US Dollar Index struggles for direction around 93.20

- DXY stays cautious above 93.00 ahead of key events.

- US 10-year yields rebound past the 1.34% area.

- Building Permits, Housing Starts, API report next on tap.

The greenback, when tracked by the US Dollar Index (DXY), faces some selling pressure after hitting fresh tops near 93.50 on Monday.

US Dollar Index looks vigilant ahead of FOMC

The index adds to Monday’s small losses and returns to the 93.20 area on the back of the broad-based cautious note in the global markets and despite the move higher in US 10-year yields to levels above 1.34%.

The dollar loses some ground and stays offered in the first half of the week amidst some loss of upside momentum despite climbing to new monthly highs around 93.50 on Monday.

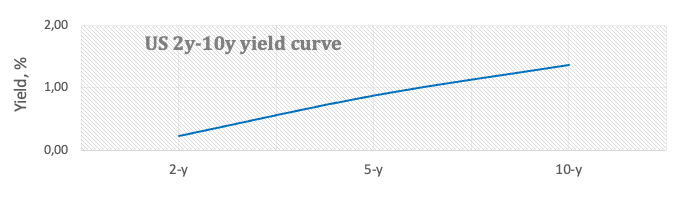

The closely followed US 2y-10y yield gap gave away around 6 pts on Monday amidst falling yields in a context dominated by the risk aversion mood, all reflecting rising jitters around China’s Evergrande crisis.

Moving forward, the greenback is predicted to trade within a narrow range and vigilant in light of the FOMC gathering on Wednesday.

Later in the US docket, the housing sector will take centre stage with the releases of Building Permits and Housing Starts for the month of August.

What to look for around USD

The index extended the march north to the mid-93.00s on Monday, reaching at the same time new highs for the current month. Tapering speculations, risk aversion, higher yields and some auspicious results from US fundamentals kept the upbeat mood around the buck unchanged in past sessions. While developments around the Delta variant and the impact on the economy should also underpin the upside momentum in the dollar, cautiousness among investors could spark some consolidation in DXY ahead of the key FOMC event later in the week.

Key events in the US this week: Building Permits, Housing Starts (Tuesday) – FOMC meeting, Existing Home Sales (Wednesday) – Initial Claims, Flash Manufacturing PMI, CB Leading Index (Thursday) – New Home Sales, Chairman Powell speech (Friday).

Eminent issues on the back boiler: Biden’s multi-trillion plan to support infrastructure and families. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Debt ceiling debate. Geopolitical risks stemming from Afghanistan.

US Dollar Index relevant levels

Now, the index is gaining 0.02% at 93.24 and a break above 93.45 (monthly high Sep.20) would open the door to 93.72 (2021 high Aug.20) and then 94.30 (monthly high Nov.4 2020). On the flip side, the next down barrier emerges at 92.32 (weekly low Sep.14) seconded by 91.94 (monthly low Sep.3) and finally 91.78 (monthly low Jul.30).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.