USD/CAD Price Analysis: Bears eye a break of bull cycle trendline

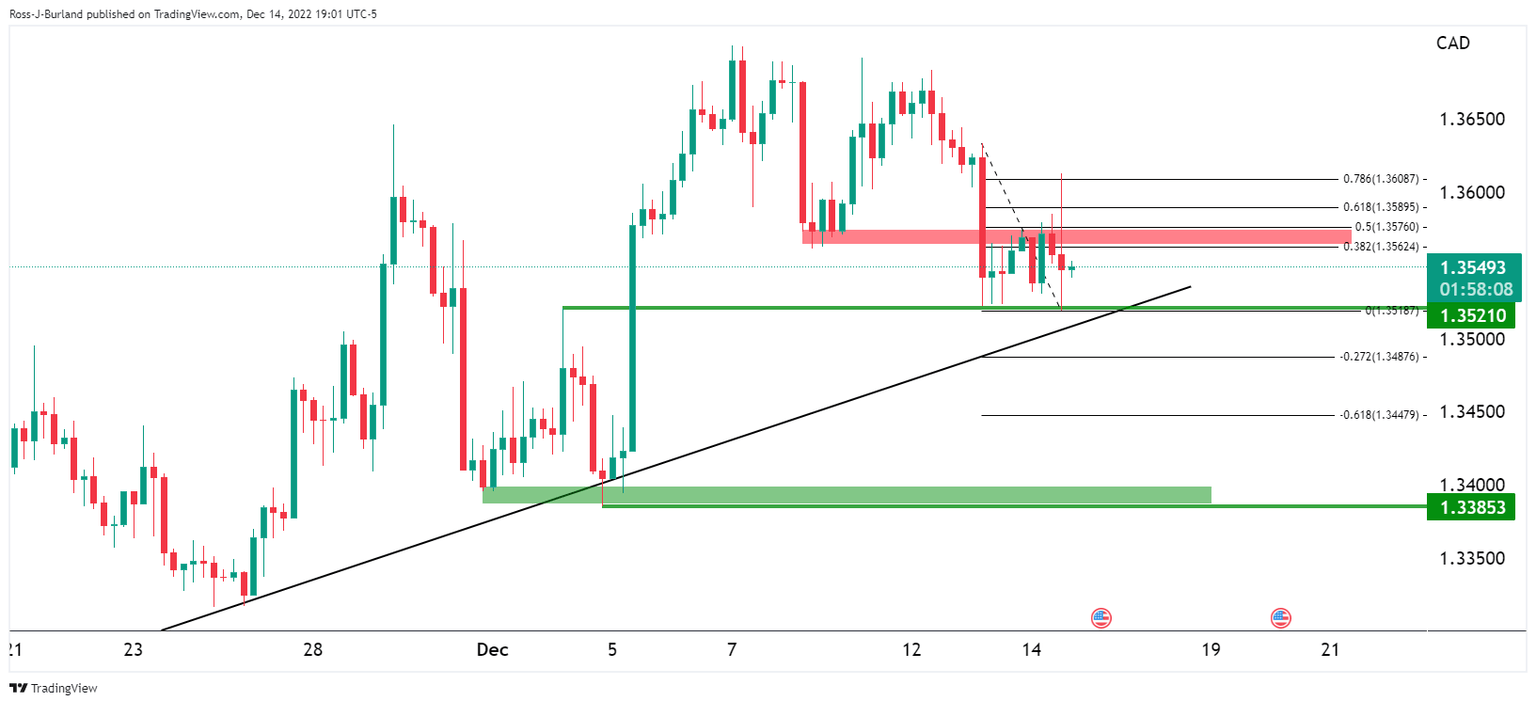

- USD/CAD is being resisted by the upper quarter of the 1.35s around a 50% mean reversion of the prior bearish impulse.

- A break of the trendline and the 1.3520 opens risk to the 1.3380s.

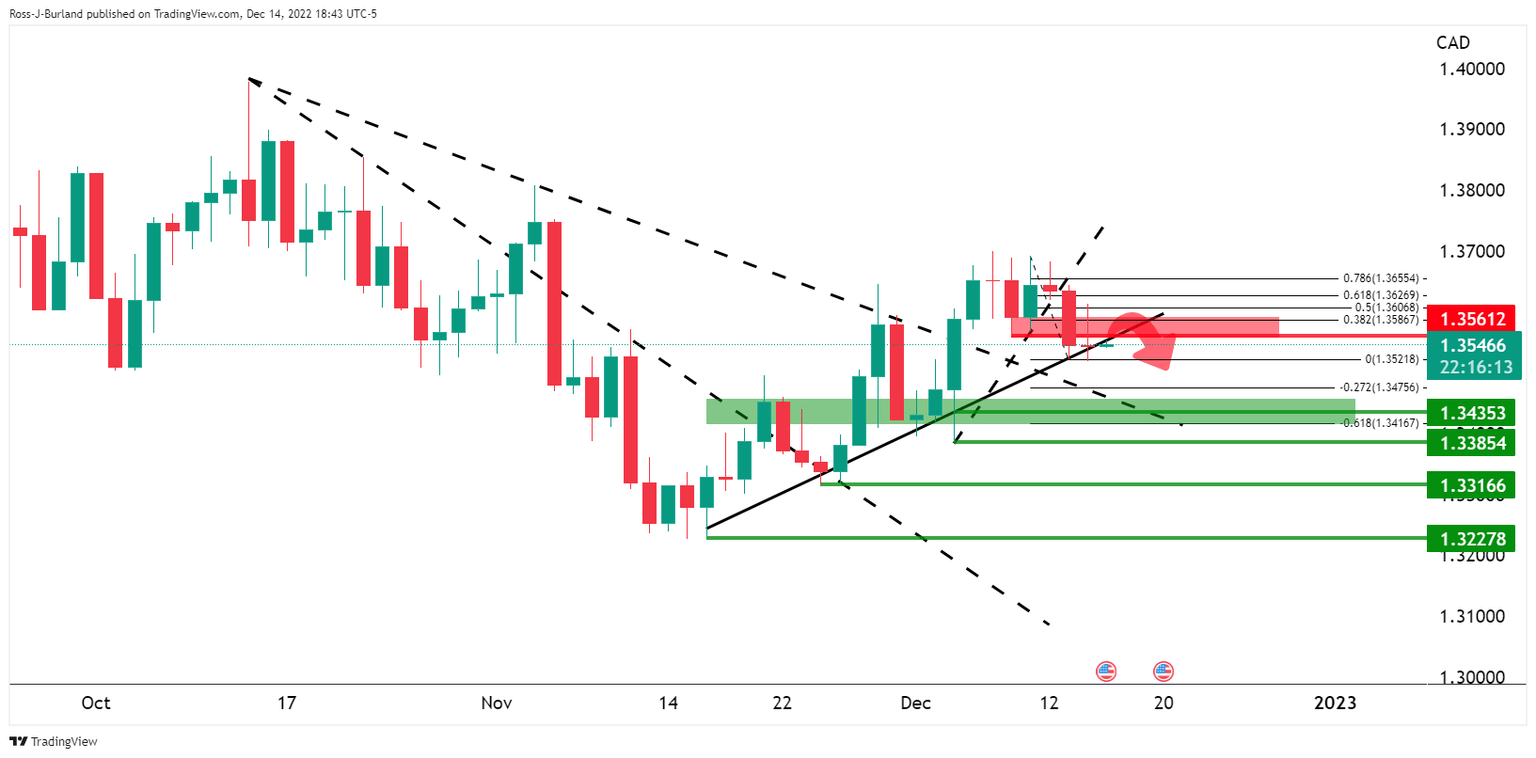

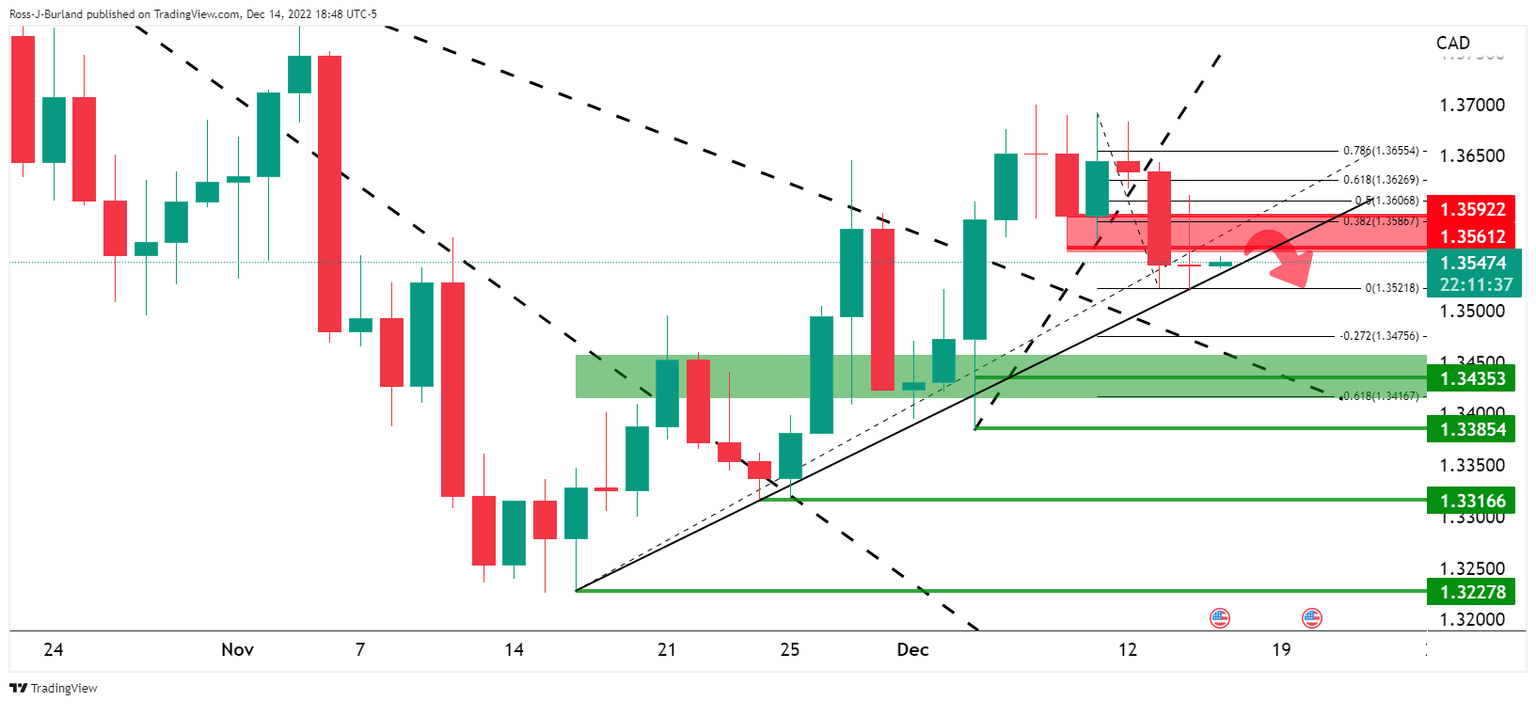

As per the prior analysis, USD/CAD Price Analysis: Bears on the prowl at key resistance, USD/CAD is chipping away at the trendline support while being resisted by a key area on the daily chart. The following illustrates prospects of a downside continuation for the days ahead with 1.3400 and 1.3380 eyed:

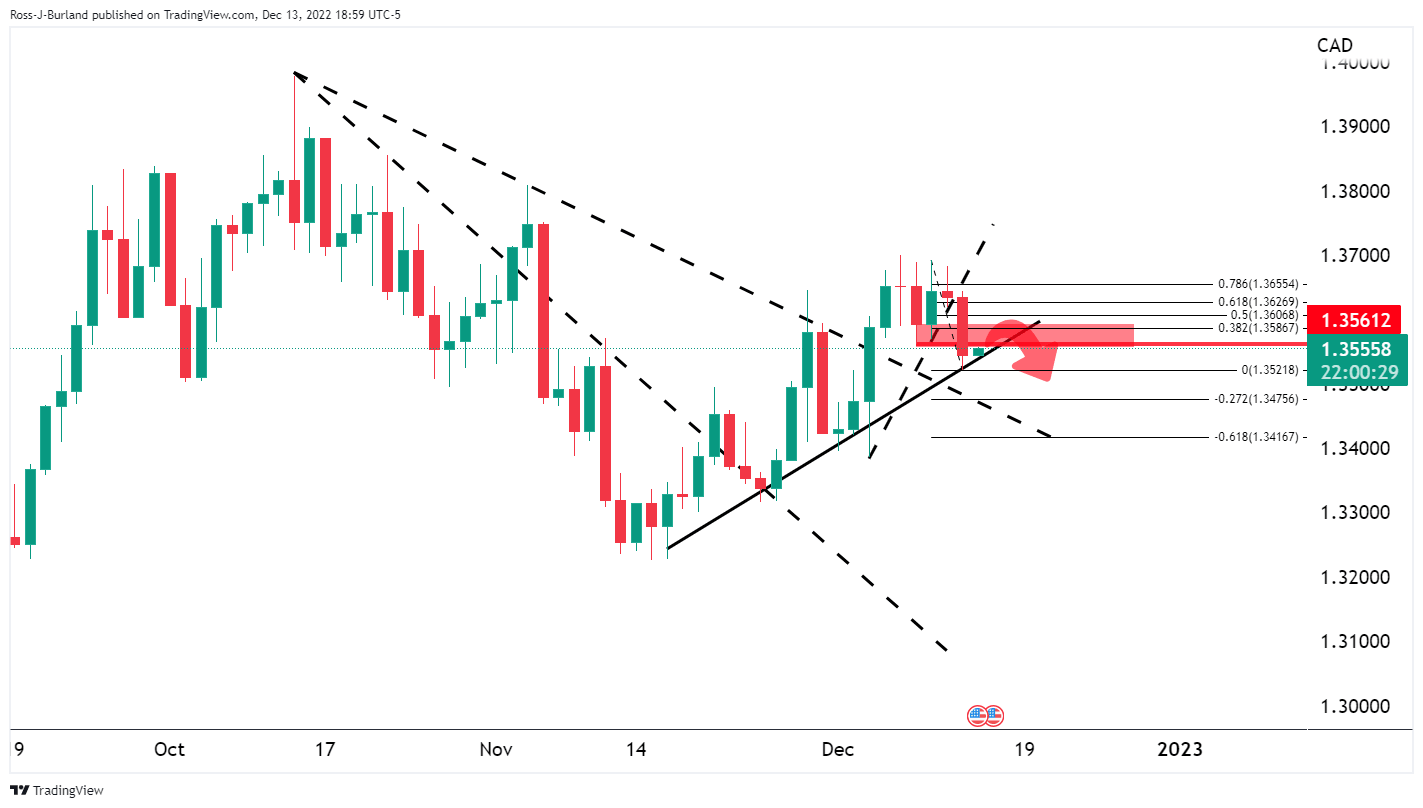

USD/CAD prior analysis

It was stated that the M-formation is a reversion pattern that drew the price into the neckline. It was suggested that if this were to act as a resistance, the micro trendline would come under pressure and open the risk of a substantial continuation to the downside for the days ahead.

USD/CAD update

The price is pressed against the trend lines and this could lead to a retest into the resistance area between 1.3590 and 1.3560s as illustrated before the bears engage again.

USD/CAD H4 chart

However, as illustrated, the price is resisted by the upper quarter of the 1.35s around a 50% mean reversion of the prior bearish impulse. A break of 1.3520 opens risk to the 1.3380s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.