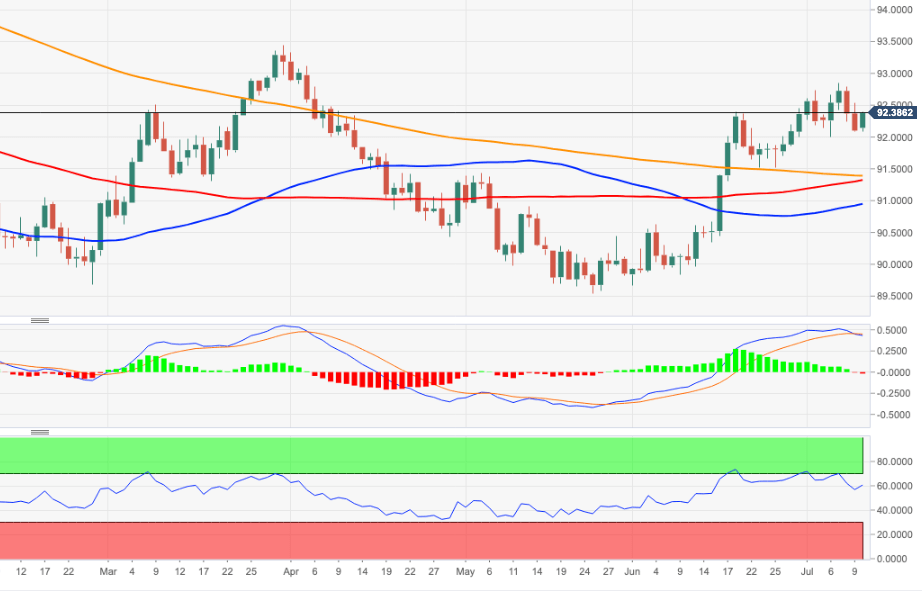

US Dollar Index Price Analysis: Recovery targets 92.85

- DXY reverses the recent weakness and retakes 92.35/40.

- The next hurdle comes in at the July tops beyond 92.80.

DXY regains upside traction and reverses two consecutive daily pullbacks at the beginning of the week.

The corrective decline appears to have met solid contention around the 92.00 neighbourhood so far. The continuation of the rebound is expected to target the July peaks around 92.85 (July 7) ahead of the round level at 93.00 the figure.

Further north comes in the so far 2021 highs near 93.50 recorded in late March.

In the meantime, and looking at the broader scenario, the positive outlook for the dollar is expected to remain unchanged as long as the index trades above the 200-day SMA, today at 91.39.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.