USD/CAD breaks 1.3600 as US Dollar weakness returns

- The USD/CAD pair has fallen below 1.3600, which is now providing resistance.

- Israel’s attack on Iran fails to support a broader recovery for the US Dollar.

- Inflation expectations in the US continue to decline, putting pressure on the US Dollar.

The Canadian Dollar (CAD) is trading higher against the US Dollar (USD) in the American session on Friday, with the Loonie erasing gains from earlier sessions.

At the time of writing, USD/CAD is trading back below 1.3600, with prices currently testing the lowest levels in eight months.

Friday’s headlines were dominated by reports that Israel had targeted Iranian nuclear facilities and apartment complexes, reportedly killing several senior Iranian officials. That news briefly lifted USD/CAD off its recent lows, though the pair soon slid back down, with the lower trendline of its wedge still holding firm.

Also on Friday, the University of Michigan released its preliminary Consumer Sentiment survey, showing a noticeable uptick in confidence among US households.

Meanwhile, both one-year and five-year Consumer Inflation Expectations edged lower, echoing softer-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) readings earlier in the week.

Slowing inflation has increased the prospects for the Federal Reserve (Fed) to cut interest rates, reducing US yield and weighing on the USD.

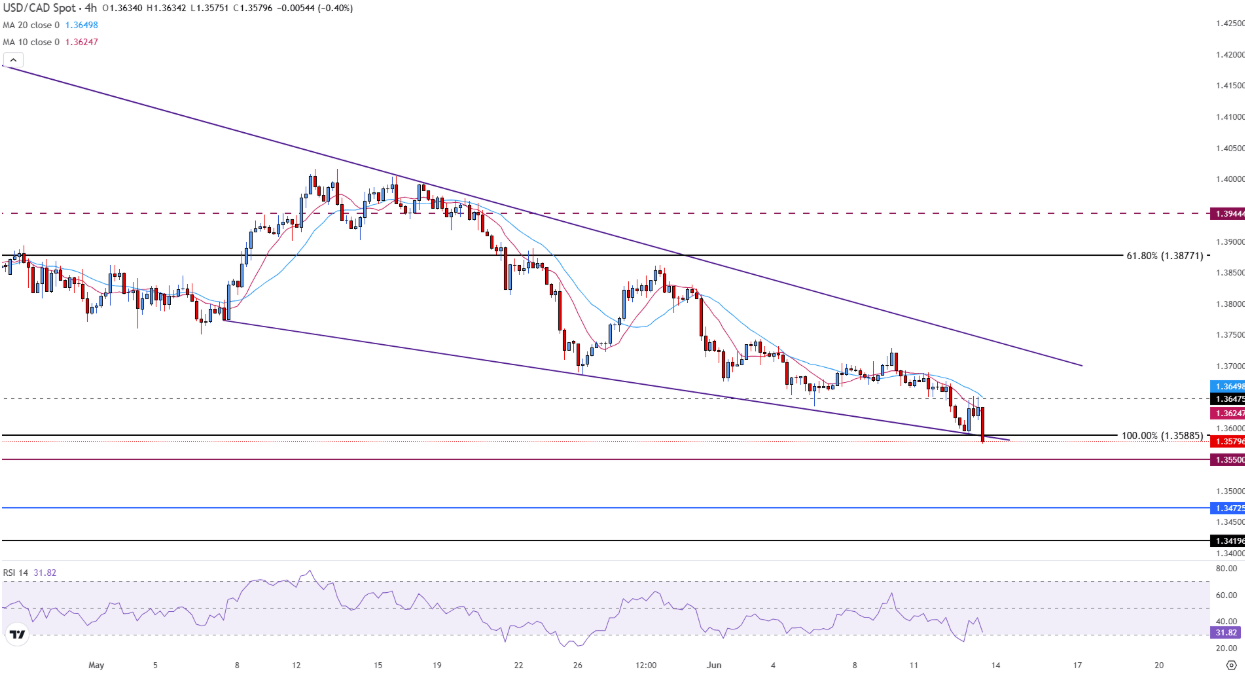

Technical analysis: USD/CAD falls below 1.3600, threatening wedge support

USD/CAD is approaching the support level of 1.3588, which corresponds to the base of a falling wedge pattern on the four-hour chart. This level has now become near-term resistance, contributing to bearish momentum.

The Relative Strength Index (RSI) is currently near 32, indicating a bearish bias and approaching oversold territory, though there is still potential for further declines.

If the bearish momentum persists, the price could reach the psychological support level of 1.3500, potentially leading to a further decline toward the October low of 1.3472. On the other hand, if the price moves above 1.3588 and surpasses the psychological resistance level of 1.3600, it could provide an opportunity for USD/CAD bulls to retest the 10-period Simple Moving Average (SMA) at 1.3624.

USD/CAD four-hour chart

has fallen below 1.3600, which is now providing

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.