USD/CAD marches firmly towards 1.2600, post-NFP/ISM PMI

- The USD/CAD to finish the week with losses of 1.09%, despite Friday's recovery.

- Sentiment remains negative as fears of a US recession mount.

- May’s US Nonfarm Payrolls crushed expectations and further cemented the case of an aggressive Fed.

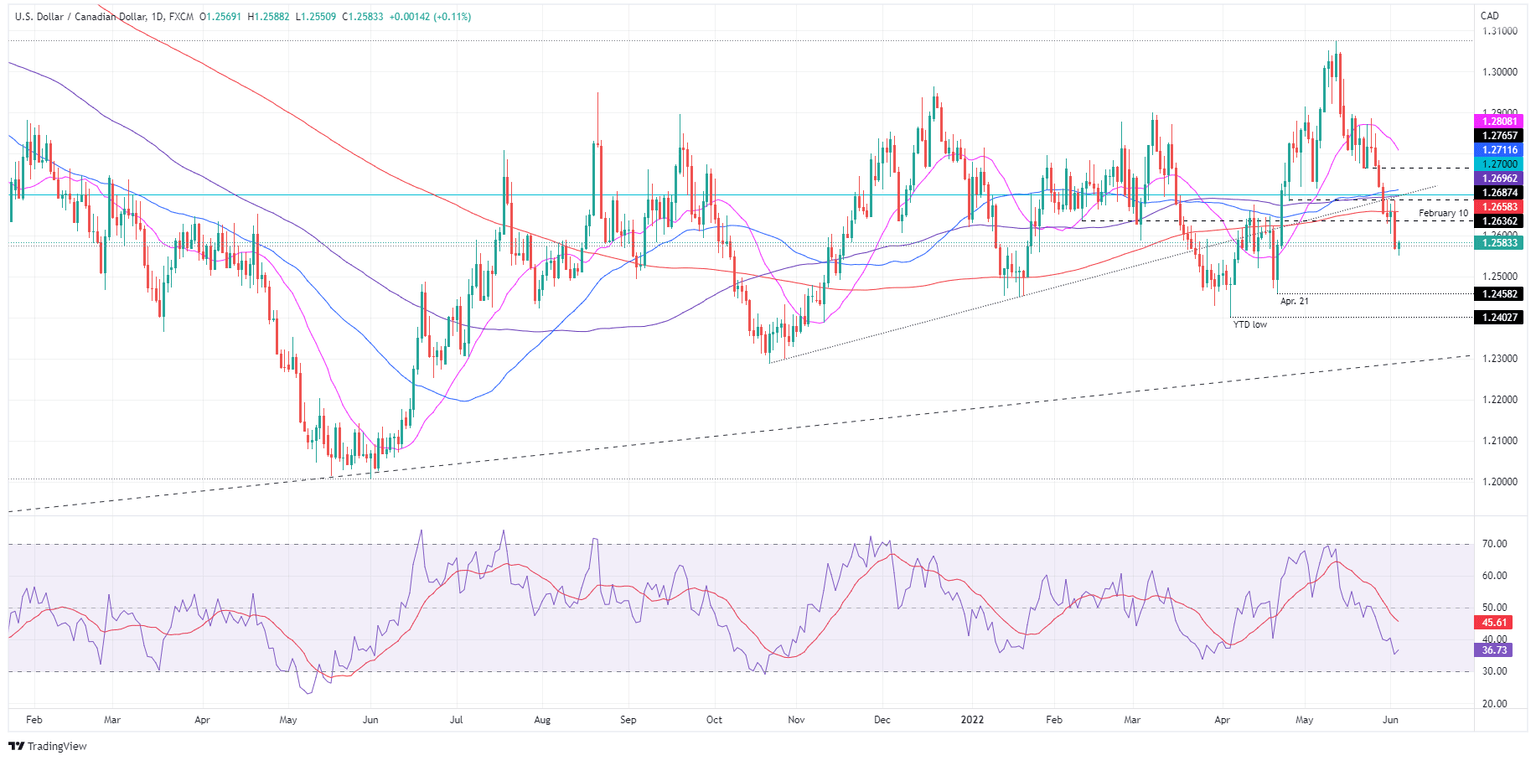

- USD/CAD Price Forecast: To consolidate, unless the USD/CAD breaks below 1.2458, that would expose the YTD low around 1.2400.

The USD/CAD edges up during the New York session, though earlier seesawed between minimal gains/losses of 0.01-0.03%, but remains above the weekly low of 1.2551, amidst investors’ risk-off mood. At 1.2572, the USD/CAD remains steady after the Bank of Canada’s (BoC) 50 bps rate hike earlier in the week.

Upbeat US NFP lifts the greenback

Friday’s US calendar remains busy. Earlier, the US Nonfarm Payrolls for May, showed that the economy added 390K new jobs, far more than the 318K estimated. Financial analysts’ chatter about the US labor market still supports the view that the US Federal Reserve will tighten aggressively after receiving the green light.

Sources cited by Bloomberg commented that May’s solid job growth showed further evidence that the US economy was not in a recession in the spring. In the meantime, Average Hourly Earnings on its YoY reading remained unchanged at 5.2%, reflecting the tight labor market though easing worries of a wage-price spiral.

Of late, the Institute for Supply Management (ISM) unveiled that the Non-Manufacturing PMI increased by 55.9, lower than the 56.4 expected. It shows businesses’ resilience, after last week’s Q1 GDP contraction of 1.5%, according to the second estimate from the Bureau of Economic Analysis.

In the meantime, the USD/CAD was unchanged on the release, but of late, it regains some control and is aiming up toward the June 1 low at 1.2605. Also, it’s worth noting that oil prices remain high, a headwind for the USD/CAD. WTI is exchanging hands at $118.23 per barrel.

Meanwhile, the US Dollar Index, a measure of the buck’s value against six currencies, recovers some of Thursday’s losses, up by 0.36%, sitting at 102.106, boosted by US Treasury yields, particularly the 10-year benchmark note rate at 2.955%, gaining four bps.

Next week’s calendar, the Canadian docket, would feature the Balance of Trade, Ivey PMI, the Canadian employment report, and Bank of Canada speakers.

On the US front, the Federal Reserve officials begin their blackout period. However, investors’ eyes would be on the inflation report alongside the UoM June’s Consumer Sentiment.

USD/CAD Price Forecast: Technical outlook

From the daily chart perspective, the USD/CAD remains downward biased, but the RSI’s reading at 36.65, moving slightly up, suggests a correction might occur in the near term. Nevertheless, if the USD/CAD continues downwards and breaks below April’s 21 low at 1.2458, then a retest of the YTD lows at 1.2402 is on the cards.

Otherwise, the USD/CAD might head upwards to test the 1.2600. Failure of a daily close above the figure would keep the major in the 1.2550-1.2600 range.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.