GBP/JPY Price Forecast: Pair steadies above 207.00 ahead of BoE and BoJ decisions

- GBP/JPY rebounds from the 207.00 area after UK inflation weighs on Sterling.

- Traders avoid aggressive bets ahead of Thursday’s BoE monetary policy meeting.

- A sustained break above 208.00 could open the door for a move toward a fresh year-to-date high above 209.00.

The British Pound (GBP) trims earlier losses against the Japanese Yen (JPY) on Wednesday after an initial sell-off triggered by softer-than-expected UK inflation data. At the time of writing, GBP/JPY is trading around 207.80, rebounding after buyers stepped in near the 207.00 psychological level.

The recovery, however, lacks conviction and appears driven by short-term repositioning, as traders remain reluctant to take aggressive bets ahead of the interest rate decisions from both the Bank of England (BoE) and the Bank of Japan (BoJ).

Looking ahead, most of the policy outcome is already priced in. The BoJ is expected to raise interest rates, while the BoE is seen cutting rates, leaving the focus firmly on forward guidance that could play a key role in setting the next move for GBP/JPY.

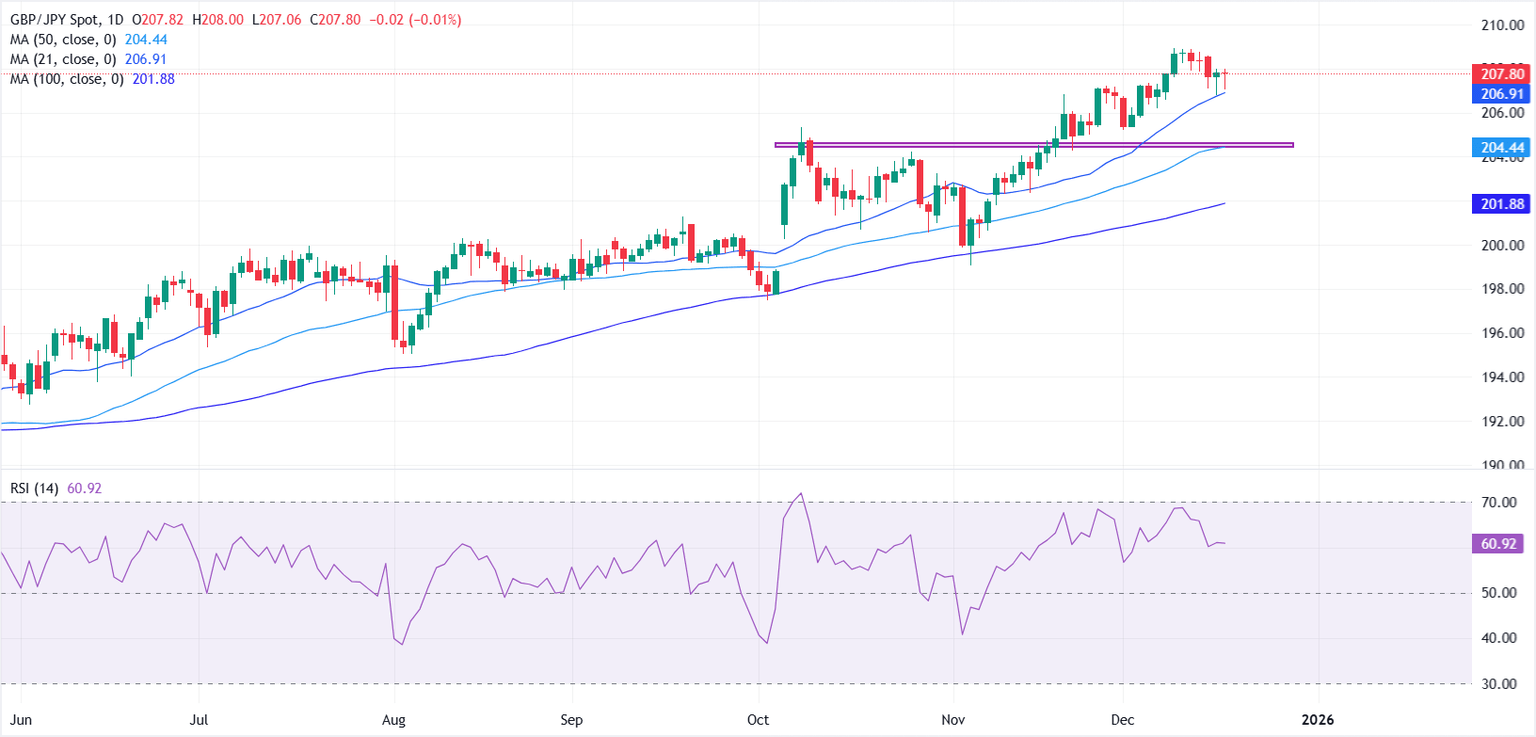

From a technical perspective, GBP/JPY remains in a strong uptrend on the daily chart, marked by a clear sequence of higher highs and higher lows. Prices continue to trade comfortably above key moving averages, reinforcing the broader bullish bias.

On the upside, the 208.00 psychological level acts as immediate resistance. A sustained break above this barrier could open the door for another leg higher toward a fresh year-to-date high above 209.00, with scope for further gains if bullish momentum strengthens.

On the downside, immediate support is seen near 207.00, which aligns with the 21-day Simple Moving Average (SMA). A break below this level would weaken the near-term outlook and expose the 204.00–205.00 support zone near the 50-day SMA. A decisive drop below the 50-day SMA would shift the tone toward a deeper corrective phase, with the 100-day SMA around 201.00 coming into focus.

Momentum indicators remain supportive, with the Relative Strength Index (RSI) holding near 60 and staying above its midline, suggesting that bullish momentum is still intact.

Economic Indicator

BoJ Interest Rate Decision

The Bank of Japan (BoJ) announces its interest rate decision after each of the Bank’s eight scheduled annual meetings. Generally, if the BoJ is hawkish about the inflationary outlook of the economy and raises interest rates it is bullish for the Japanese Yen (JPY). Likewise, if the BoJ has a dovish view on the Japanese economy and keeps interest rates unchanged, or cuts them, it is usually bearish for JPY.

Read more.Next release: Fri Dec 19, 2025 03:00

Frequency: Irregular

Consensus: 0.75%

Previous: 0.5%

Source: Bank of Japan

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.