USD/CAD Price Analysis: Bears could be about to move in below the daily counter trendline

- USD/CAD bears are lurking below the counter trendlines on the weekly and daily charts.

- Bears will look for a restest of the weekly trendline support near 1.2520.

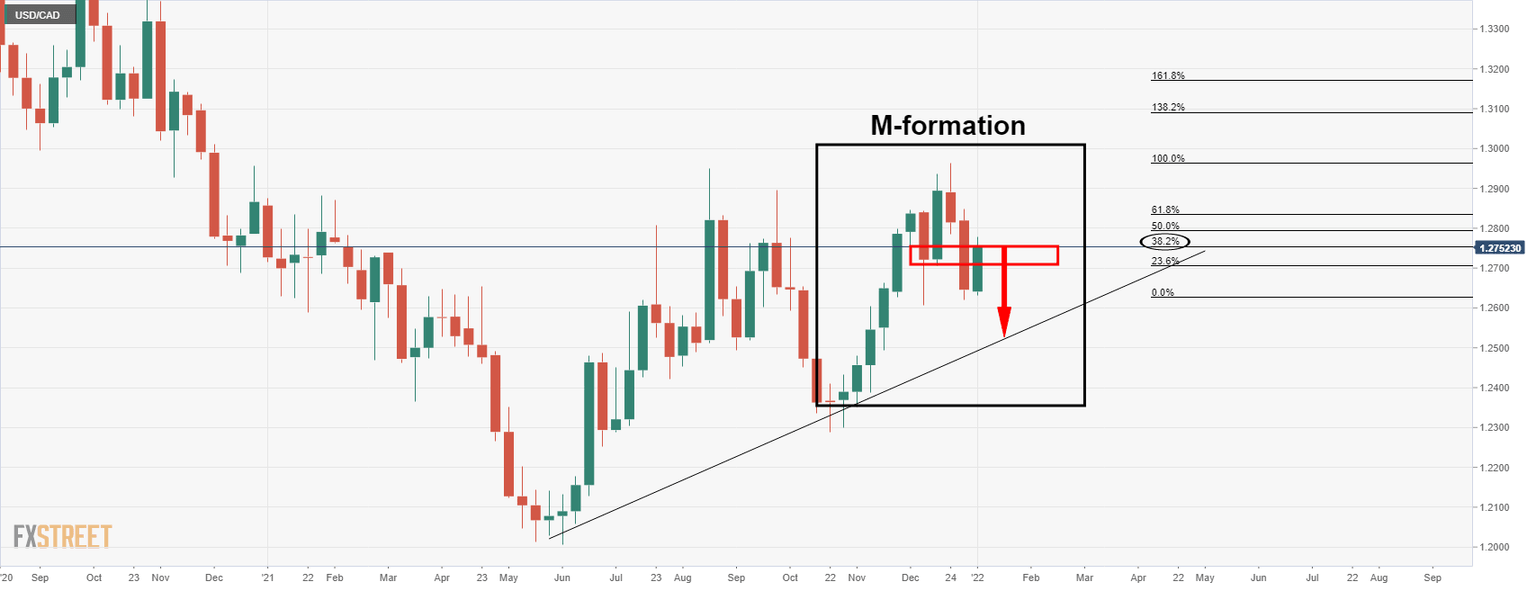

USD/CAD has been testing the downside although has recently recovered. However, the weekly chart is seeing the price run into the M-formation's neckline. This could be expected to act as resistance, considering the break of the trendline support.

USD/CAD weekly chart

There is also a confluence of Fibonacci levels on both the weekly and daily charts in this area. A restest of the trendline near 1.2520 could be on the cards for the weeks ahead.

USD/CAD daily chart

The nearer-term target area is based on an imbalance of price between 1.2585 and 1.2540. The 61.8% Fibonacci is also a compelling area of resistance on the daily chart.

USD/CAD H4 chart

As illustrated, there is a wall of support at this juncture. The bears would be prudent to wait for a bearish confirmation on a break of this 4-hour structure prior to engaging to target towards the 1.2540/85.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.