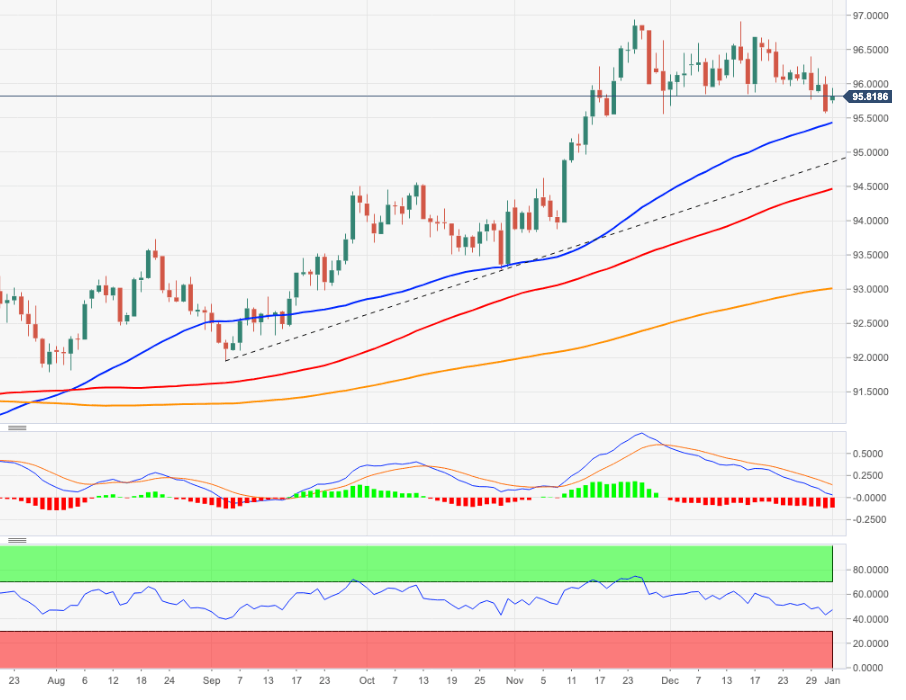

US Dollar Index Price Analysis: The 95.50 area offers decent support so far

- DXY partially reverses Friday’s pullback and approaches 96.00.

- Recent lows in the mid-95.00s should hold the downside for now.

The recent corrective downside in DXY seems to have met some decent contention in the 95.50 region.

A breach of the 95.50 zone should allow for an immediate test of the 55-day SMA at 95.39. On the other hand, if bulls manage to regain control, an attempt to the YTD high just below the 97.00 barrier (November 24) should not be ruled out.

In the meantime, while above the 4-month support line (off September’s low) around 94.80, the constructive view in DXY remains unchanged. The broader positive stance stays underpinned by the 200-day SMA at 92.99.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.