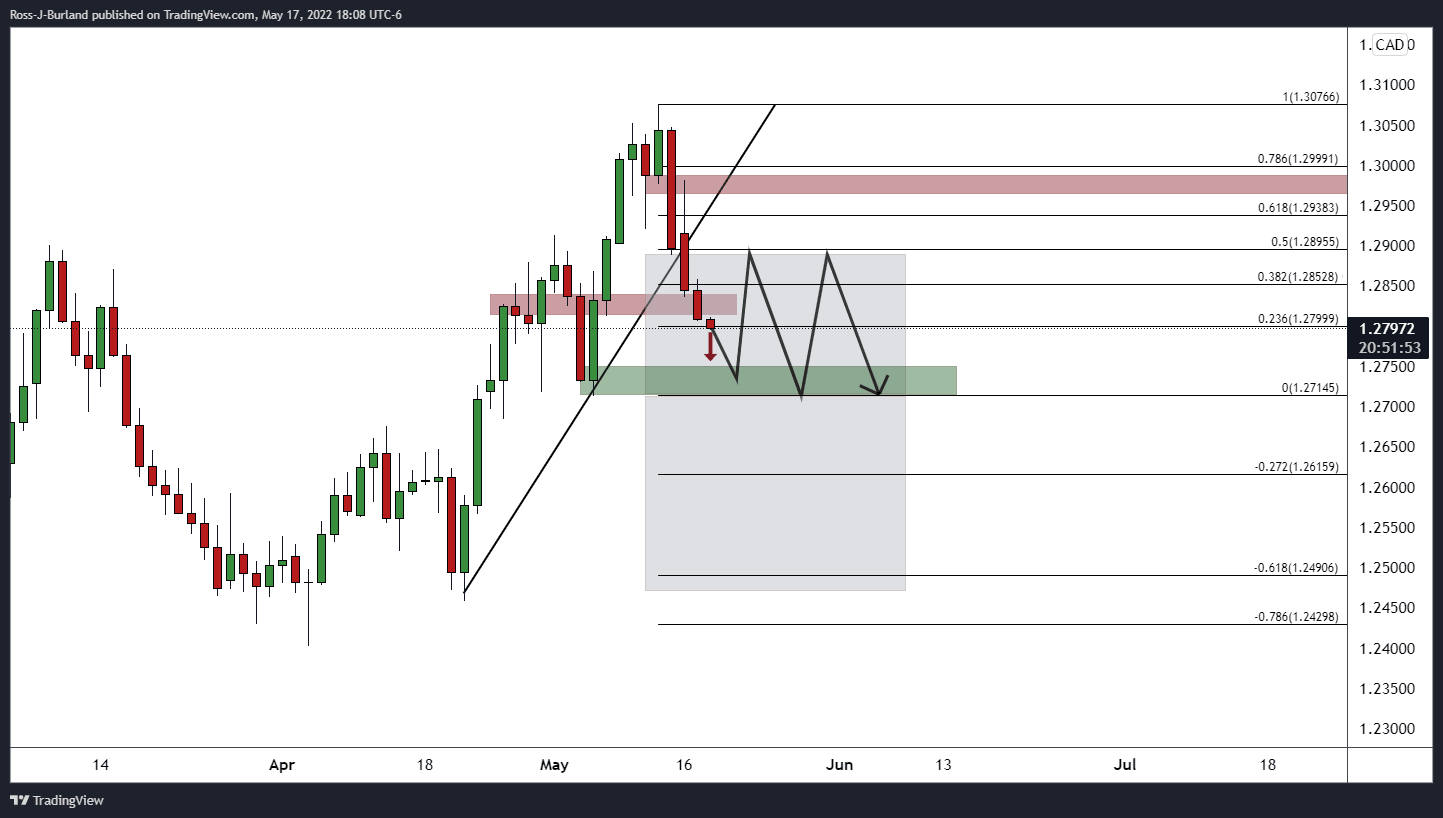

USD/CAD daily chart

The price would be expected to meet with demand in the low 1.2700s and potentially mitigate upside territory and price imbalances over the course of the coming days between there and 1.2900 vs. the counter trendline.

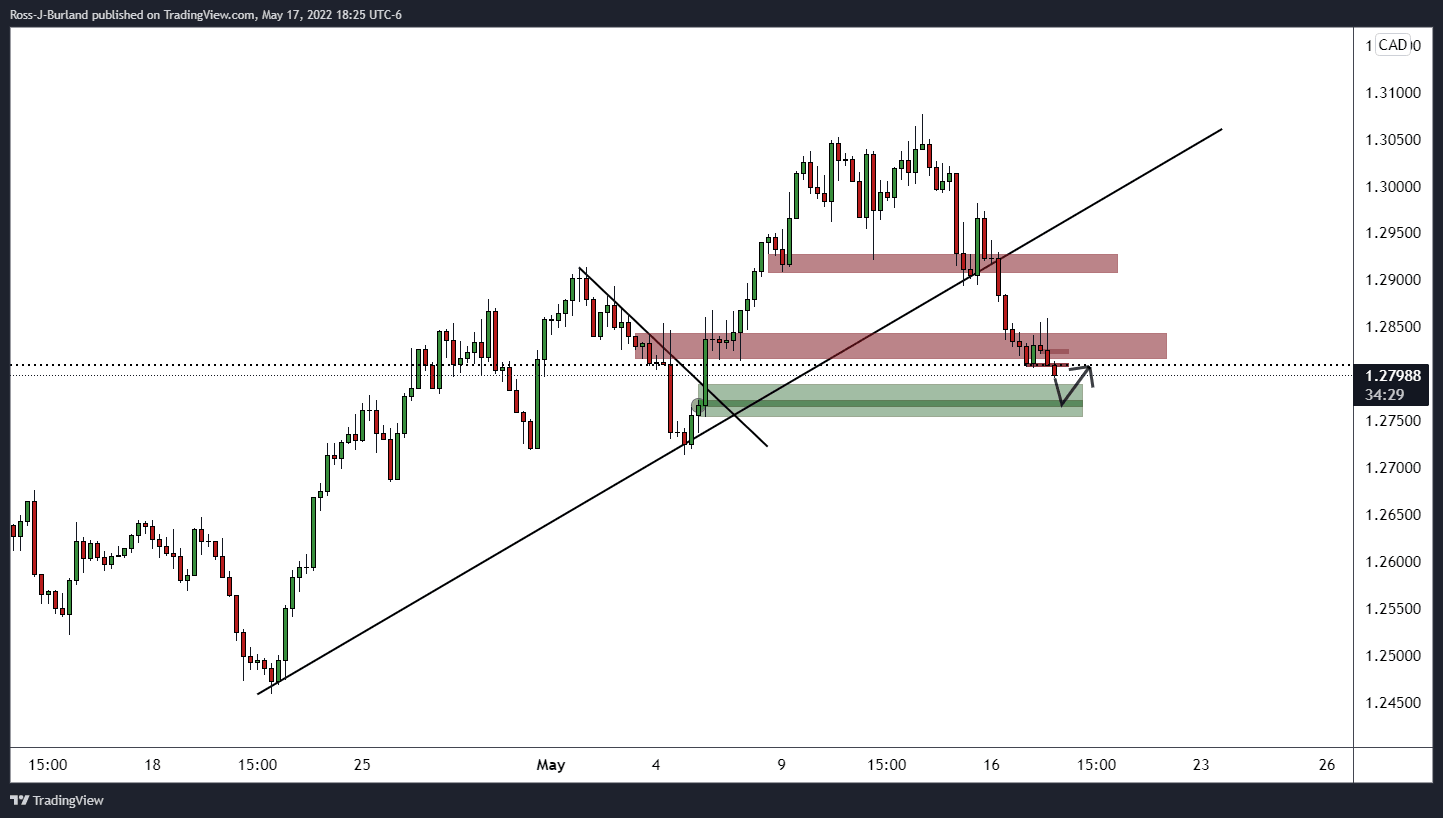

USD/CAD H4 and H1 charts

The price has melted all the way through four-hour support and is now embarking on a run even lower to test the next critical layer of support in the 1.2770s.

This is identified even clearer on the hourly chart.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.