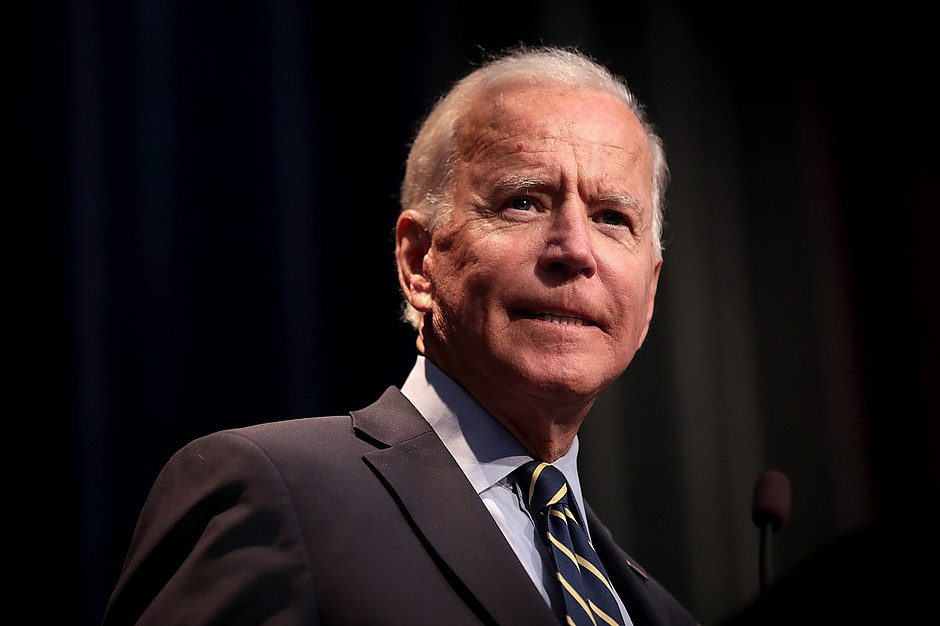

US President Biden urges congress to pass his proposed billionaire minimum tax

US President Joe Biden is delivering his second State of the Union address to a Joint Session of Congress at the Capitol on Wednesday.

Key quotes

Committed to work with China where it can advance American interests and benefit the world.

If China’s threatens US sovereignty, US will act to protect the country.

We are in strongest position in decades to compete with china or anyone else.

Told China's Xi that US seeks competition, not conflict.

I'm announcing new standards to require all construction materials used in federal infrastructure projects to be made in America.

We must hold social media companies 'accountable for the experiment they are running on our children for profit'.

Calls for major surge to stop fentanyl production, sale and trafficking.

It's time to pass legislation to stop big tech from collecting personal data on children, ban targeted ads to kids and impose stricter limits on data collection.

I propose that we quadruple the tax on corporate stock buybacks.

Calls on congress to pass his proposal for a billionaire minimum tax.

Call for restoring child tax credit.

Asks congress to commit 'here, tonight' that full faith and credit of country will never be questioned.

Calls for passing 'key elements' of George Floyd Police-Reform Act.

Market reaction

The US Dollar Index is uninspired by Biden’s remarks, as it clings to the overnight recovery at around 103.35, as of writing.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.