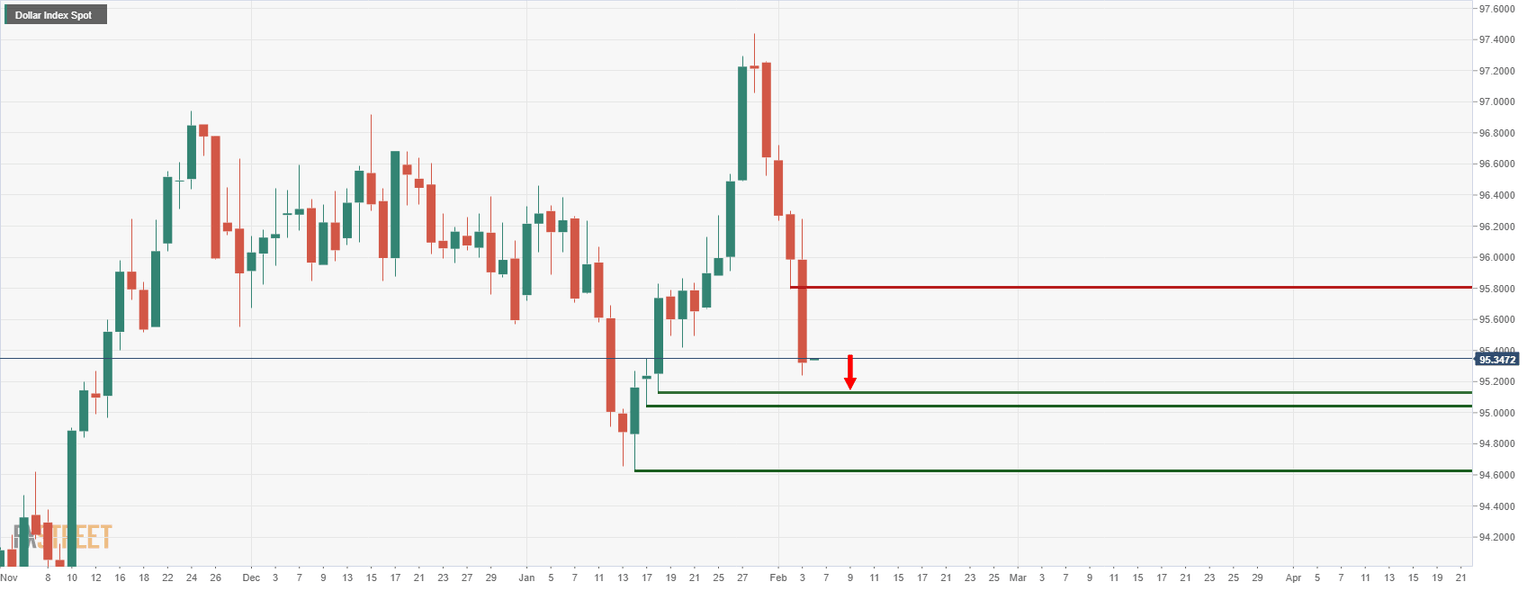

US dollar is at the mercy of US Nonfarm Payrolls, 94.60's and 95.80's eyed

- USD is in the hands of the bears in anticipation of poor NFP outcomes.

- The bears have 95 the figure in their sights and 94.63, Jan. swing low below there.

- 95.80 is the bulls target on a bullish surprise from NFP.

The dollar index (DXY) fell heavily on Thursday to an over two-week low as central banks play catch-up with the Federal Reserve while, at the same time, Fed officials have dialled back uber hawkish rhetoric.

The euro, by far, the largest component of the index, making up 57.6% of the DXY basket, jumped against the dollar after comments from Europea Central Bank president Christine Lagarde fuelled expectations of faster monetary policy tightening.

When she was questioned over whether the ECB was "very unlikely" to raise rates this year, Lagarde said it would assess conditions very carefully and be "data-dependent". This leaves March as a key meeting where the ECB could signal an even more hawkish stance. Eurozone money markets are currently pricing an 80% chance of a 10 bps hike in June and an almost 100% chance of 40 bps of hikes by year-end, from a 90% chance of 30 bps hikes before Lagarde's press conference.

Meanwhile, the Bank of England raised interest rates to 0.5% and nearly half its policymakers wanted a more significant increase to contain rampant price pressures. This too has weighed the DXY down. GBP makes up 11.9% of the index. However, besides the hawkishness at central banks, the US dollar has come unstuck this week from the Fed-bid.

The combination of less hawkish remarks at the start of the week from a chorus of Fed officials, weaker jobs data and a slide in ISM services from the prior month are pulling the DXY lower. Risk appetite has also come crawling back into global markets. DXY fell below 96 DXY on Thursday as a consequence.

NFP in focus

The focus will now be on Friday's Nonfarm Payroll. Payrolls likely plunged in January, but only because of temporary Omicron fallout due to the vast number of people calling in sick early last month. This would be expected to be reflected in the data.

Analysts at TD Securities argued that ''several Fed officials have already made clear that they will discount weak data as temporary. Also, we see upside risk on average hourly earnings, with an already strong trend likely to be added to by temporary Omicron effects relating to the composition of payrolls and the length of the workweek. Our 0.6% MoM estimate for hourly earnings implies 5.3% YoY, up from 4.7% YoY in December.''

The Federal Reserve is expected to look through any near term weakness in the labour market, and subsequently will hike in March regardless of tomorrow's jobs data outcome, as analysts at Brown Brothers Harriman explained. ''If labour market weakness persists for a couple of months beyond this, then the Fed will rethink its likely rate path.''

Analysts at Morgan Stanley is forecasting a 215,000 loss of jobs, a substantial downward revision to its previous forecast in what would be the first decline in the monthly US jobs report since December 2020. A Reuters survey shows economists expect 150,000 jobs were created in January

US dollar technical analysis

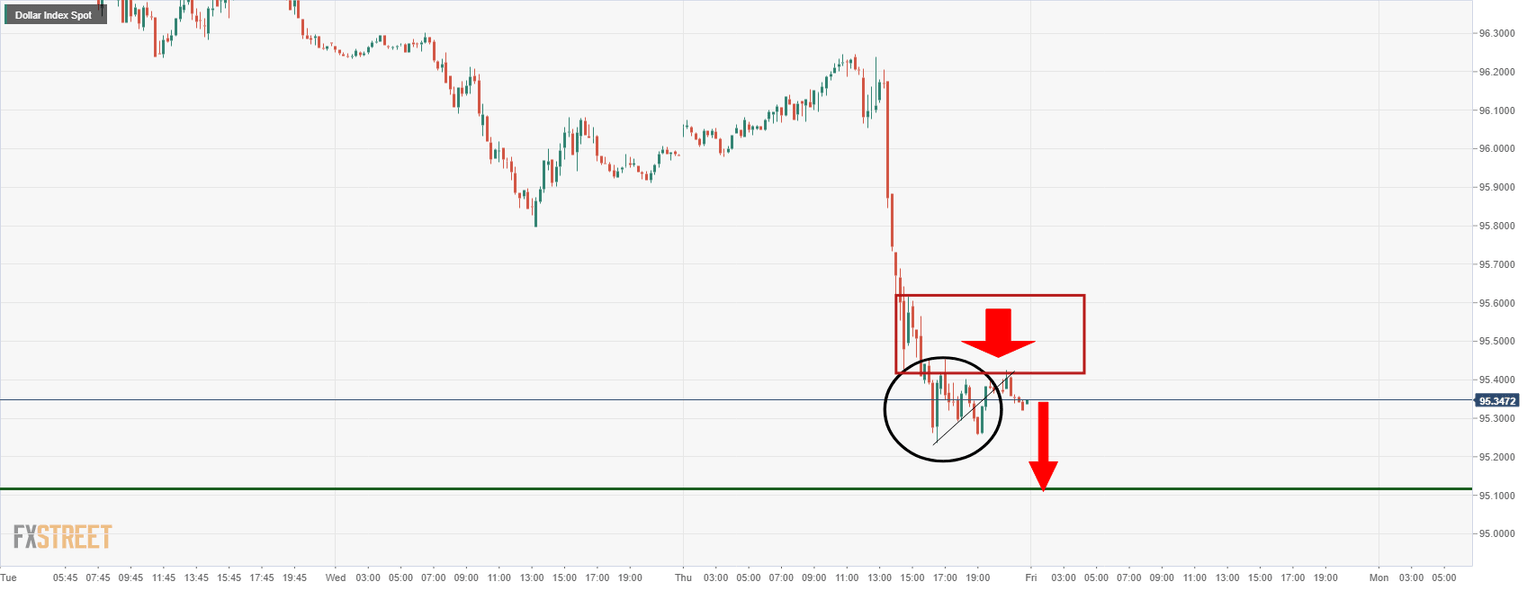

From a daily perspective, the slide is heavy ad there are little signs, so far, of a bottom. 95.10 could be targeted in the coming sessions, 95 the figure guards 94.63 as the Jan. swing low.

The 15-min chart is also bearish while below 96.40/60.

On the other hand, on a surprise in the NFP report, then the hawkish sentiment will bounce back into vouge and likely propel a downtrodden USD dollar sharply higher towards 95.80

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.