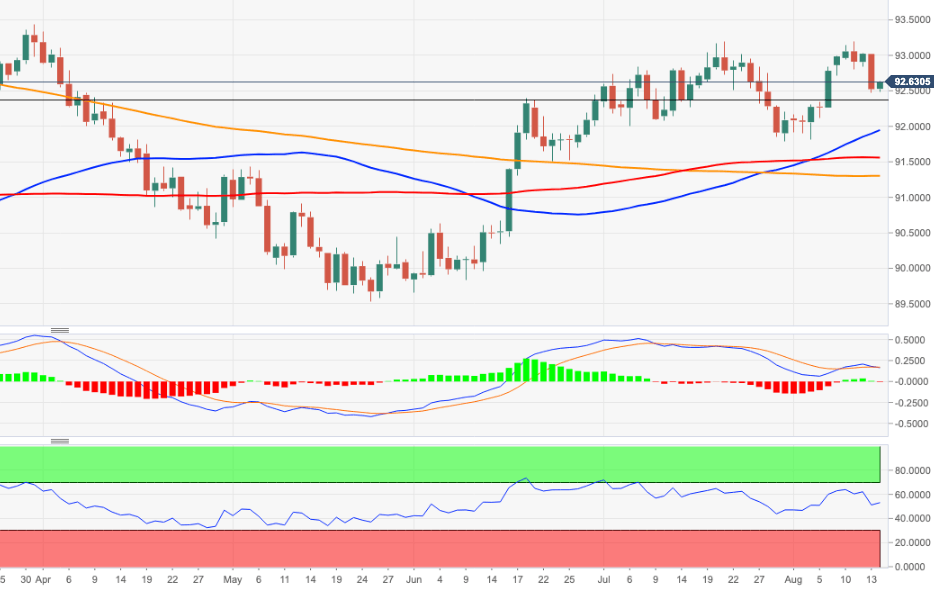

US Dollar Index Price Analysis: Moderate resistance comes in around 93.20

- DXY regains the smile following Friday’s strong pullback.

- The recovery is expected to target recent tops near 93.20.

DXY manages to pick up some buying interest and rebound from earlier lows in the 92.50 region.

The continuation of the recovery could extend beyond the 93.00 mark in the short-term horizon, although a tough barrier is forecast to emerge around July/August peaks in the 93.15/20 band.

In the meantime, and looking at the broader scenario, the positive stance on the dollar is expected to remain unchanged as long as the index trades above the 200-day SMA, today at 91.30.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.