USD/CAD Price Analysis: Bears are in the market, but bulls flexing

- USD/CAD bears are in the market which leaves prospects of a correction on the cards.

- Support is playing its role and there is a focus on the Fibo scale.

The Canadian Dollar strengthened on the back of data showing the domestic economy grew stronger than expected in the first quarter. USD/CAD is now breaking important structures as the following will illustrate.

Meanwhile, Canada's economy expanded at an annualized rate of 3.1% in the first quarter, eclipsing forecasts for an increase of 2.5%, and likely accelerated further in April.

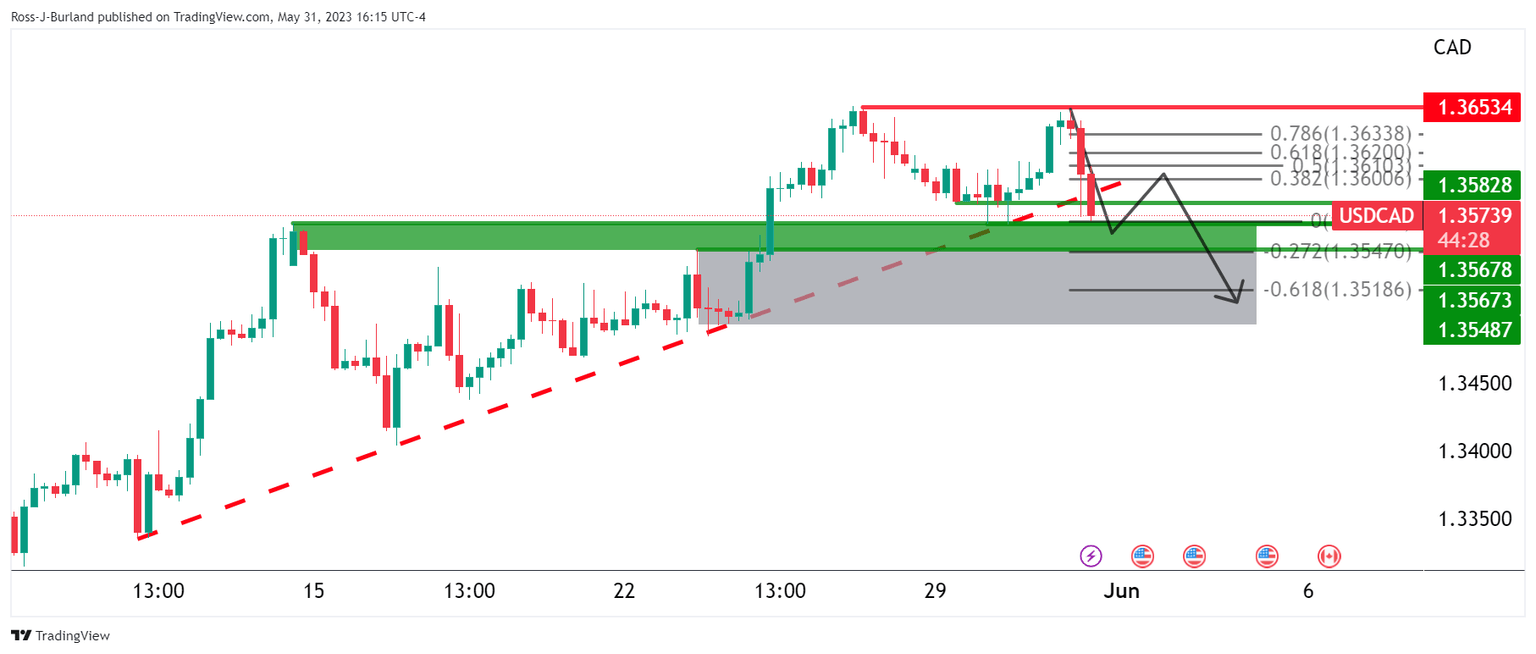

USD/CAD H4 chart

The price is sinking below prior support and is now heading toward the next area of support as illustrated on the charts. A pullback could be on the verge of a correction.

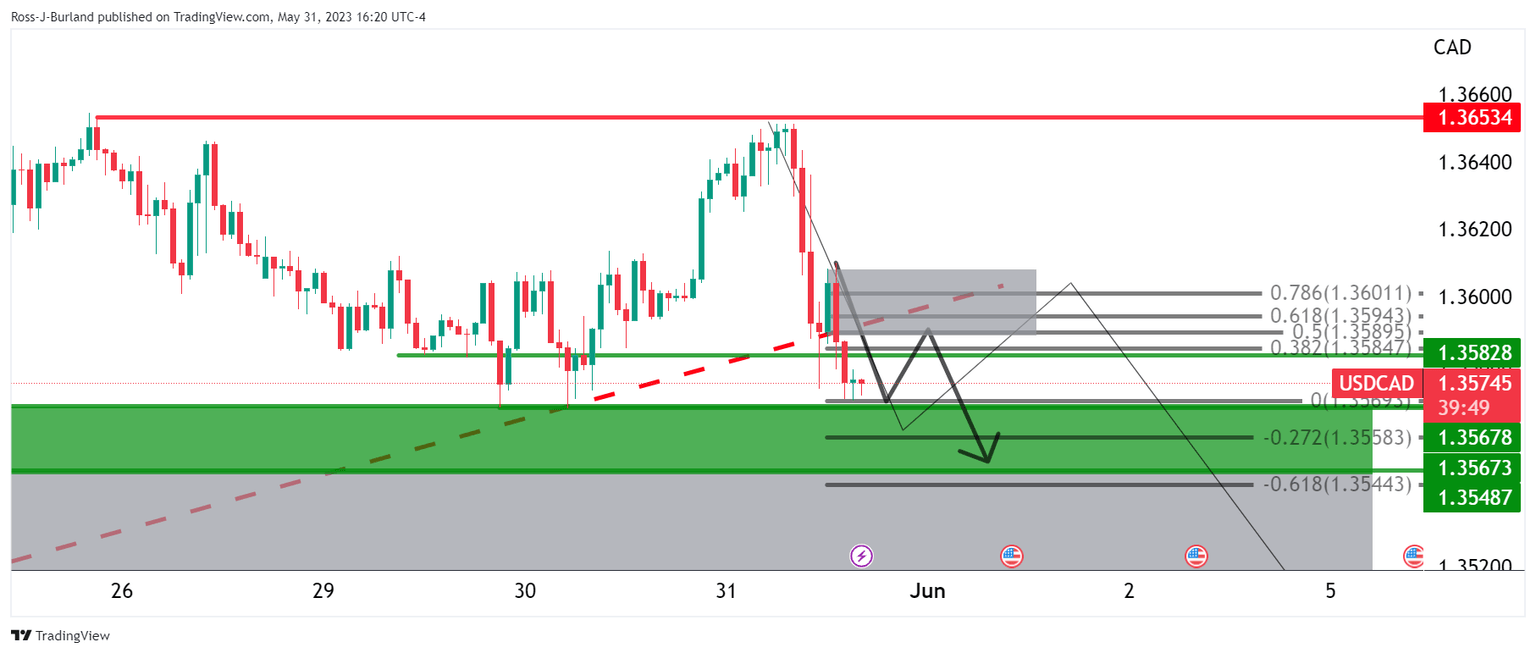

USD/CAD H1

The hourly chart shows that the price is decelerating at this point. This leaves a focus on the upside with 1.36 eyed. However, we may see a commitment from the bears before then.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.