USD/CAD bears in control to 2017 support structure, eyes on a correction

- USD/CAD is tracking the lower greenback and broadly stronger commodity prices in the month of April and May.

- Bears take on bullish commitments at the early Sep 2017 lows.

At the time of writing, USD/CAD is trading at 1.2084 and is down some 0.3% after travelling from a high of 1.2103 to a low of 1.2080.

The greenback has been on the backfoot since the 5th May and was beaten up further on Friday due to the disappointment in the Nonfarm Payrolls report.

The US created a little more than a quarter of the jobs that economists had forecast last month.

On top of that, the unemployment rate unexpectedly ticked higher which leaves the market speculating that the Fed will not be looking to taper or raise rates sooner than what they had already communicated.

The report encouraged investors to unwind their growing long positions in the US dollar and bet on riskier asset classes, such as stocks.

The dollar index DXY, which measures the greenback against six rivals, stands at 90.13 at the time of writing, broadly flat on the day, after dipping as low as 90.128 for the first time since Feb. 26 earlier in the session.

The greenback is training at odds with the wider spectrum of markets with global equity prices bid and with even the benchmark US Treasury yields well above Friday's lows with the ten-year up some 0.6% at the time of writing.

Meanwhile, the loonie has been benefitting from the Bank of Canada's recent change to policy settings, higher commodity prices ad general risk-on markets.

The CAD can remain solid, in the main, as a function of the diverging monetary policy outlooks within the dollar bloc.

The BoC has already started to taper its asset purchases and has even signalled it may hike as soon as 2022, or at least as of when the output gap is significantly smaller.

USD/CAD technical analysis

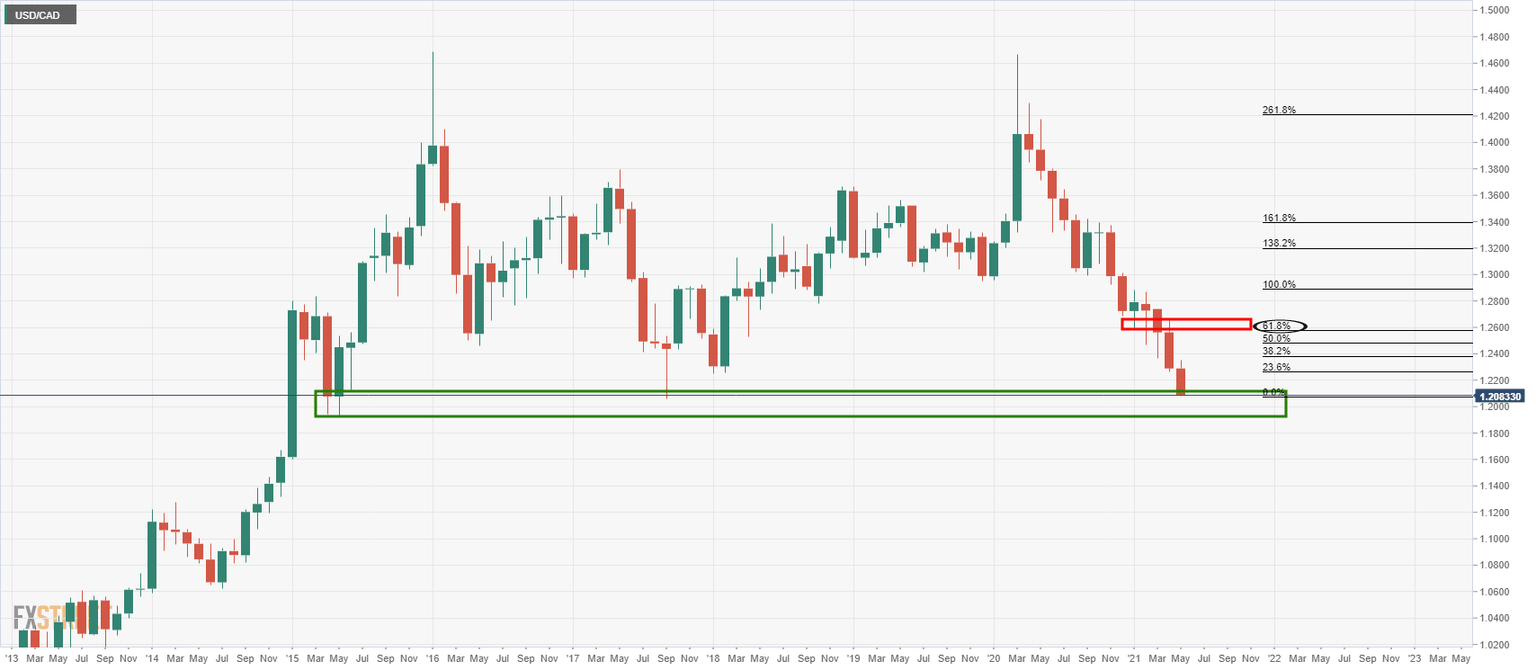

USD/CAD has fallen some 4.6% since March.

The loonie is now taking on the USD/CAD bulls at multi-year lows as follows:

While there are prospects of a deeper extension into the demand territory, a correction may not be too far away.

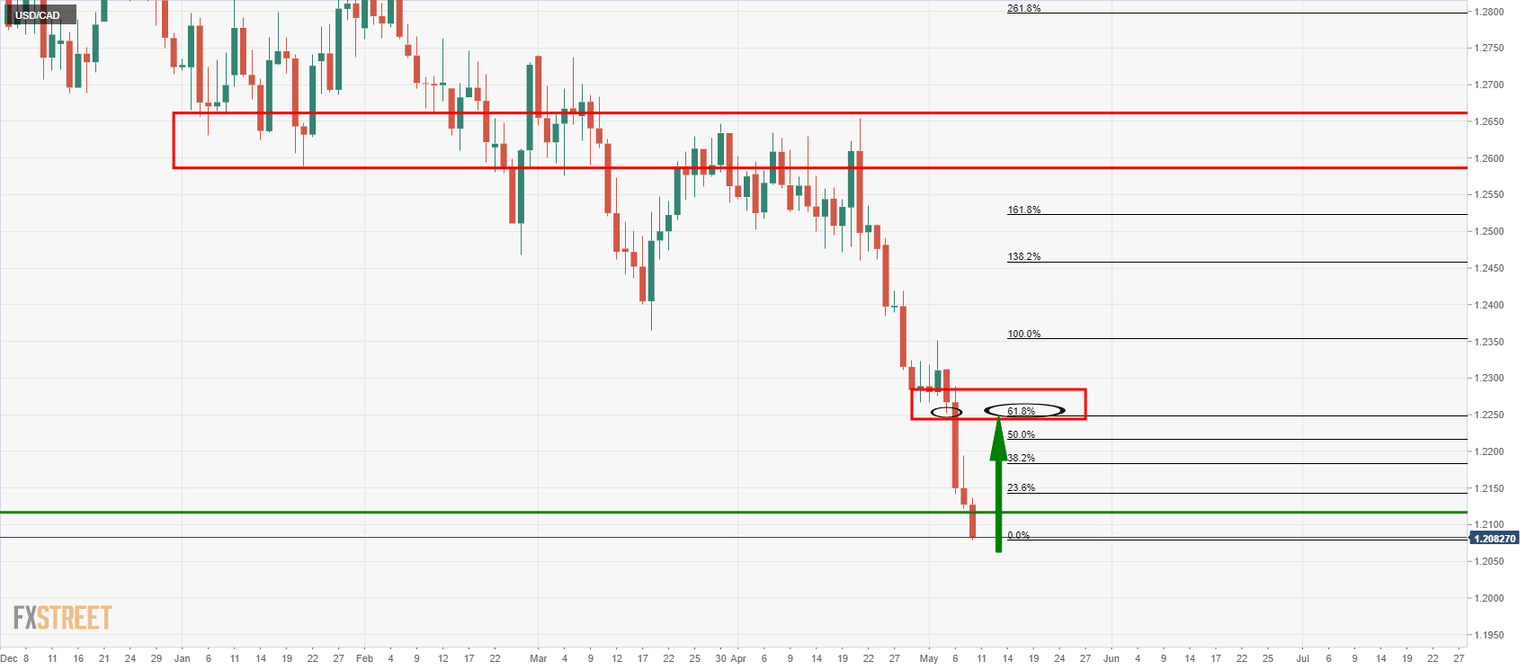

From a daily perspective, the 61.8% Fibonacci retracement of the latest bearish impulse aligns with the prior lows as follows:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.