US Dollar sees over 1% intraday gain on US-China deal

- The US Dollar rallies against most major peers, after news of a deal between China and the US.

- Both China and the US agreed to slash tariffs for 90 days following two days of talks in Switzerland.

- The US Dollar Index pops to 101.60, seeing the relief in US-China tensions as tailwind.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, exceeds a more than 1% rally on Monday after China and the United States (US) agreed to a 90-day pause in their trade war by slashing tariffs on both sides. After a weekend of discussion, US Treasury Secretary Scott Bessent announced the defusing of the trade war between the two nations: China will lower its tariffs on US goods to only 10% from the original 125%, while the US will do so to 30% (from 145%) on Chinese goods, both for 90 days, Bloomberg reports. The news sent the US Dollar to its highest level in one month.

Several correlations are kicking in again on the back of this event, with the benchmark 10-year US Treasury yield hitting 4.45%. The rate differential gap between the US and other countries sees the Greenback being valued higher against the local currencies of countries with lower yields. The repercussion of this correlation could be that Federal Reserve rate cuts for 2025 get fully priced out.

Daily digest market movers: Next focus on Ukraine

- Ukraine-Russia peace talks will be held Thursday in Istanbul. It appears that both Russian President Vladimir Putin and Ukraine President Volodymyr Zelenskyy will both be there.

- US Treasury Secretary Scott Bessent announced during a press conference in Switzerland the breakthrough between the US-China trade war has led to a pause of 90 days and the lowered reciprocal tariffs for both parties. Bessent went on by saying that both countries want to defuse the situation and said that a possibility of a China purchasing agreement could be possible, Bloomberg reports.

- At 14:25 GMT, Federal Reserve Bank Governor Adriana Kugler delivers a speech on the economic outlook at the National Association for Business Economics and the Central Bank of Ireland's International Economic Symposium, in Dublin, Ireland.

- Around 18:00 GMT, the Loan Officer Survey (SLOOS) for the first quarter is due. The report often tells more about the lending circumstances in the US for households and small businesses.

- US equities are keeping their big gains for this Monday. On average all three major indices are trading near 3% gains on the day.

- The CME FedWatch tool shows the chance of an interest rate cut by the Federal Reserve in June’s meeting at just 7.9%. Further ahead, the July 30 decision sees odds for rates being lower than current levels at 44.1%.

- The US 10-year yields trade around 4.45%, edging higher towards levels not seen since the beginning of April, and reducing rate cut bets for 2025.

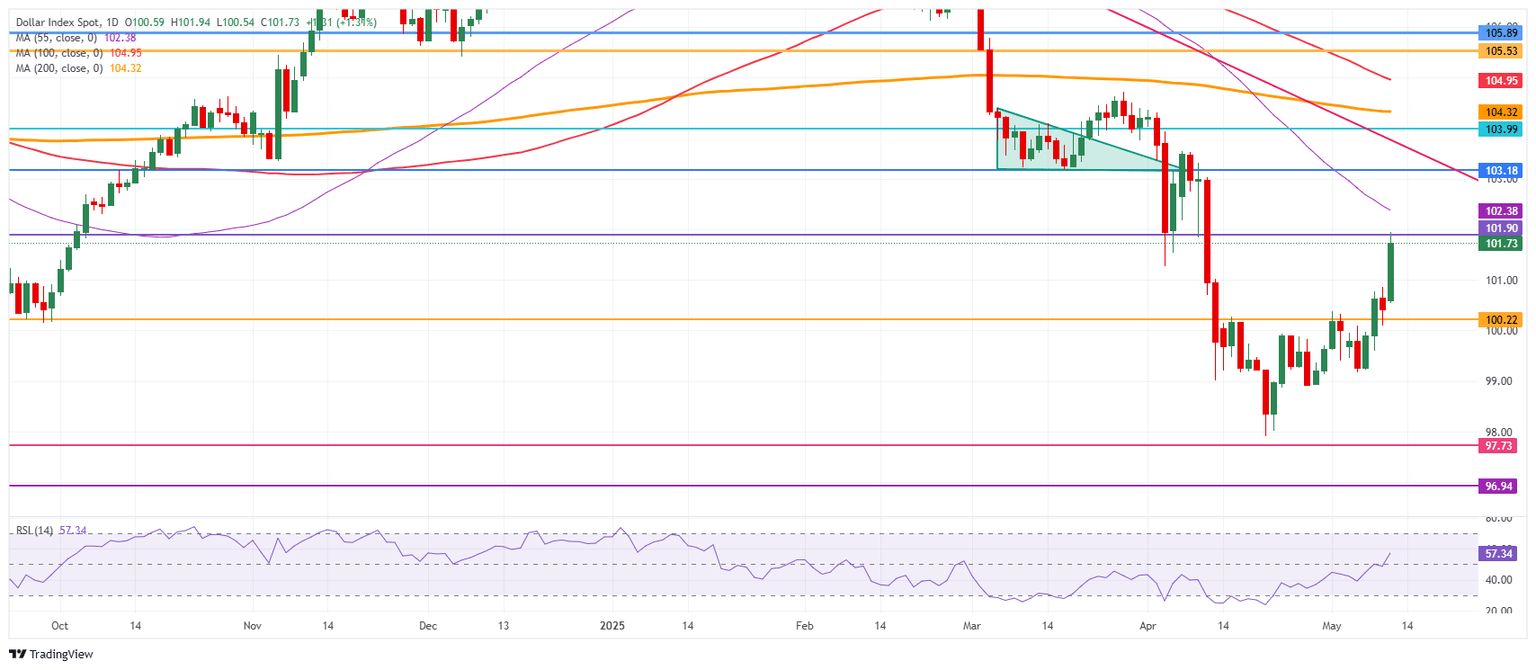

US Dollar Index Technical Analysis: Big resistance level

Bulls are returning to support the US Dollar Index (DXY), and they are leaving an impressive mark. The DXY pops over 1% higher and is nearing that pivotal 101.90 level that could unlock a return back to the moving averages. It will depend on whether the beginning of the US session causes a second wave of US Dollar buying.

On the upside, the DXY’s first resistance comes in at 101.90, which acted as a pivotal level throughout December 2023 and as a base for the inverted head-and-shoulders (H&S) formation during the summer of 2024. In case Dollar bulls push the DXY even higher, the 55-day Simple Moving Average (SMA) at 102.37 comes into play.

On the other hand, the previous resistance at 100.22 is now acting as firm support, although the 97.73 support could also be tested on any substantial bearish headline. Further below, a relatively thin technical support comes in at 96.94 before looking at the lower levels of this new price range. These would be at 95.25 and 94.56, meaning fresh lows not seen since 2022.

US Dollar Index: Daily Chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.