US Dollar Index Price Analysis: Rising bets for another test of 105.00

- DXY adds to the recent weakness and challenges 106.00.

- Another move to the 105.00 region remains well on the cards.

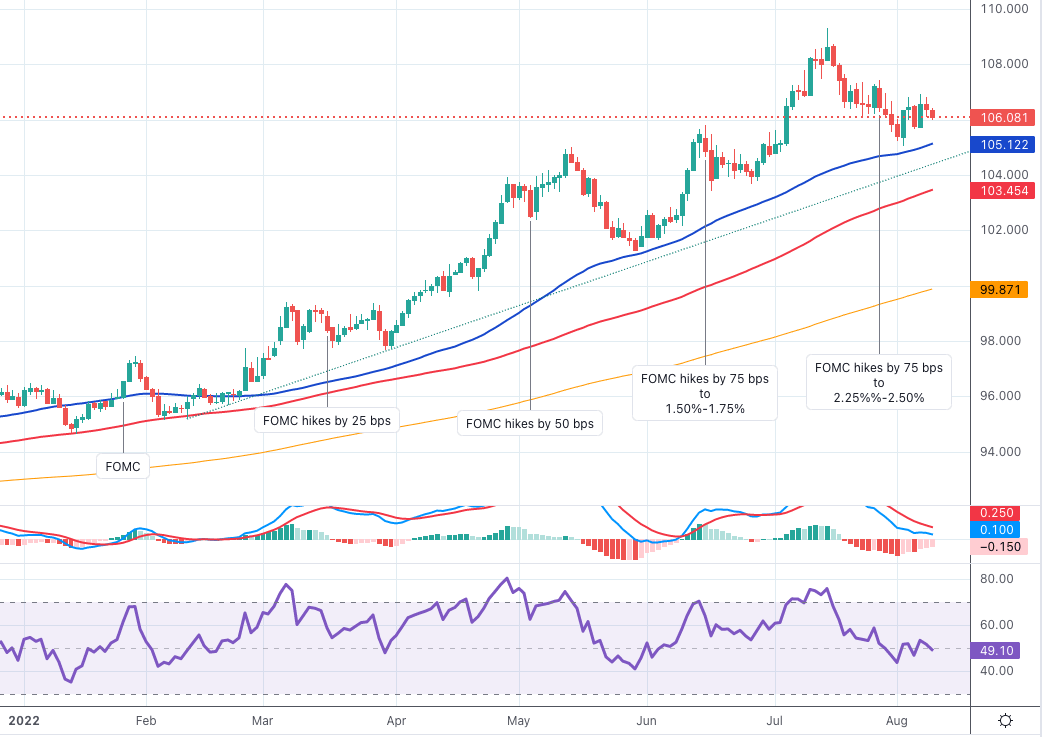

DXY extends the weekly corrective downside and briefly breaches the 106.00 neighbourhood on turnaround Tuesday.

The continuation of the selling pressure should expose a deeper pullback to, initially, the August low near 105.00 (August 2). This area of initial contention appears reinforced by the 55-day SMA.

The short-term constructive stance is expected to remain supported by the 6-month support line, today near 104.40.

Furthermore, the broader bullish view in the dollar remains in place while above the 200-day SMA at 99.87.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.