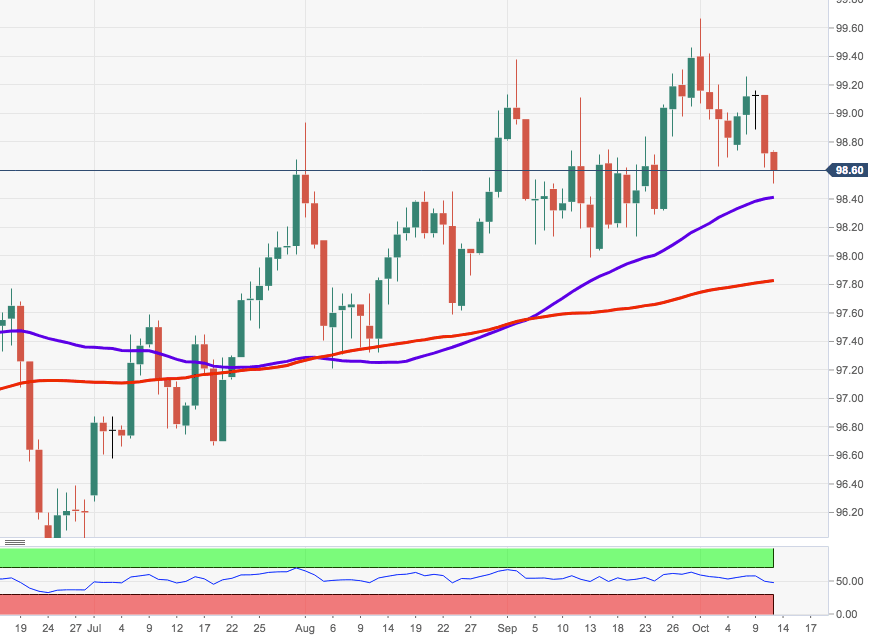

US Dollar Index Technical Analysis: The 55-day SMA at 98.36 expected to hold the downside

- DXY has exacerbated the downside after breaching the key support at 99.00 the figure, dropping to the area of fresh 2-week lows.

- The continuation of the selling impetus carries the potential to spark a deeper pullback to the 55-day SMA at 98.36, where it is expected to lose traction.

- However, a break below this area on a sustainable fashion could pave the way for a shift to a bearish view, with initial target at the 100-day SMA, today at 97.79.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.